- Australia

- /

- Electrical

- /

- ASX:SKS

Undiscovered Gems in Australia for October 2025

Reviewed by Simply Wall St

As the Australian market experiences a robust start to the week, buoyed by financial sector gains and anticipation surrounding the Albo-Trump meeting, investors are closely monitoring developments in rare earths amidst geopolitical tensions. In such dynamic conditions, identifying promising small-cap stocks requires a keen eye for companies poised to benefit from strategic partnerships and emerging industry trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Emeco Holdings (ASX:EHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emeco Holdings Limited provides surface and underground mining equipment rental and related services in Australia, with a market capitalization of A$601.95 million.

Operations: The company generates revenue primarily through its rental segment, contributing A$615.39 million, and its workshops segment, adding A$273.47 million. The net profit margin reflects the company's efficiency in converting revenue into profit.

Emeco Holdings, a nimble player in the Australian market, has shown impressive earnings growth of 42.7% over the past year, outpacing its industry peers. The company’s net debt to equity ratio stands at a satisfactory 17.6%, a significant improvement from 159.1% five years ago, reflecting prudent financial management. Trading at a substantial discount of 65.4% below its estimated fair value, Emeco offers a compelling proposition for investors seeking value in a volatile mining sector. Recent board changes and acquisition rumors highlight potential strategic shifts, while its focus on ESG-compliant equipment signals a forward-looking approach amidst industry challenges.

SKS Technologies Group (ASX:SKS)

Simply Wall St Value Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services, with a market cap of A$449.65 million.

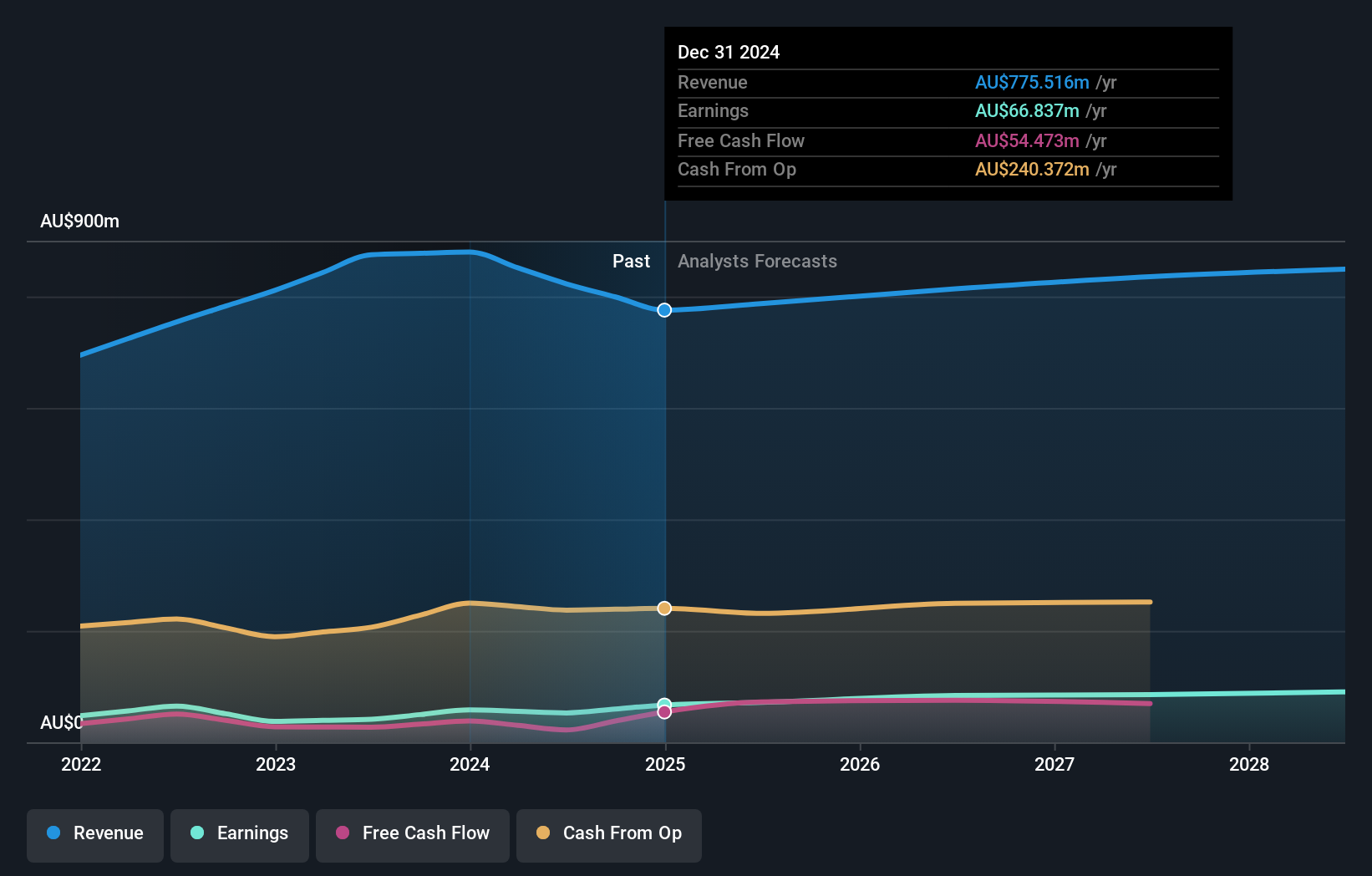

Operations: SKS Technologies Group generates revenue primarily from the lighting and audio-visual markets, amounting to A$261.66 million.

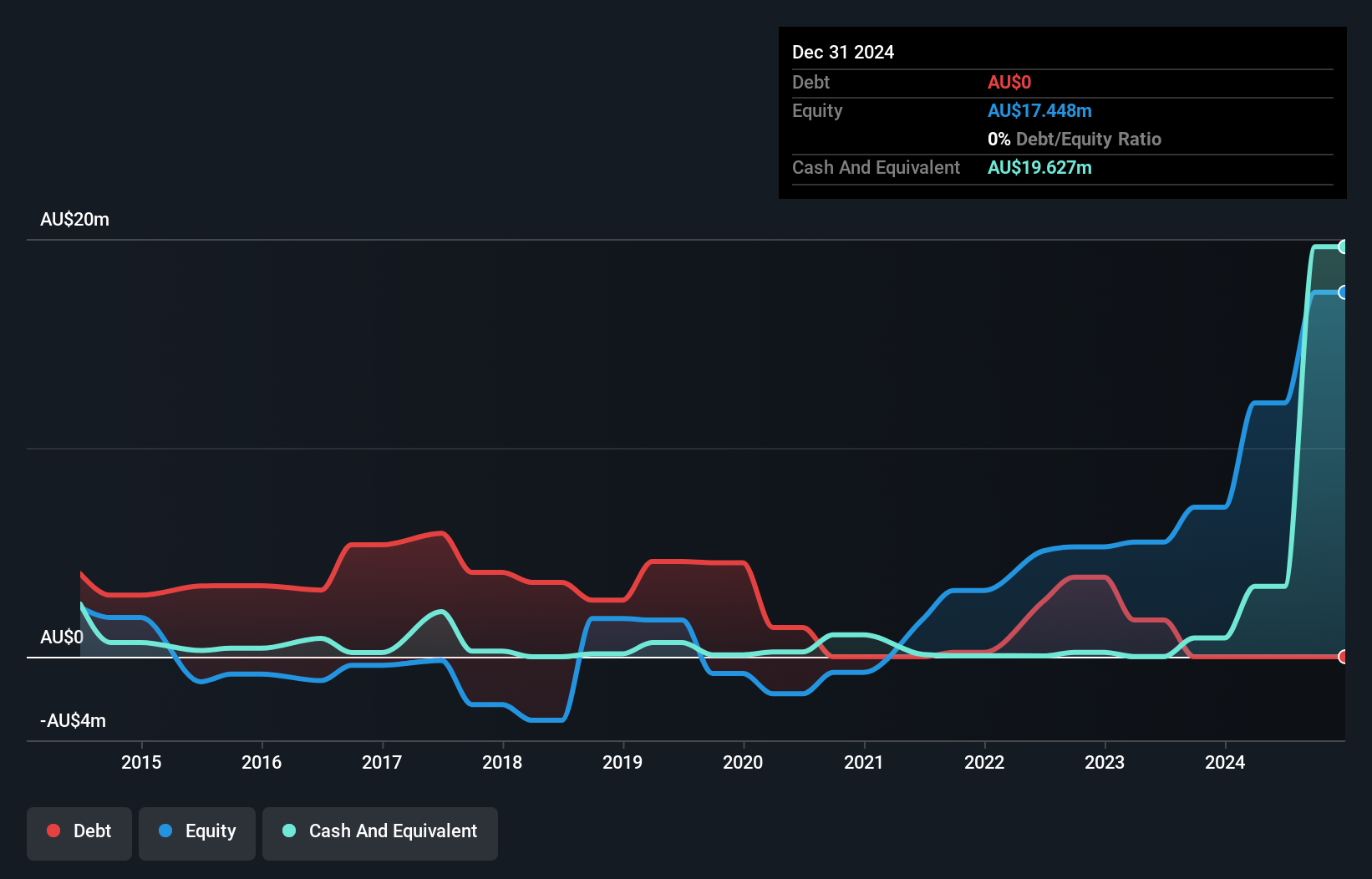

SKS Technologies Group has seen impressive growth, with earnings surging 111.8% over the past year, outpacing the Electrical industry average of 9.3%. With no debt on its books, SKS is well-positioned financially, boasting high-quality earnings and positive free cash flow. The company reported a revenue jump to A$263.23 million from A$136.52 million last year, alongside net income rising to A$14.03 million from A$6.62 million. Despite operational risks tied to large data center contracts and rising labor costs, SKS is projected to achieve a 12.1% annual revenue increase over the next three years, with profit margins expected to rise from 5.4% to 6%.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited operates by offering executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services across Australia, New Zealand, Southeast Asia, the United States, Europe, the Middle East, North Asia, and other international locations, with a market cap of A$722.21 million.

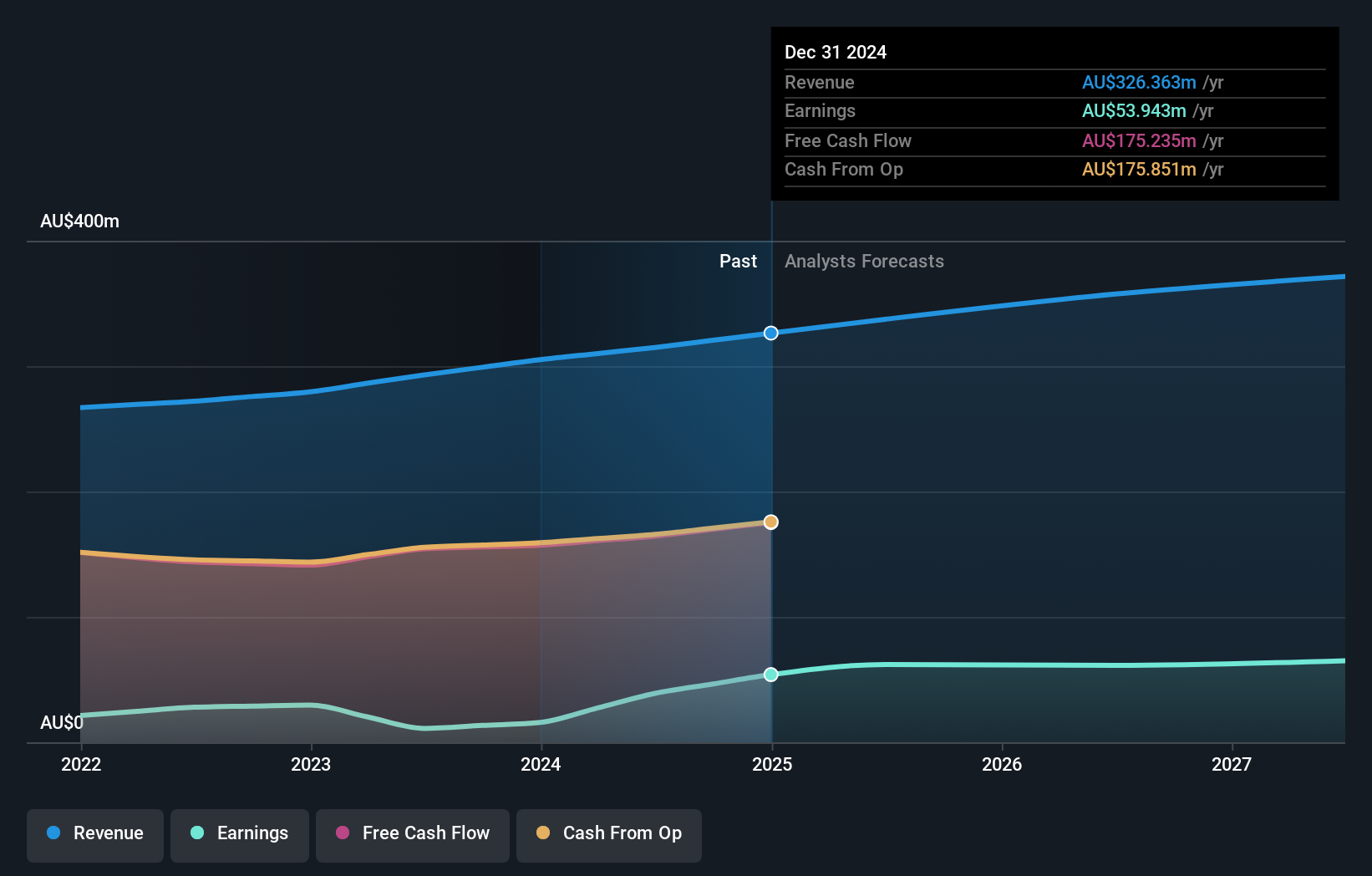

Operations: Servcorp Limited generates revenue primarily from real estate rentals, amounting to A$349.86 million. The company's financial performance can be analyzed through its net profit margin, which reflects its profitability after all expenses.

Servcorp, a player in the flexible workspace industry, has been expanding into strategic markets like Japan and the UAE, enhancing its global footprint. The company reported a revenue of A$352.08 million for the year ending June 2025, up from A$317.01 million the previous year, with net income rising to A$53.12 million from A$39.04 million. Despite no debt burden and consistent dividend payouts, Servcorp faces challenges such as high operational costs and stiff competition. Trading at A$6.8, with a target price of A$7.2, it offers potential value but requires careful consideration of market dynamics.

Make It Happen

- Click through to start exploring the rest of the 56 ASX Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SKS

SKS Technologies Group

Engages in the design, supply, and installation of audio visual, electrical, and communication products and services in Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives