Exploring 3 Undervalued Small Caps In Australia With Insider Buying

Reviewed by Simply Wall St

In the last week, the Australian market has been flat, but over the past 12 months, it has risen by 20%, with earnings expected to grow by 12% per annum in the coming years. In this context of steady growth and positive outlooks, identifying small-cap stocks with potential insider buying activity can offer intriguing opportunities for investors seeking value in a dynamic market environment.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.7x | 1.6x | 41.03% | ★★★★★★ |

| Magellan Financial Group | 8.4x | 5.3x | 30.50% | ★★★★★☆ |

| Tabcorp Holdings | NA | 0.4x | 21.41% | ★★★★★☆ |

| Collins Foods | 17.9x | 0.7x | 7.98% | ★★★★☆☆ |

| Dicker Data | 19.7x | 0.7x | -62.79% | ★★★★☆☆ |

| Corporate Travel Management | 19.6x | 2.3x | 5.03% | ★★★★☆☆ |

| Centuria Capital Group | 22.3x | 5.0x | 43.91% | ★★★★☆☆ |

| Bapcor | NA | 0.8x | 49.43% | ★★★★☆☆ |

| Coventry Group | 234.4x | 0.4x | -16.51% | ★★★☆☆☆ |

| Abacus Storage King | 12.4x | 7.7x | -31.30% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Abacus Storage King (ASX:ASK)

Simply Wall St Value Rating: ★★★☆☆☆

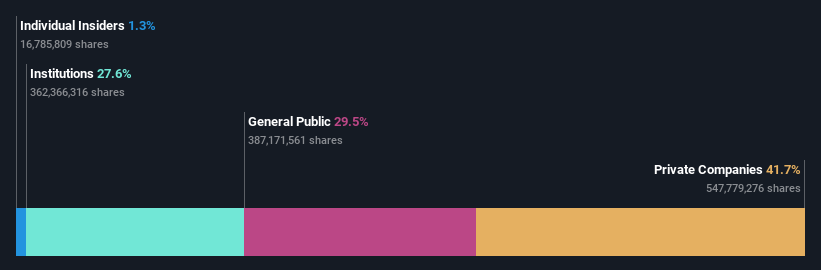

Overview: Abacus Storage King is a company that specializes in self-storage operations, focusing on rental and merchandising services, with a market capitalization of A$1.5 billion.

Operations: The company's revenue primarily comes from rental and merchandising activities, totaling A$220.48 million. Over the periods observed, the gross profit margin has shown a consistent upward trend, reaching 80.99%. Operating expenses have increased alongside revenue growth, with general and administrative expenses being a significant component. Net income margin experienced fluctuations but recently reached 62.67%, influenced by substantial non-operating income adjustments in the latest period.

PE: 12.4x

Abacus Storage King, a smaller player in the Australian market, has seen insider confidence with recent share purchases. Despite forecasts indicating a 1.7% annual decline in earnings over the next three years, revenue is expected to grow by 6.74% annually. However, their financial position raises concerns due to reliance on external borrowing for funding and large one-off items impacting earnings quality. Recent board changes include Sally Herman's appointment as an Independent Non-Executive Director and Audit & Risk Committee Chair, potentially steering future strategic decisions positively.

GWA Group (ASX:GWA)

Simply Wall St Value Rating: ★★★★★★

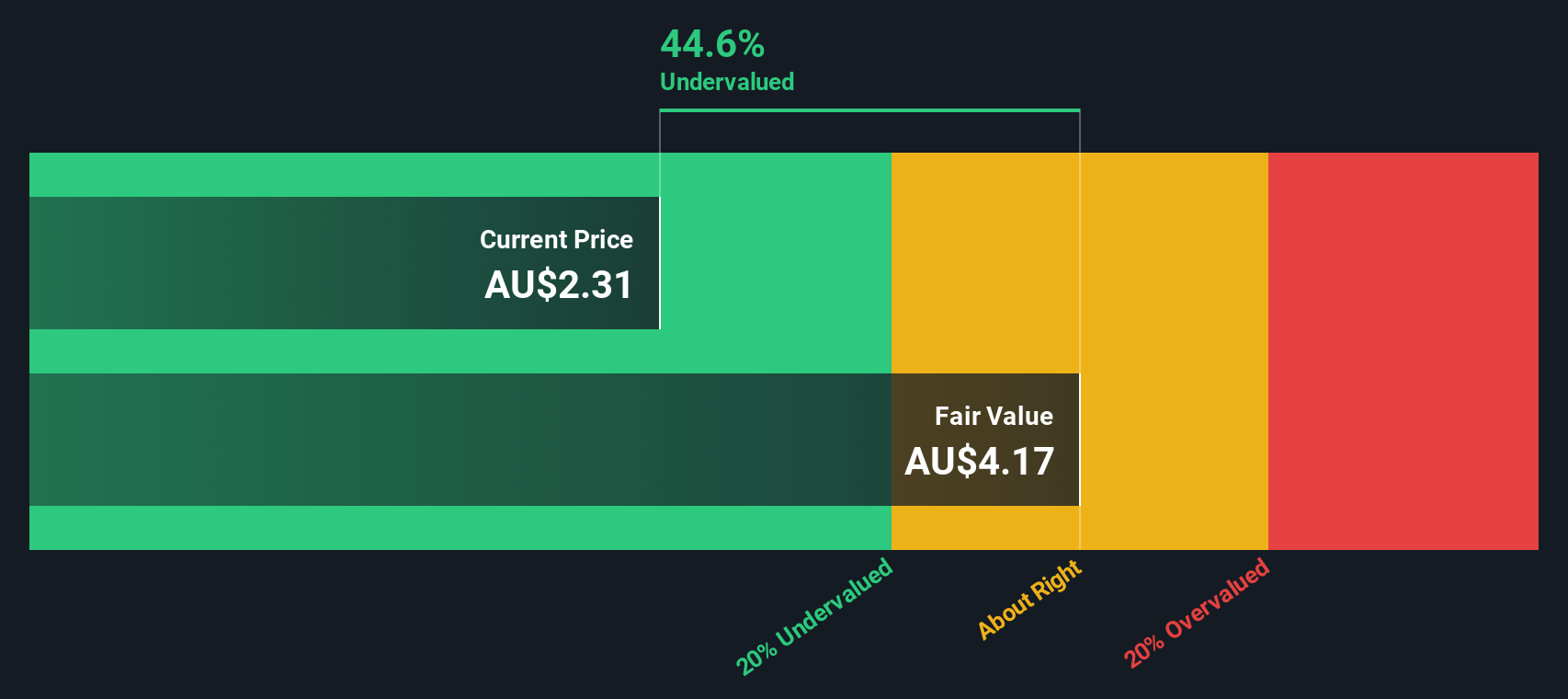

Overview: GWA Group is a company focused on water solutions, with operations centered around providing innovative products for the management and conservation of water resources, and it has a market capitalization of A$0.75 billion.

Operations: GWA Group generates revenue primarily from its Water Solutions segment, with a recent quarterly revenue of A$413.49 million. The company's cost of goods sold (COGS) for the same period was A$251.14 million, resulting in a gross profit margin of 39.26%. Operating expenses include significant allocations to sales and marketing, and general and administrative costs. Net income for the quarter stood at A$38.63 million, reflecting a net income margin of 9.34%.

PE: 16.7x

GWA Group, a smaller player in its sector, has captured attention with insider confidence through recent share purchases. Despite a slight dip in net income to A$38.63 million for the year ending June 2024, sales edged up to A$413.49 million from the previous year. The company faces higher risk due to reliance on external borrowing but anticipates earnings growth of 11.56% annually. Leadership changes are underway as Mr. McDonough steps down in November 2024, succeeded by Bernadette Inglis as Chair.

- Navigate through the intricacies of GWA Group with our comprehensive valuation report here.

Assess GWA Group's past performance with our detailed historical performance reports.

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

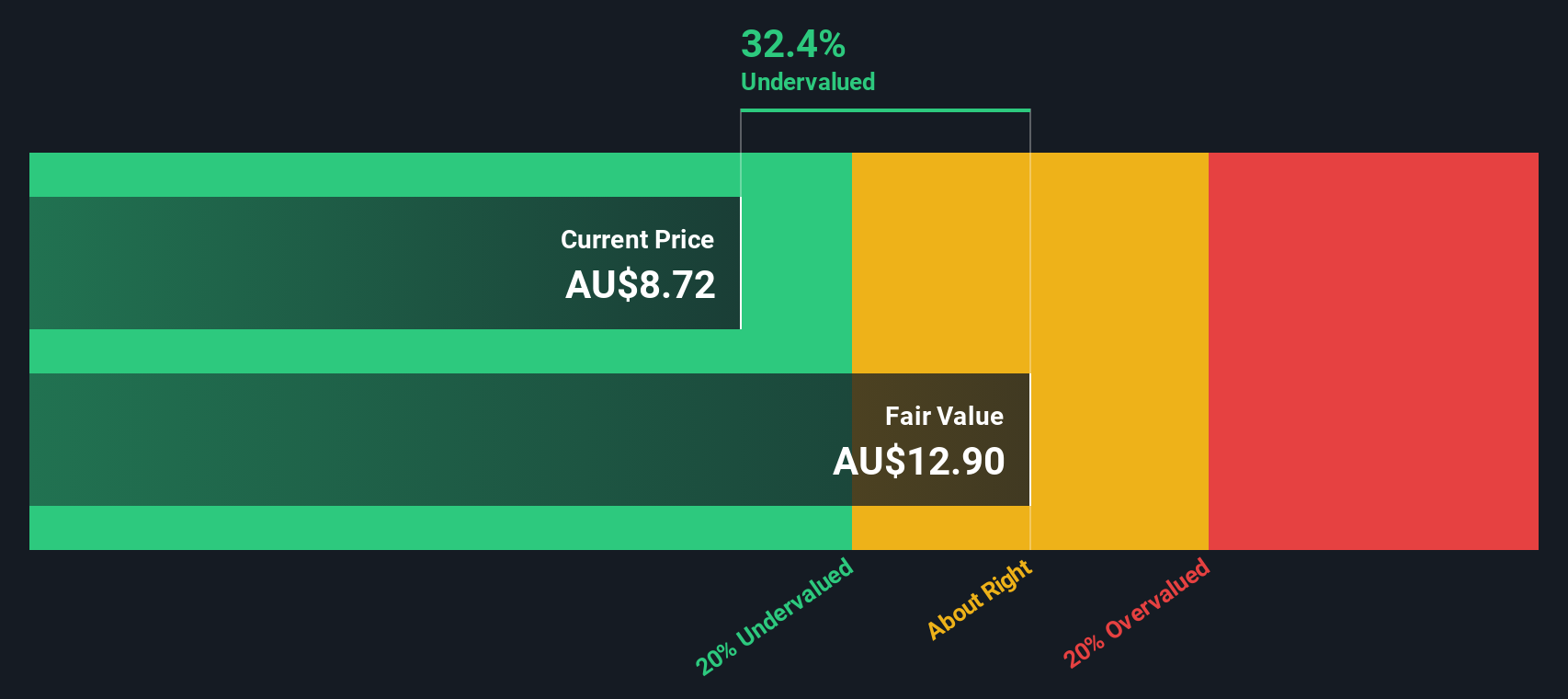

Overview: Magellan Financial Group is an Australian-based investment management company that primarily offers investment management services, with a market capitalization of A$4.5 billion.

Operations: Magellan Financial Group generates revenue primarily from Investment Management Services, with additional contributions from Fund and Corporate Investments. The company's gross profit margin has shown variability, peaking at 90.26% in June 2021 before decreasing to 80.78% by June 2024. Operating expenses have been a consistent component of the cost structure, with general and administrative expenses being a significant part of these costs.

PE: 8.4x

Magellan Financial Group, a smaller player in the Australian market, has caught attention with its strategic share repurchase plan. From July 2023 to June 2024, it bought back 685,571 shares for A$5.19 million as part of a larger initiative since March 2022. Despite facing an anticipated average earnings decline of 9.2% annually over the next three years and relying on external borrowing for funding, its recent net income rose to A$238.76 million from A$182.66 million last year, showcasing resilience amidst challenges. With leadership changes underway and plans to appoint a new non-executive director by late 2025, Magellan is navigating through transitions while maintaining shareholder engagement through dividends and buybacks.

Make It Happen

- Access the full spectrum of 25 Undervalued ASX Small Caps With Insider Buying by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GWA

GWA Group

Researches, designs, manufactures, imports, and markets building fixtures and fittings to residential and commercial premises in Australia, New Zealand, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives