- Australia

- /

- Trade Distributors

- /

- ASX:EHL

Emeco Holdings Limited Just Missed EPS By 89%: Here's What Analysts Think Will Happen Next

Shareholders might have noticed that Emeco Holdings Limited (ASX:EHL) filed its interim result this time last week. The early response was not positive, with shares down 3.1% to AU$1.10 in the past week. Statutory earnings per share fell badly short of expectations, coming in at AU$0.0068, some 89% below analyst forecasts, although revenues were okay, approximately in line with analyst estimates at AU$299m. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Emeco Holdings

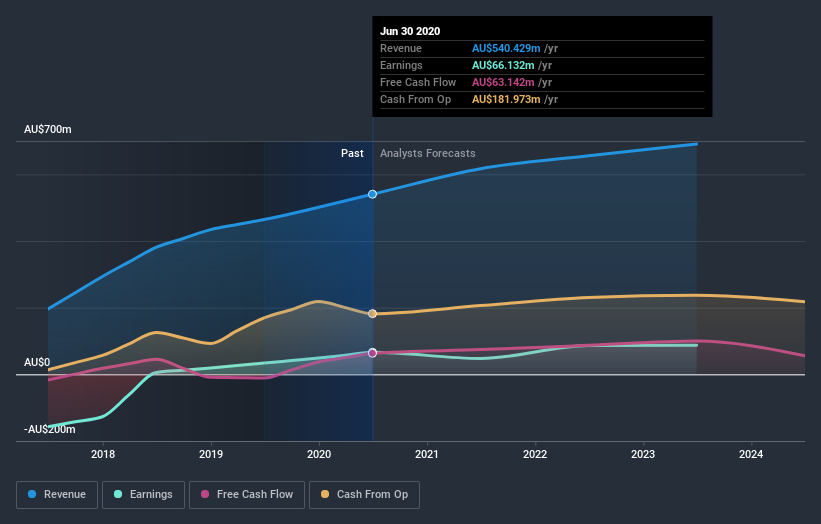

Following the latest results, Emeco Holdings' eight analysts are now forecasting revenues of AU$616.8m in 2021. This would be a notable 14% improvement in sales compared to the last 12 months. Statutory earnings per share are expected to plummet 49% to AU$0.10 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of AU$602.8m and earnings per share (EPS) of AU$0.15 in 2021. While next year's revenue estimates increased, there was also a pretty serious reduction to EPS expectations, suggesting the consensus has a bit of a mixed view of these results.

Curiously, the consensus price target rose 11% to AU$1.37. We can only conclude that the forecast revenue growth is expected to offset the impact of the expected fall in earnings. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Emeco Holdings, with the most bullish analyst valuing it at AU$1.58 and the most bearish at AU$1.09 per share. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Of course, another way to look at these forecasts is to place them into context against the industry itself. Next year brings more of the same, according to the analysts, with revenue forecast to grow 14%, in line with its 16% annual growth over the past year. Compare this with the wider industry, which analyst estimates (in aggregate) suggest will see revenues grow 4.6% next year. So although Emeco Holdings is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Emeco Holdings going out to 2023, and you can see them free on our platform here.

It is also worth noting that we have found 3 warning signs for Emeco Holdings (2 shouldn't be ignored!) that you need to take into consideration.

If you decide to trade Emeco Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Emeco Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EHL

Emeco Holdings

Provides surface and underground mining equipment rental, complementary equipment, and mining services in Australia.

Very undervalued with solid track record.