- Australia

- /

- Trade Distributors

- /

- ASX:EHL

These 4 Measures Indicate That Emeco Holdings (ASX:EHL) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Emeco Holdings Limited (ASX:EHL) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Emeco Holdings

What Is Emeco Holdings's Net Debt?

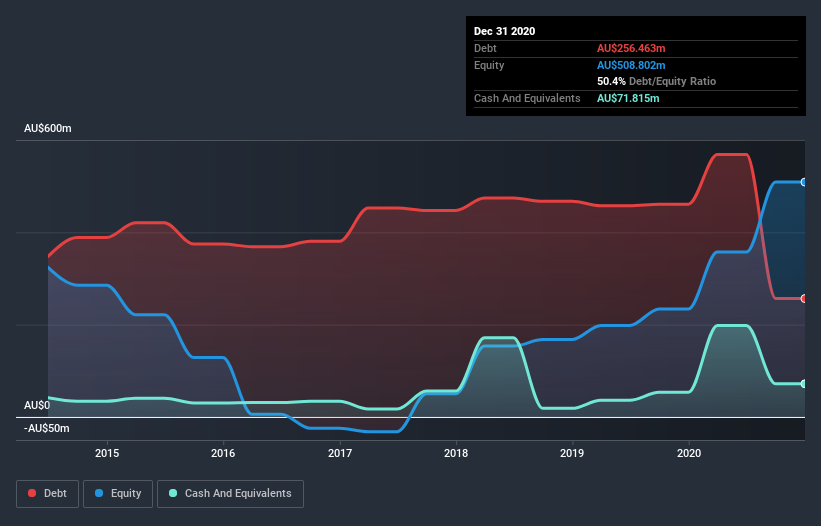

As you can see below, Emeco Holdings had AU$256.5m of debt at December 2020, down from AU$461.0m a year prior. However, because it has a cash reserve of AU$71.8m, its net debt is less, at about AU$184.6m.

How Strong Is Emeco Holdings' Balance Sheet?

We can see from the most recent balance sheet that Emeco Holdings had liabilities of AU$136.4m falling due within a year, and liabilities of AU$285.7m due beyond that. Offsetting this, it had AU$71.8m in cash and AU$106.7m in receivables that were due within 12 months. So it has liabilities totalling AU$243.6m more than its cash and near-term receivables, combined.

Emeco Holdings has a market capitalization of AU$542.5m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Given net debt is only 0.83 times EBITDA, it is initially surprising to see that Emeco Holdings's EBIT has low interest coverage of 1.4 times. So while we're not necessarily alarmed we think that its debt is far from trivial. Unfortunately, Emeco Holdings saw its EBIT slide 4.1% in the last twelve months. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Emeco Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Emeco Holdings recorded free cash flow of 36% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Emeco Holdings's interest cover was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. But on the bright side, its ability to handle its debt, based on its EBITDA, isn't too shabby at all. Taking the abovementioned factors together we do think Emeco Holdings's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Emeco Holdings .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Emeco Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Emeco Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EHL

Emeco Holdings

Provides surface and underground mining equipment rental, complementary equipment, and mining services in Australia.

Very undervalued with solid track record.