- Australia

- /

- Real Estate

- /

- ASX:PPC

3 ASX Dividend Stocks Yielding Up To 19.8%

Reviewed by Simply Wall St

As the Australian market experiences a mild upswing, buoyed by potential diplomatic developments and a rebound in commodity prices, investors are keenly observing opportunities that promise stable returns amidst global uncertainties. In this context, dividend stocks stand out as attractive options for those seeking consistent income streams, especially when geopolitical events and fluctuating commodity prices continue to influence market dynamics.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 6.42% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.73% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.94% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.27% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.33% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.83% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.03% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.86% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.66% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.97% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

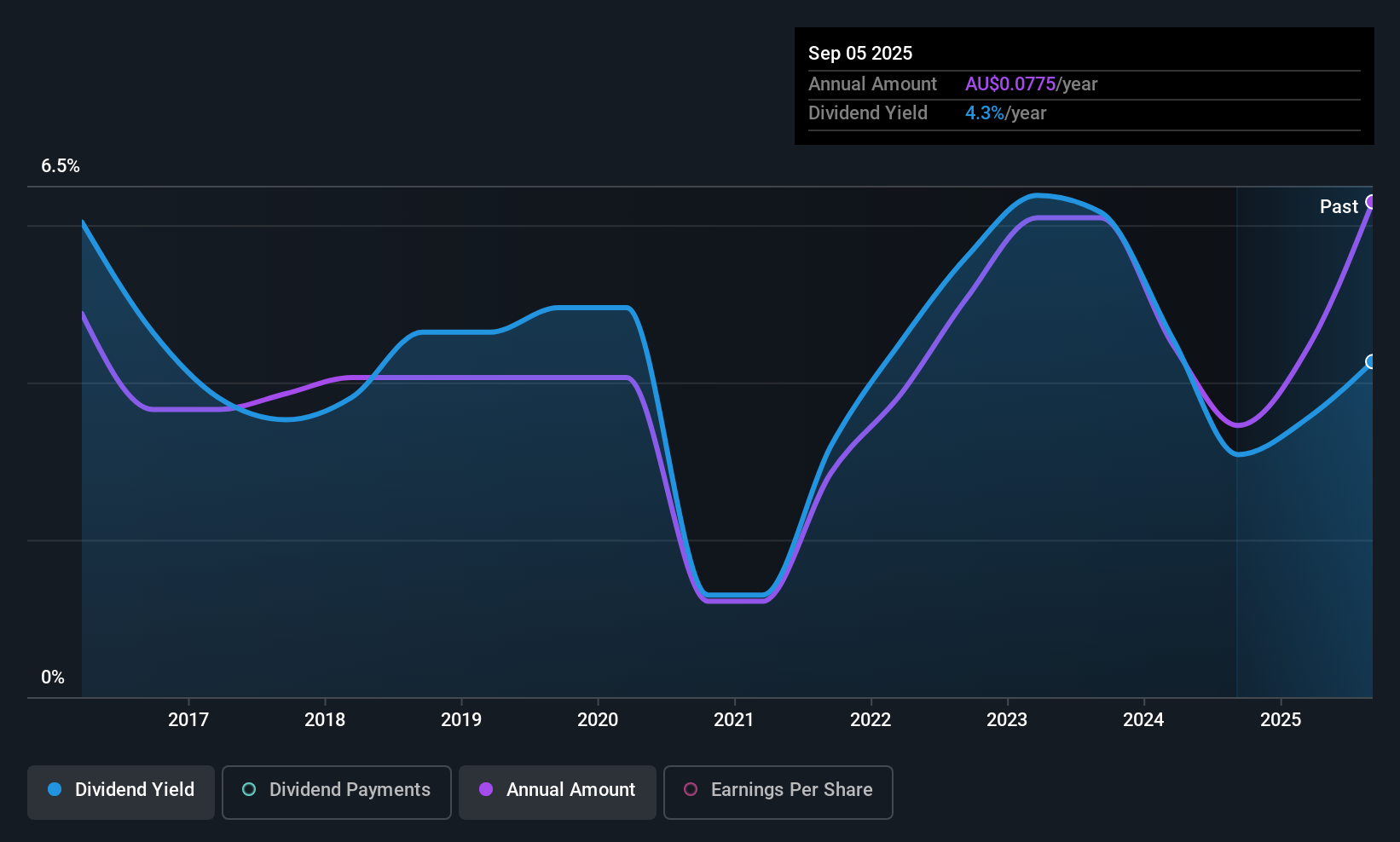

GWA Group (ASX:GWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GWA Group Limited researches, designs, manufactures, imports, and markets building fixtures and fittings for residential and commercial premises in Australia, New Zealand, the United Kingdom, and internationally with a market cap of A$665.22 million.

Operations: GWA Group Limited's revenue primarily comes from its Water Solutions segment, which generated A$418.48 million.

Dividend Yield: 6.1%

GWA Group's dividend yield of 6.13% ranks in the top 25% of Australian dividend payers, though its sustainability is questionable due to a high payout ratio of 94.8%, indicating dividends are not fully covered by earnings. Despite a recent earnings increase to A$43.38 million, GWA's dividends have been volatile over the past decade. The company announced an A$30 million share buyback for capital management after being dropped from the S&P Global BMI Index in September 2025.

- Click to explore a detailed breakdown of our findings in GWA Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of GWA Group shares in the market.

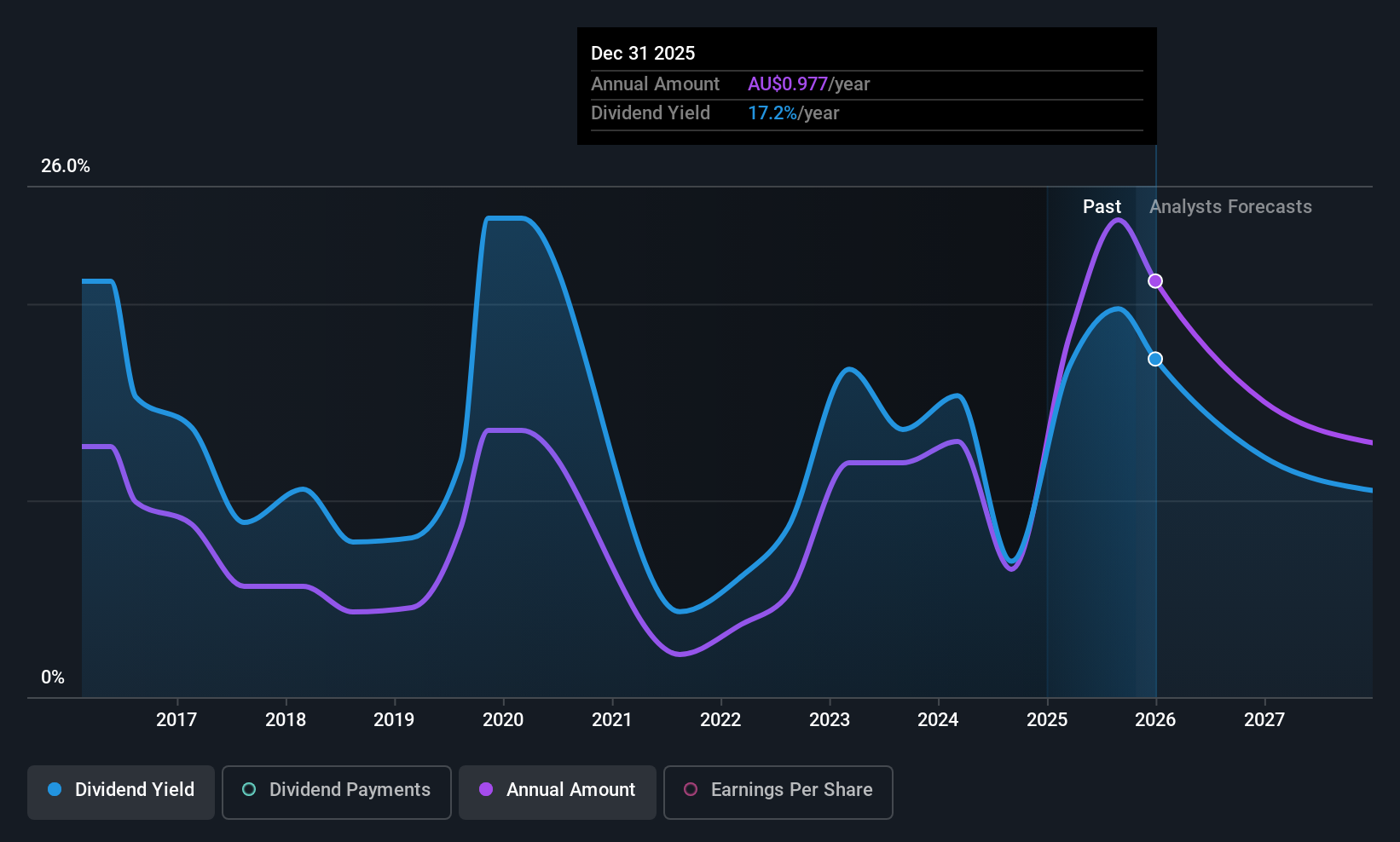

Helia Group (ASX:HLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Helia Group Limited, with a market cap of A$1.53 billion, operates in Australia through its subsidiaries, focusing on the loan mortgage insurance business.

Operations: Helia Group Limited generates revenue of A$559.63 million from its operations in the loan mortgage insurance sector in Australia.

Dividend Yield: 19.9%

Helia Group's dividend yield of 19.86% places it among the top Australian dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 209.7%, indicating dividends are not well covered by cash flows despite a low earnings payout ratio of 33.1%. Recent earnings rose to A$133.7 million for H1 2025, with special and ordinary dividends announced alongside an increased revenue forecast, reflecting strategic financial management amidst board changes and share buybacks.

- Delve into the full analysis dividend report here for a deeper understanding of Helia Group.

- Our valuation report unveils the possibility Helia Group's shares may be trading at a discount.

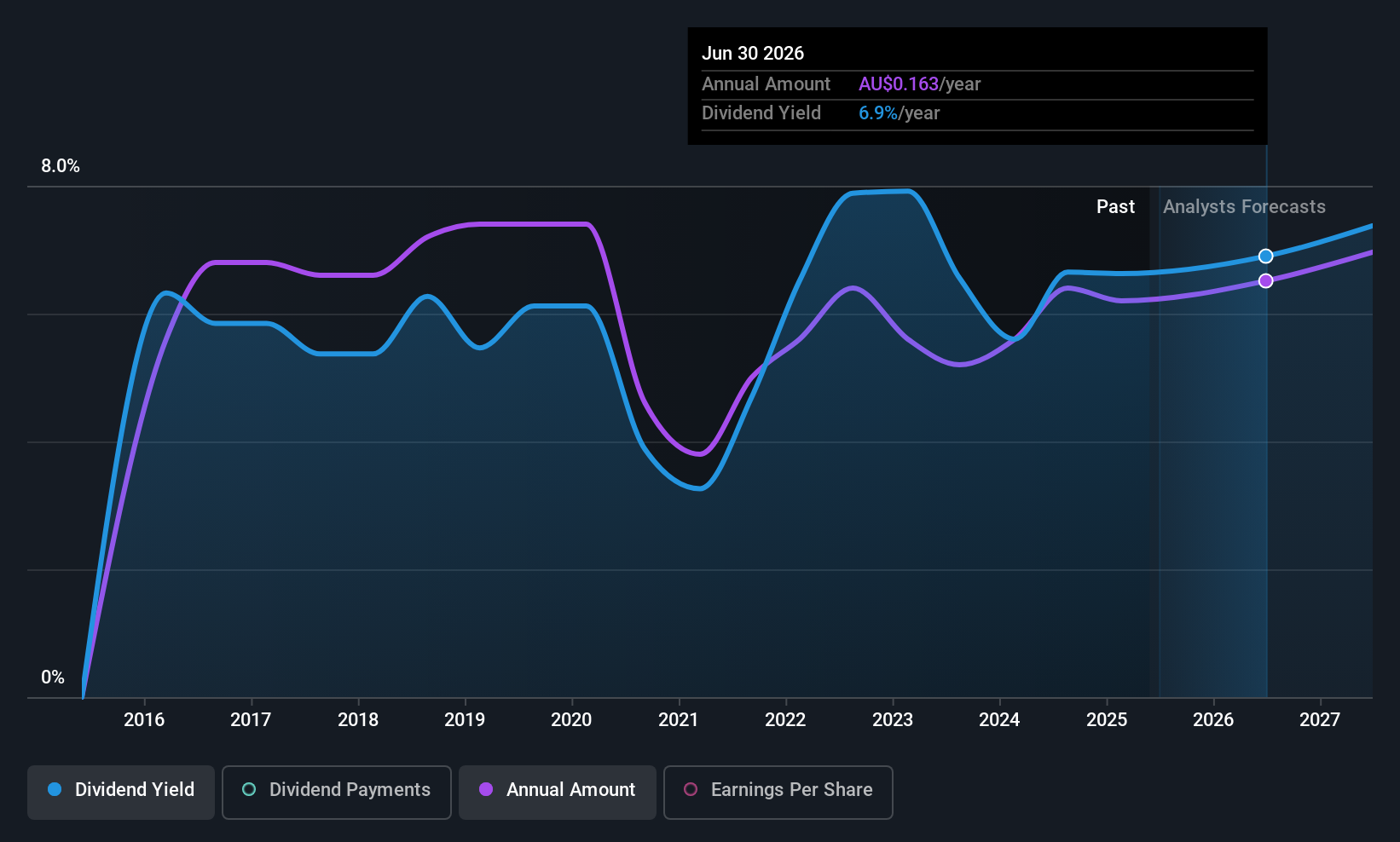

Peet (ASX:PPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peet Limited acquires, develops, and markets residential land in Australia with a market cap of A$894.18 million.

Operations: Peet Limited's revenue is primarily derived from Company Owned Projects (A$313.24 million), supplemented by contributions from Funds Management (A$56.39 million) and Joint Arrangements (A$51.88 million).

Dividend Yield: 4.1%

Peet's dividend payments, covered by a 62.1% earnings payout and a 34.1% cash payout ratio, are financially sustainable despite historical volatility. Recent growth in earnings to A$58.47 million supports this coverage, although the dividend yield of 4.06% is below top-tier Australian payers. The company is undergoing a strategic review with Goldman Sachs to leverage market conditions and enhance shareholder value amidst strong property sector tailwinds and recent dividend increases to A$0.05 per share for H2 2025.

- Click here to discover the nuances of Peet with our detailed analytical dividend report.

- According our valuation report, there's an indication that Peet's share price might be on the cheaper side.

Turning Ideas Into Actions

- Delve into our full catalog of 27 Top ASX Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPC

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives