The Australian market has shown resilience over the past year, with a notable increase of 6.2%, despite remaining flat in the last week. In this context of positive growth forecasts, identifying undervalued small-cap stocks like GWA Group can offer potential opportunities for investors seeking value in a rising market.

Top 10 Undervalued Small Caps In Australia

| Name | PE | Value Rating |

| Duratec (ASX:DUR) | 10.8x | ★★★★★☆ |

| GUD Holdings (ASX:GUD) | 13.3x | ★★★★★☆ |

| Catalyst Metals (ASX:CYL) | -10.8x | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | 13.0x | ★★★★☆☆ |

| Reject Shop (ASX:TRS) | 17.9x | ★★★★☆☆ |

| GWA Group (ASX:GWA) | 15.0x | ★★★★☆☆ |

| Michael Hill International (ASX:MHJ) | 18.5x | ★★★★☆☆ |

| Aroa Biosurgery (ASX:ARX) | -24.2x | ★★★★☆☆ |

| Australian Clinical Labs (ASX:ACL) | 32.2x | ★★★★☆☆ |

| WOTSO Property (ASX:WOT) | -16.9x | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

GWA Group (ASX:GWA)

Simply Wall St Value Rating: ★★★★☆☆

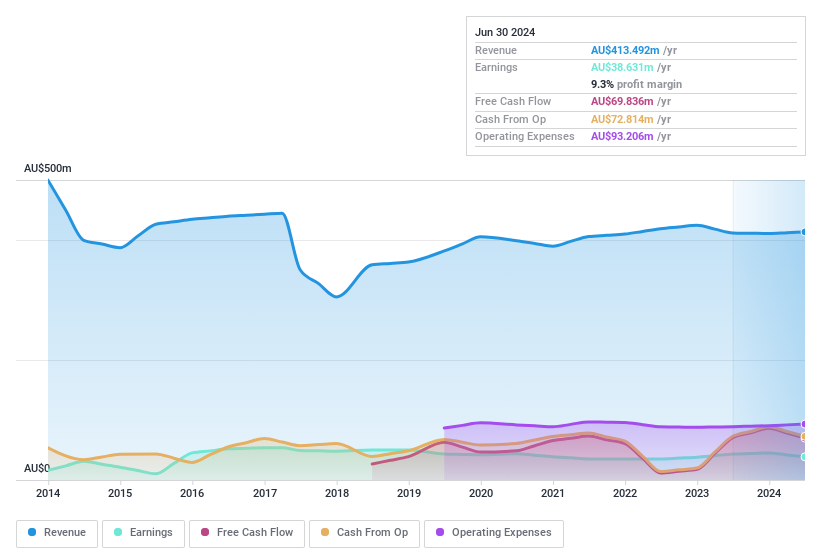

Overview: GWA Group Limited, with a market capitalization of A$673.62 million, is engaged in researching, designing, manufacturing, importing, and marketing building fixtures and fittings for residential and commercial premises across Australia, New Zealand, and other international markets.

Operations: GWA Group Limited generates revenue primarily through the sale of building fixtures and fittings, with a consistent pattern of increasing quarterly revenues reaching A$837.92 million by the end of 2024. The company's cost structure includes significant expenditures on goods sold, which accounted for A$505.48 million in COGS, alongside operational expenses amounting to A$318.13 million in the same period, reflecting its manufacturing and marketing operations.

PE: 14.9x

GWA Group, a notable player in the Australian market, has demonstrated a compelling narrative of resilience and potential. With recent insider buying signaling confidence from those at the helm, there's an optimistic outlook on its future. Financially, GWA has maintained steady revenue and net income growth over the years—highlighted by a recent report showing sales of A$205.97 million and net income of A$23.23 million for the half year ended December 2023. This performance is underpinned by consistent gross profits and controlled operating expenses, suggesting effective management execution amid varying market conditions. Furthermore, GWA's ability to surpass market returns with forecasts pointing towards continued earnings growth positions it as an intriguing prospect within its sector.

- Click to explore a detailed breakdown of our findings in GWA Group's valuation report.

-

Gain insights into GWA Group's historical performance by reviewing our past performance report.

SHAPE Australia (ASX:SHA)

Simply Wall St Value Rating: ★★★★☆☆

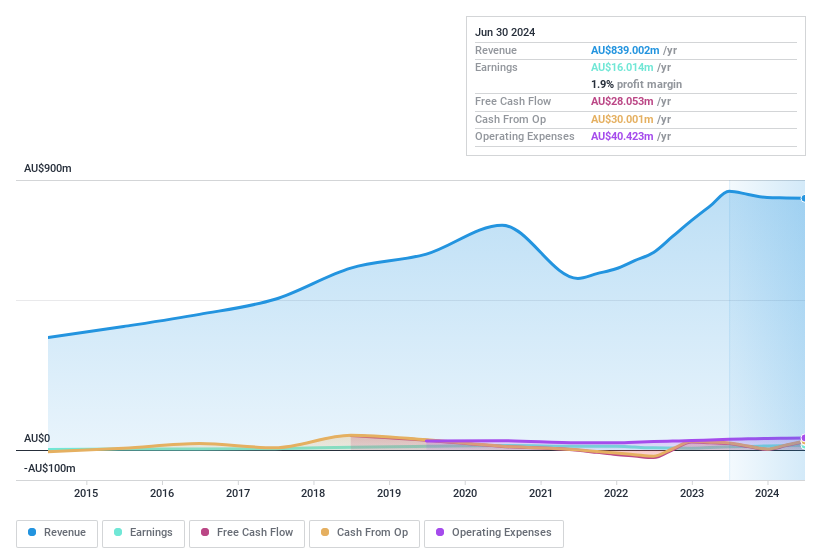

Overview: SHAPE Australia Corporation Limited operates in the construction, fit-out, and refurbishment of commercial properties across Australia, with a market capitalization of approximately A$172.13 million.

Operations: SHAPE Australia Corporation Limited generates its revenue primarily through the construction, fit-out, and refurbishment services for commercial properties. The company's financial model shows a consistent pattern of revenue growth with quarterly revenues increasing from A$617.96 million to A$837.92 million over the observed period, supported by gross profits that also saw a gradual rise despite fluctuations in net income and operational costs.

PE: 13.0x

SHAPE Australia Corporation Limited, trading significantly below our fair value estimate, showcases a promising trajectory with consistent revenue growth—from A$392.24 million in 2013 to A$841.40 million by mid-2024—and a notable increase in net income over the same period. Insider buying over the past three months suggests strong belief in the company’s prospects among those who know it best. Recent financials reveal a robust gross profit margin improvement and operational efficiency, culminating in an interim dividend increase of 60% announced on February 22, 2024. This trend, coupled with earnings that have outpaced market returns, positions SHAPE as a compelling entity within its industry landscape.

- Dive into the specifics of SHAPE Australia here with our thorough valuation report.

-

Explore historical data to track SHAPE Australia's performance over time in our Past section.

Reject Shop (ASX:TRS)

Simply Wall St Value Rating: ★★★★☆☆

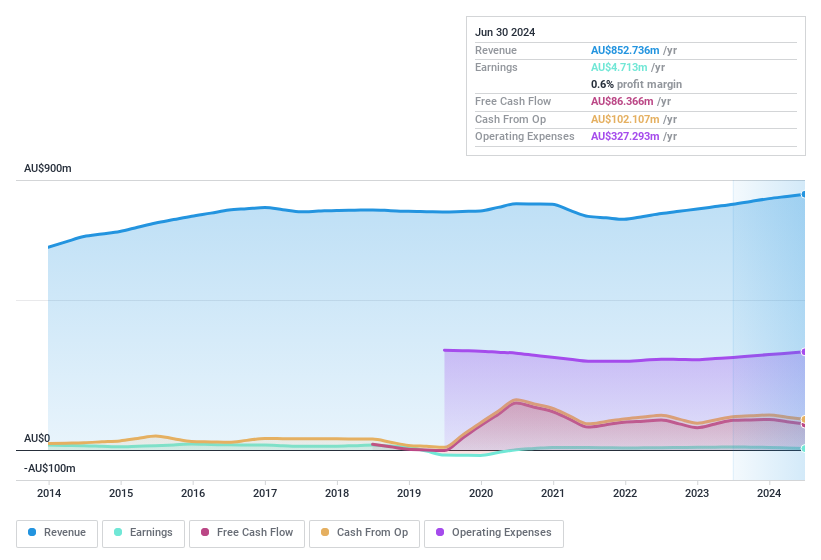

Overview: The Reject Shop Limited operates as a retailer offering discount variety merchandise across Australia, with a market capitalization of approximately A$152.18 million.

Operations: The Reject Shop Limited generates revenue primarily through the sale of discount variety merchandise. The company's cost structure involves significant expenditures on goods sold (COGS), which consistently represents a major portion of its revenue, alongside operating expenses related to store operations and corporate management.

PE: 17.9x

Reject Shop Limited, recently added to the S&P/ASX All Ordinaries Index, reflects a strategic positioning with a P/E ratio of 17.9x, notably lower than the Australian market average of 19.5x. This fiscal prudence is underscored by insider confidence; significant purchases by insiders over the last three months suggest a bullish outlook from those in the know. Despite a dip in net income from A$16.3 million to A$14.5 million in the latest half-yearly report, sales increased to A$458.3 million from A$439.7 million year-over-year, indicating resilience and potential underappreciated by the market. The board's decision to increase dividends also signals financial health and commitment to shareholder value, painting Reject Shop as an intriguing prospect amid undervalued entities.

- Get an in-depth perspective on Reject Shop's performance by reading our valuation report here.

-

Evaluate Reject Shop's historical performance by accessing our past performance report.

Taking Advantage

- Dive into all 21 of the Undervalued Small Caps With Insider Buying we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GWA

GWA Group

Researches, designs, manufactures, imports, and markets building fixtures and fittings to residential and commercial premises in Australia, New Zealand, and internationally.

Excellent balance sheet, good value and pays a dividend.