- Australia

- /

- Capital Markets

- /

- ASX:HM1

Uncovering Emeco Holdings And 2 Other Undiscovered Gems In Australia

Reviewed by Simply Wall St

As the Australian market navigates a landscape shaped by recent interest rate cuts from the RBA and a mixed performance across sectors, small-cap stocks are drawing attention for their potential amidst economic shifts. In this environment, identifying promising companies like Emeco Holdings involves looking for those that can capitalize on strong fundamentals and strategic positioning within their industries.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bailador Technology Investments | NA | 11.17% | 10.16% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| K&S | 16.07% | 0.09% | 33.40% | ★★★★☆☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

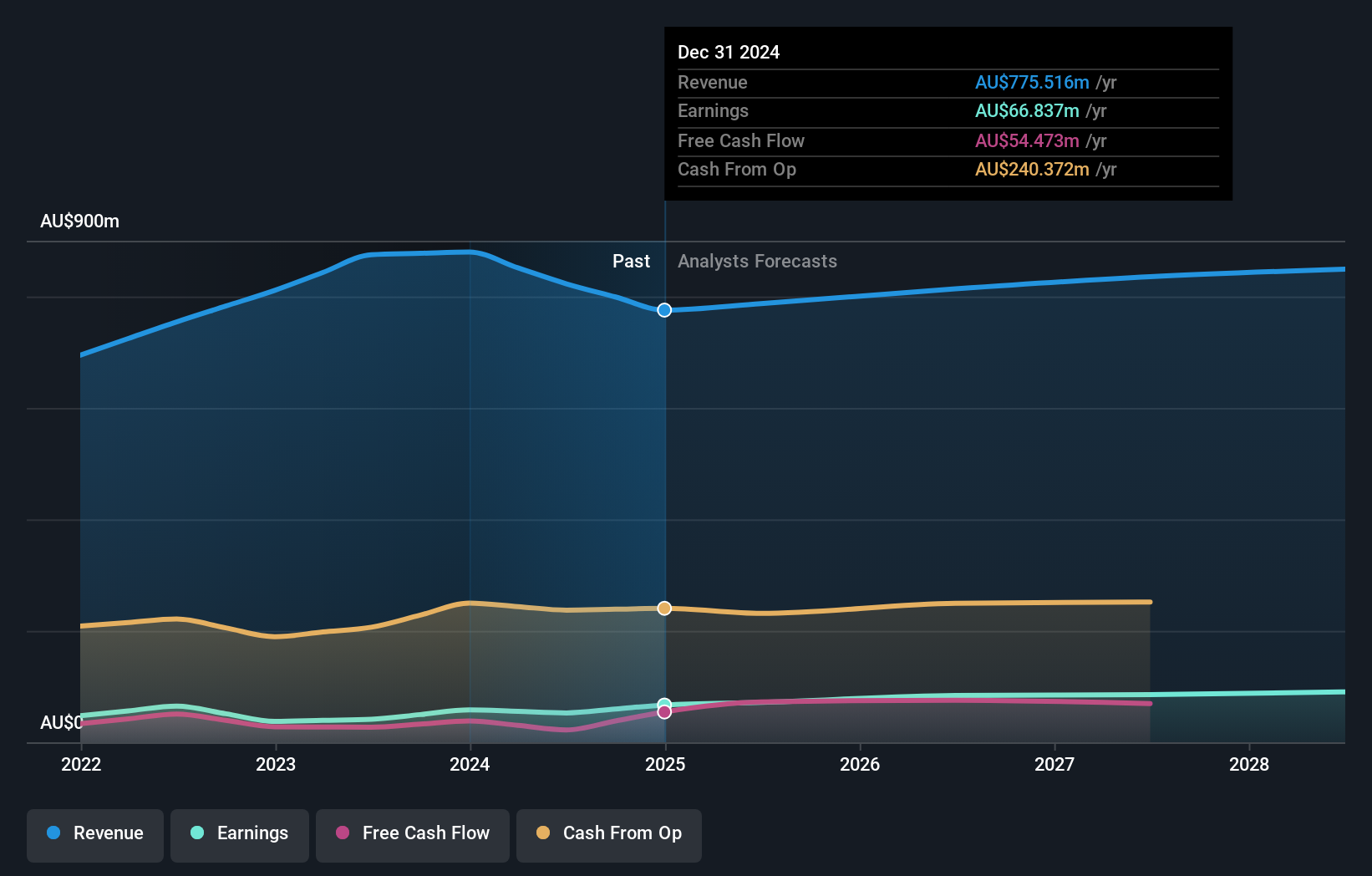

Emeco Holdings (ASX:EHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emeco Holdings Limited specializes in the rental of surface and underground mining equipment, along with offering complementary equipment and mining services in Australia, with a market capitalization of approximately A$498.91 million.

Operations: Emeco Holdings generates revenue primarily from its rental segment at A$544.75 million, followed by workshops and Pit N Portal services at A$282.41 million and A$111.77 million, respectively. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

Emeco Holdings, a nimble player in the equipment rental sector, is enhancing its focus on high-margin rentals after divesting its underground contracting unit. This strategic pivot likely boosts profit margins and operational efficiency, with anticipated earnings growth from A$52.7 million to A$87.3 million by 2028. The company's debt management appears sound with interest payments well covered at 4.7x EBIT and a reduced debt-to-equity ratio of 44.3% over five years. Trading at approximately 48.9% below estimated fair value, Emeco presents potential upside but faces risks like increased overheads and maturing debts by July 2026.

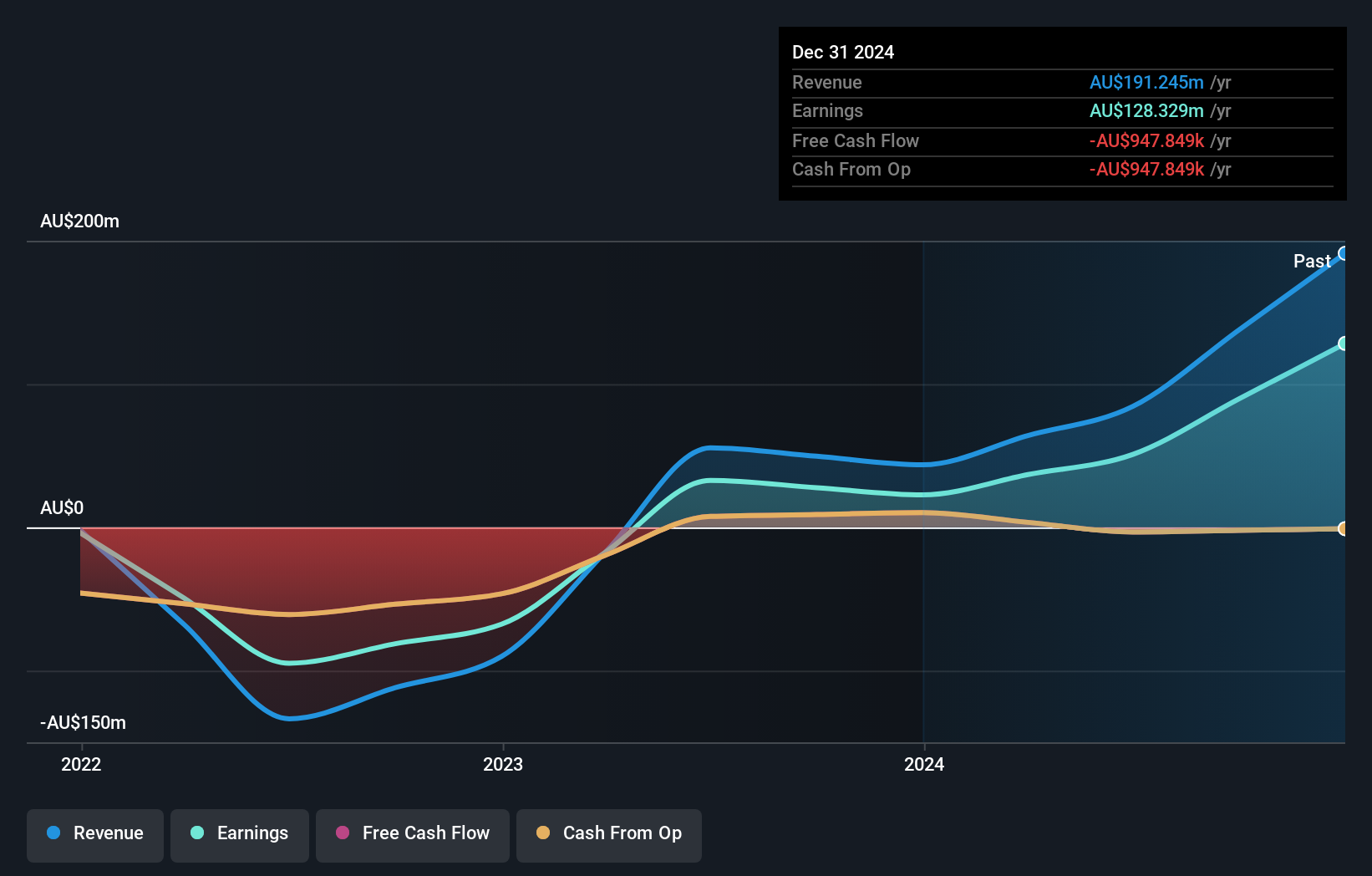

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian-listed investment company with a market cap of A$780.83 million, focusing on generating returns by leveraging the expertise of leading fund managers.

Operations: Hearts and Minds Investments generates revenue primarily through investment activities, amounting to A$84.39 million. The company's financial performance can be further assessed by examining its net profit margin, which provides insight into profitability relative to revenue generated.

Hearts and Minds Investments, a relatively small player in the market, shows promising traits with its earnings growth of 56% over the past year, significantly outpacing the Capital Markets industry average of 16%. The company’s price-to-earnings ratio stands at a favorable 15.3x compared to the broader Australian market's 19.7x, suggesting potential undervaluation. Despite not being free cash flow positive recently, its interest payments are comfortably covered by EBIT at an impressive multiple of nearly 14 million times. Additionally, Hearts and Minds declared a fully franked interim dividend of A$0.08 per share for late 2024.

- Delve into the full analysis health report here for a deeper understanding of Hearts and Minds Investments.

Gain insights into Hearts and Minds Investments' past trends and performance with our Past report.

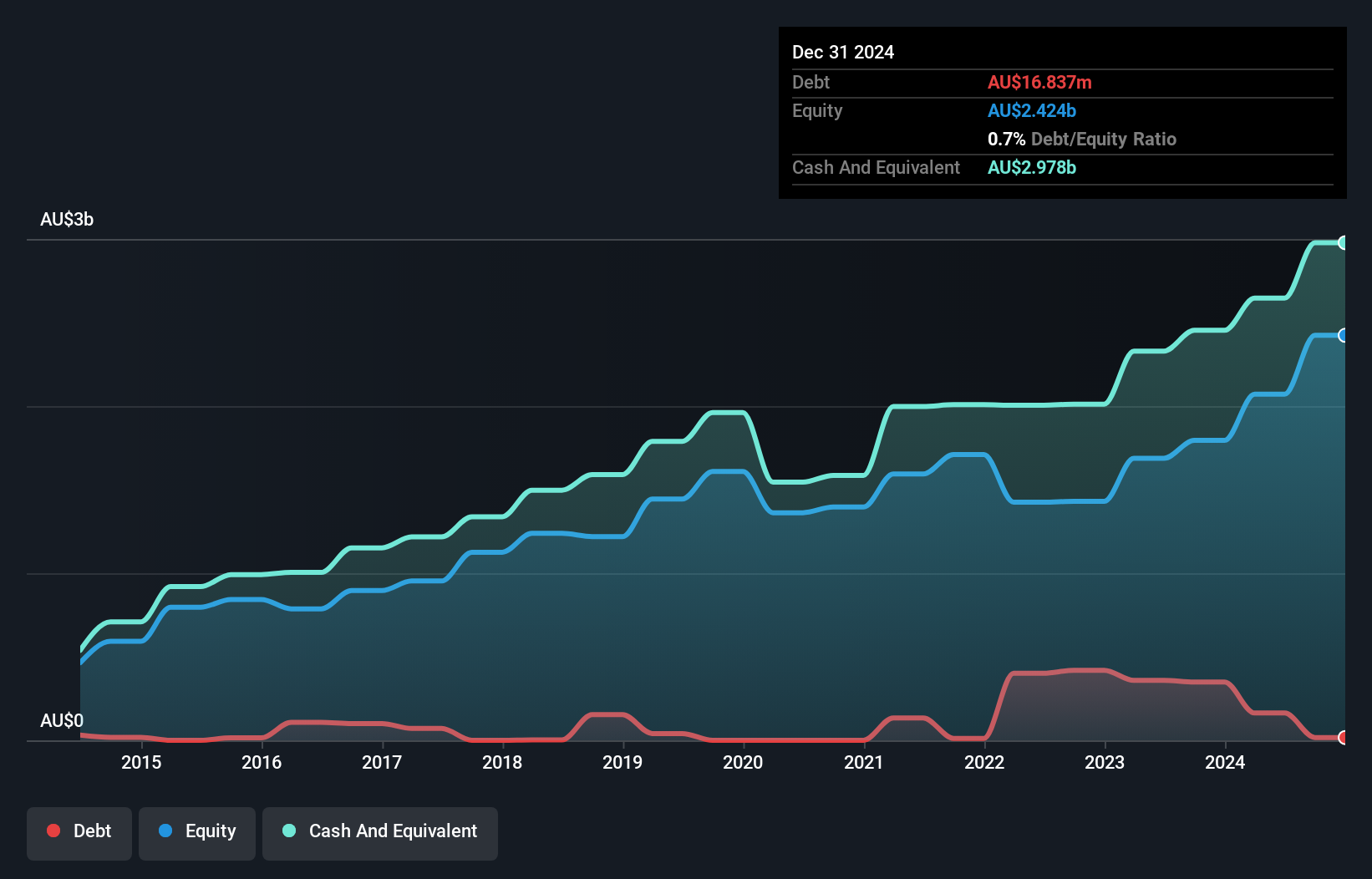

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.78 billion.

Operations: MFF Capital Investments generates revenue primarily through its equity investments, amounting to A$1.01 billion. The company's market capitalization stands at A$2.78 billion, reflecting its significant presence in the investment management sector.

MFF Capital Investments showcases a compelling profile with its earnings growth of 51.9% over the past year, surpassing the industry average of 15.6%. The company, trading at a significant discount of 41.4% below estimated fair value, boasts high-quality earnings and strong debt management, having more cash than total debt and an interest coverage ratio of 69.4x EBIT to interest payments. Recent financial results highlight robust performance with net income soaring to A$381 million from A$146 million in the previous year, alongside an increased interim dividend from 6 cents to 8 cents per share for December 2024.

Where To Now?

- Unlock more gems! Our ASX Undiscovered Gems With Strong Fundamentals screener has unearthed 45 more companies for you to explore.Click here to unveil our expertly curated list of 48 ASX Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hearts and Minds Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HM1

Hearts and Minds Investments

Proven track record with adequate balance sheet.

Market Insights

Community Narratives