- Australia

- /

- Aerospace & Defense

- /

- ASX:EOS

Market Participants Recognise Electro Optic Systems Holdings Limited's (ASX:EOS) Revenues Pushing Shares 31% Higher

Electro Optic Systems Holdings Limited (ASX:EOS) shareholders have had their patience rewarded with a 31% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 9.0% isn't as attractive.

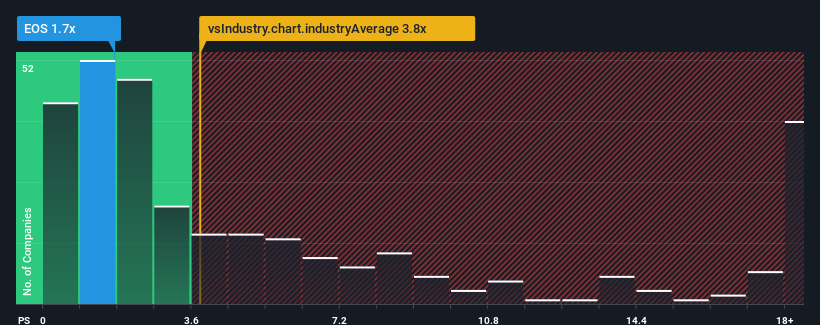

Even after such a large jump in price, it's still not a stretch to say that Electro Optic Systems Holdings' price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" compared to the Aerospace & Defense industry in Australia, where the median P/S ratio is around 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Our free stock report includes 1 warning sign investors should be aware of before investing in Electro Optic Systems Holdings. Read for free now.Check out our latest analysis for Electro Optic Systems Holdings

How Has Electro Optic Systems Holdings Performed Recently?

With revenue growth that's superior to most other companies of late, Electro Optic Systems Holdings has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Electro Optic Systems Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Electro Optic Systems Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.0% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 17% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 11% per year over the next three years. With the industry predicted to deliver 12% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Electro Optic Systems Holdings' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Electro Optic Systems Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Electro Optic Systems Holdings' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Electro Optic Systems Holdings that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Electro Optic Systems Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EOS

Electro Optic Systems Holdings

Engages in the development, manufacture, and sale of telescopes and dome enclosures, laser satellite tracking systems, and remote weapon systems.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives