- Australia

- /

- Electrical

- /

- ASX:FOS

Shareholders Should Be Pleased With FOS Capital Limited's (ASX:FOS) Price

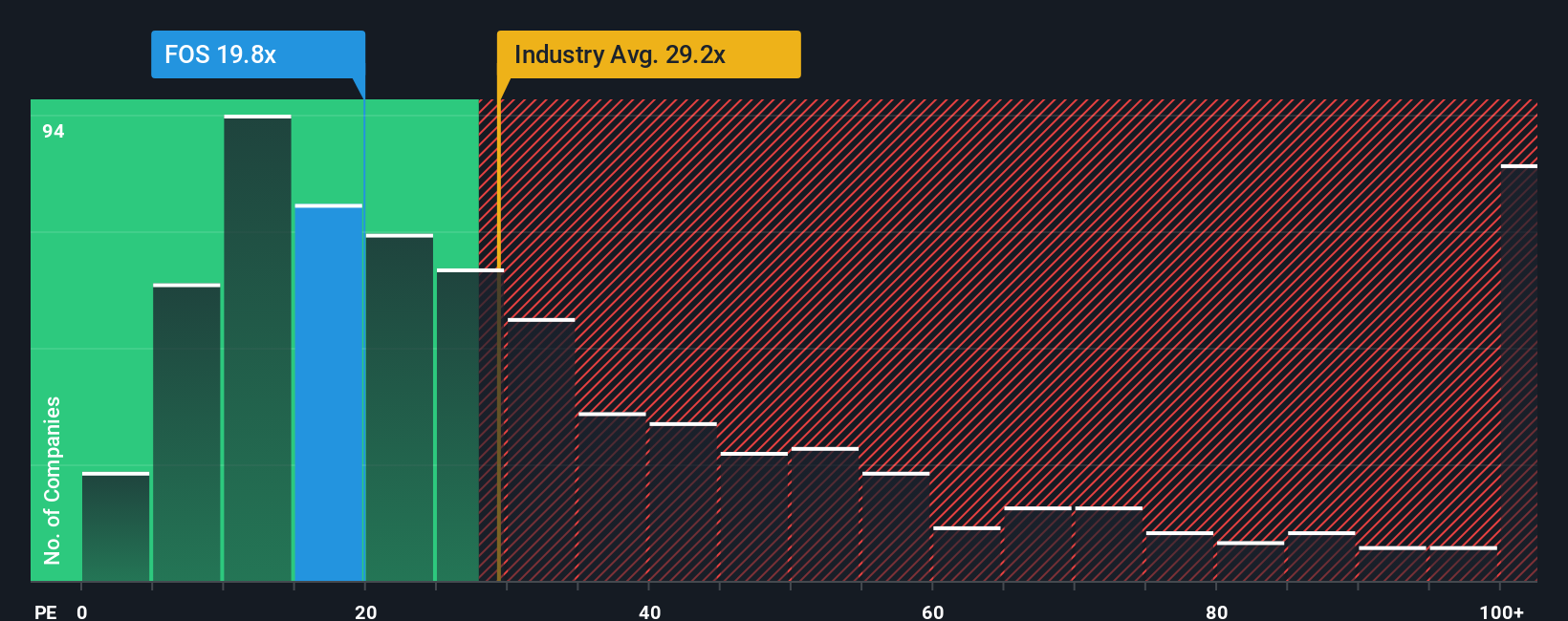

There wouldn't be many who think FOS Capital Limited's (ASX:FOS) price-to-earnings (or "P/E") ratio of 19.8x is worth a mention when the median P/E in Australia is similar at about 19x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, FOS Capital has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for FOS Capital

Is There Some Growth For FOS Capital?

There's an inherent assumption that a company should be matching the market for P/E ratios like FOS Capital's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 46%. Pleasingly, EPS has also lifted 83% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

It's interesting to note that the rest of the market is similarly expected to grow by 24% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that FOS Capital's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What We Can Learn From FOS Capital's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of FOS Capital revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for FOS Capital that you should be aware of.

You might be able to find a better investment than FOS Capital. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FOS

FOS Capital

Through its subsidiaries, manufactures and distributes commercial luminaires, outdoor fittings, linear extruded lighting, and architectural lighting solutions in Australia and New Zealand.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives