Are Embelton's (ASX:EMB) Statutory Earnings A Good Reflection Of Its Earnings Potential?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether Embelton's (ASX:EMB) statutory profits are a good guide to its underlying earnings.

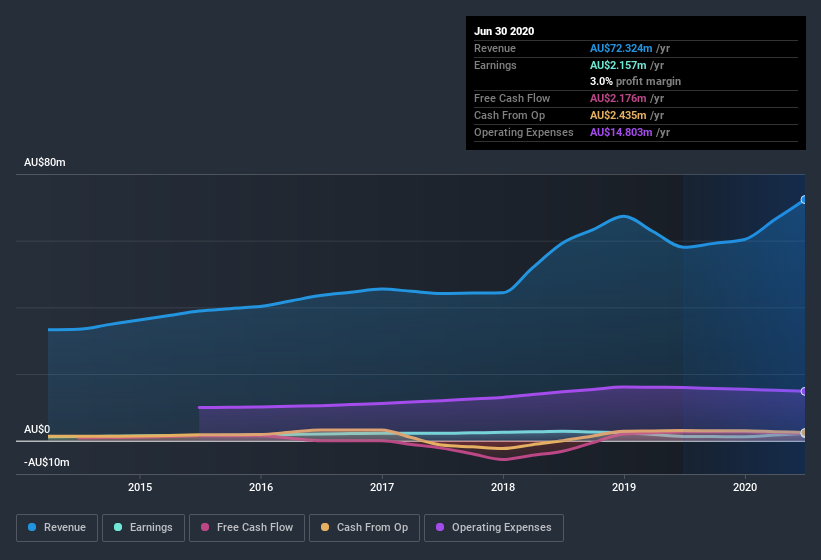

It's good to see that over the last twelve months Embelton made a profit of AU$2.16m on revenue of AU$72.3m. While it managed to grow its revenue over the last three years, its profit has moved in the other direction, as you can see in the chart below.

View our latest analysis for Embelton

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. This article will focus on the impact unusual items have had on Embelton's statutory earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Embelton.

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Embelton's profit was reduced by AU$491k, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Embelton doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Embelton's Profit Performance

Because unusual items detracted from Embelton's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Based on this observation, we consider it likely that Embelton's statutory profit actually understates its earnings potential! And the EPS is up 70% over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into Embelton, you'd also look into what risks it is currently facing. For example, Embelton has 3 warning signs (and 1 which is concerning) we think you should know about.

Today we've zoomed in on a single data point to better understand the nature of Embelton's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Embelton, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Embelton, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Embelton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EMB

Embelton

Engages in the manufacture, distribution, and installation of flooring products and services in Australia, Singapore, China, the United Kingdom, and internationally.

Flawless balance sheet with proven track record.