- Australia

- /

- Capital Markets

- /

- ASX:BKI

3 ASX Penny Stocks With Over A$100M Market Cap

Reviewed by Simply Wall St

The Australian market started the week strong, with the XJO climbing above 9,000 points, driven by gains in the financials sector as anticipation builds around a key meeting between Anthony Albanese and Donald Trump. In this context of economic shifts and strategic discussions on critical minerals, penny stocks remain an intriguing investment area for those seeking potential growth in smaller or newer companies. Despite their outdated name, these stocks can still offer surprising value when backed by solid financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.70 | A$125.48M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.90 | A$56.35M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.65 | A$410.95M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.32 | A$245.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.042 | A$47.96M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$38.45M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.50 | A$59.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.83 | A$397.09M | ✅ 5 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.8225 | A$149.33M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 422 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

BKI Investment (ASX:BKI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BKI Investment Company Limited is a publicly owned investment manager with a market capitalization of A$1.43 billion.

Operations: The company generates revenue from the Securities Industry amounting to A$69.33 million.

Market Cap: A$1.43B

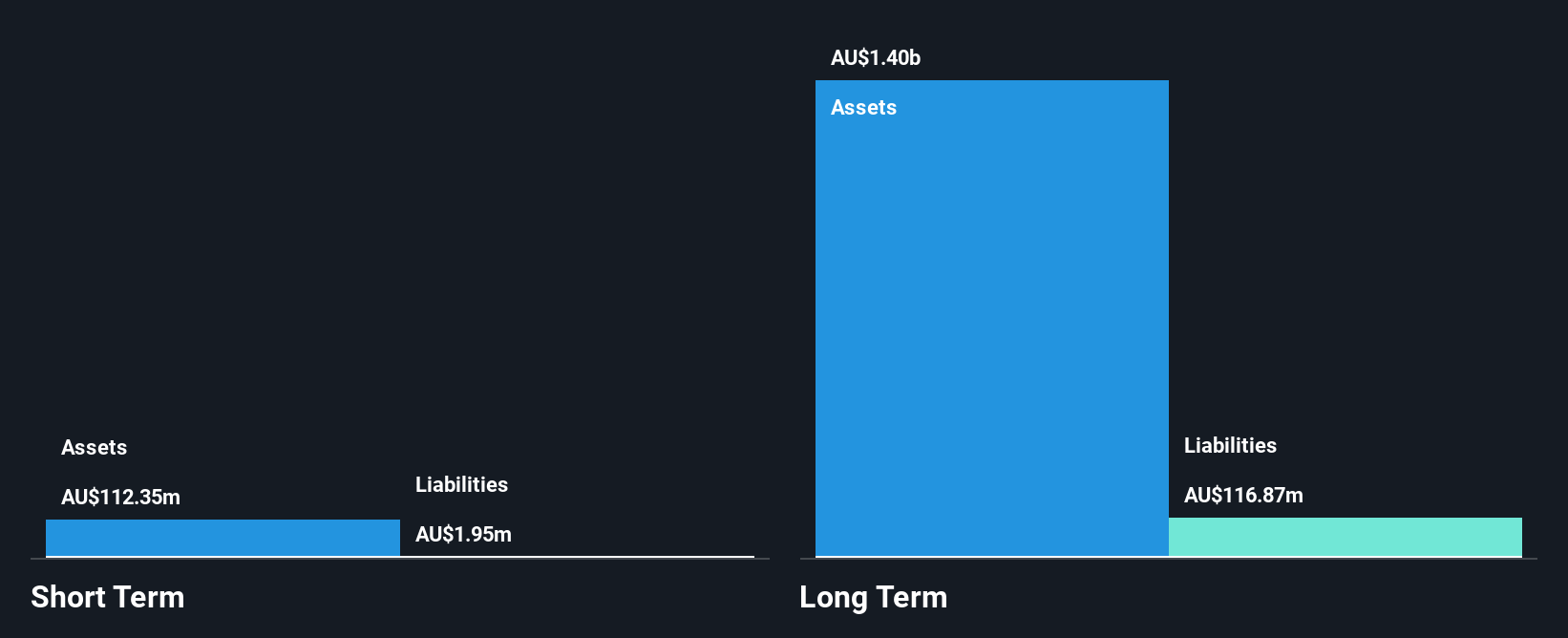

BKI Investment Company Limited, with a market cap of A$1.43 billion, operates debt-free and has maintained stable earnings over the past five years. Recent financials show a slight dip in net income to A$61.86 million from A$64.39 million last year, despite revenue growth to A$69.33 million. The company's dividend yield is 4.44%, though not fully covered by earnings or cash flows, raising sustainability concerns. BKI's board boasts an average tenure of 22 years, indicating strong governance experience, while the recent appointment of Belinda Cleminson as Company Secretary may enhance corporate oversight amidst evolving market dynamics.

- Dive into the specifics of BKI Investment here with our thorough balance sheet health report.

- Explore historical data to track BKI Investment's performance over time in our past results report.

EMVision Medical Devices (ASX:EMV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EMVision Medical Devices Ltd focuses on the research, development, and commercialization of neurodiagnostic technology for stroke diagnosis and monitoring, as well as other medical imaging needs in Australia, with a market cap of A$175.54 million.

Operations: The company's revenue segment is primarily derived from research and development of medical device technology, amounting to A$5.05 million.

Market Cap: A$175.54M

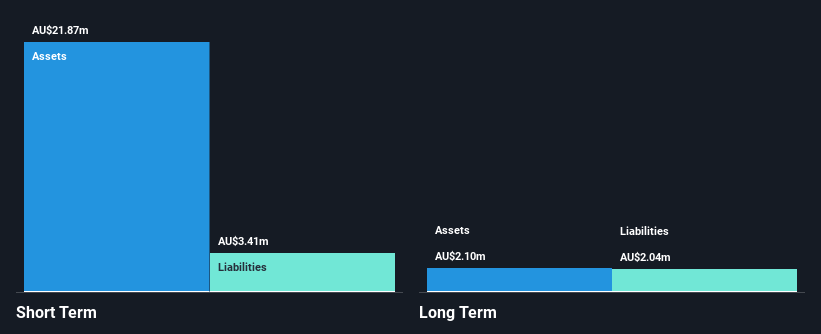

EMVision Medical Devices Ltd, with a market cap of A$175.54 million, remains pre-revenue despite generating A$5.63 million in revenue last year, down from A$11.56 million previously. The company recently raised A$14 million through follow-on equity offerings to support its operations and development efforts. While its management and board are experienced, EMVision is unprofitable and not expected to achieve profitability within the next three years. Despite sufficient short-term asset coverage over liabilities and a cash runway of over a year, the company's financial volatility and increasing debt-to-equity ratio are potential concerns for investors in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of EMVision Medical Devices.

- Gain insights into EMVision Medical Devices' future direction by reviewing our growth report.

GWA Group (ASX:GWA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GWA Group Limited is involved in the research, design, manufacture, importation, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, the United Kingdom, and other international markets with a market cap of A$649.44 million.

Operations: The company's revenue is primarily generated from its Water Solutions segment, which accounted for A$418.48 million.

Market Cap: A$649.44M

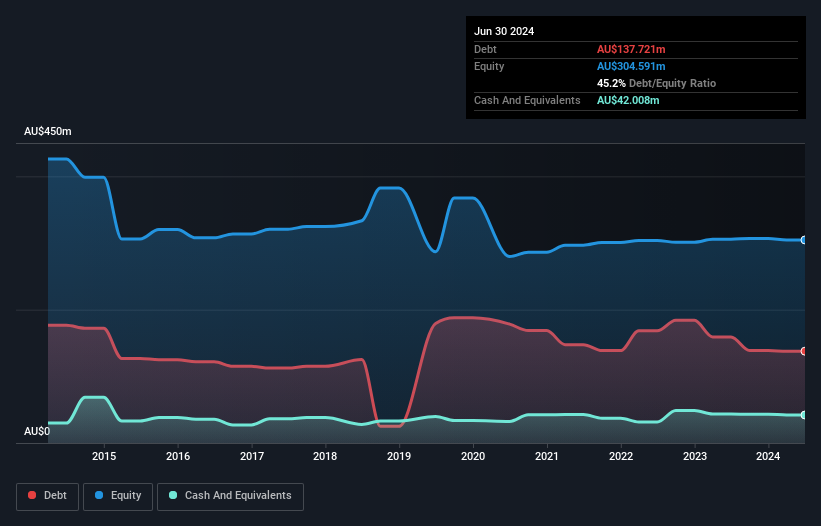

GWA Group Limited, with a market cap of A$649.44 million, is experiencing solid earnings growth, outpacing the broader building industry and improving its net profit margins to 10.4%. The company's debt management has been effective, reducing its debt-to-equity ratio over five years while maintaining satisfactory net debt levels. However, GWA's dividend yield of 6.2% is not well covered by earnings, and short-term assets fall short of long-term liabilities. Recent strategic moves include a share buyback program aimed at capital management despite being dropped from the S&P Global BMI Index in September 2025.

- Click to explore a detailed breakdown of our findings in GWA Group's financial health report.

- Understand GWA Group's earnings outlook by examining our growth report.

Next Steps

- Click here to access our complete index of 422 ASX Penny Stocks.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BKI Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BKI

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives