- Australia

- /

- Trade Distributors

- /

- ASX:IPG

Duratec And 2 Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As the Australian market navigates a landscape marked by tariff concerns and fluctuating indices, small-cap stocks continue to capture investor interest with their potential for growth amidst broader economic uncertainties. In this environment, identifying promising opportunities requires a keen eye for companies that demonstrate resilience and innovation, such as Duratec and two other undiscovered gems that show significant promise.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

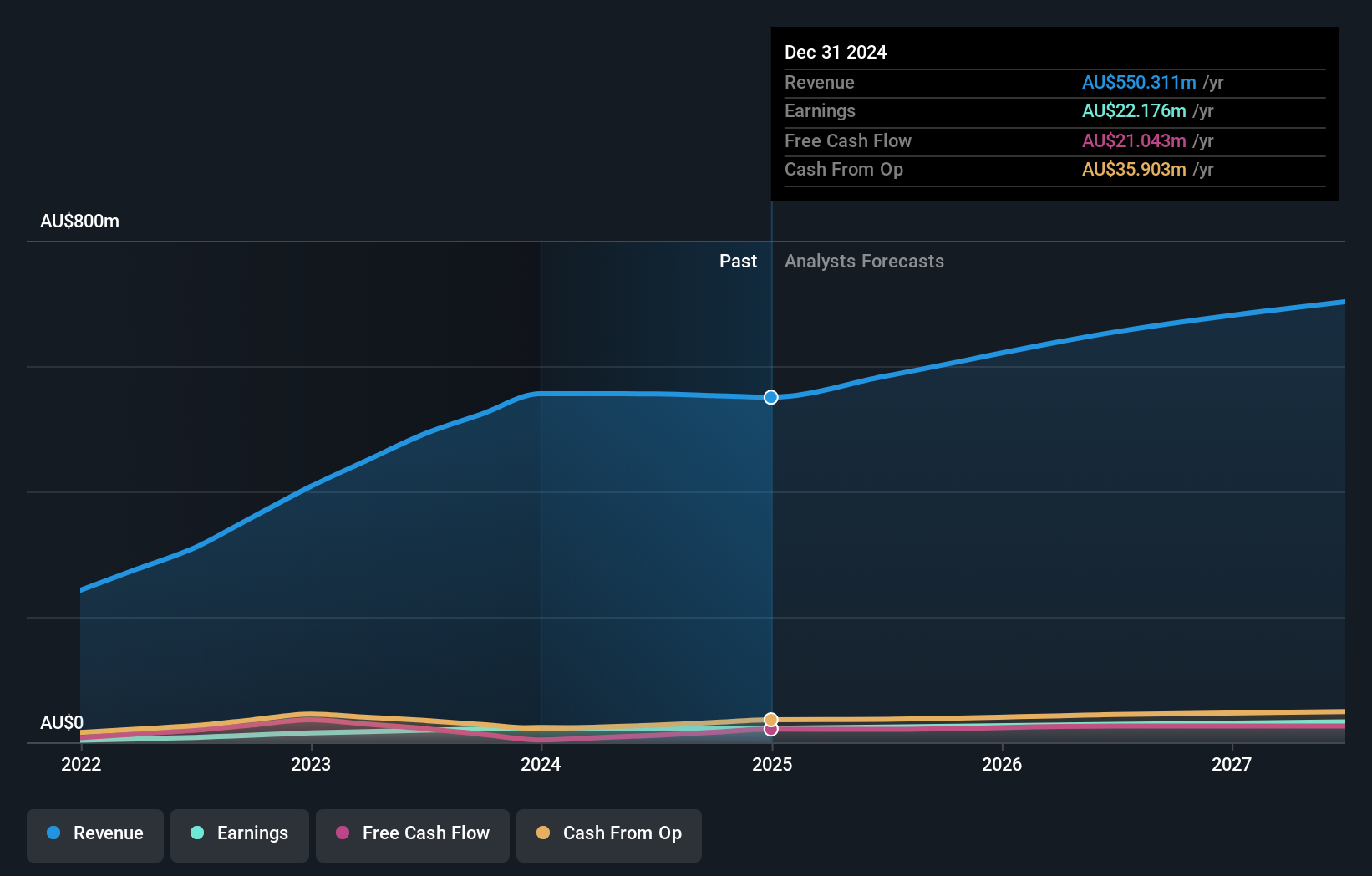

Duratec (ASX:DUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Duratec Limited, with a market cap of A$415.87 million, specializes in providing assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure across Australia.

Operations: Duratec generates revenue primarily through its Defence segment (A$193.48 million), followed by Mining & Industrial (A$144.05 million) and Buildings & Facades (A$113.64 million).

Duratec, a notable player in the construction sector, has shown resilience despite recent challenges. The company's earnings for the half-year ended December 31, 2024, were A$12.97 million compared to A$12.23 million a year prior. With high-quality earnings and interest payments well-covered by EBIT at an impressive 1374x, Duratec's financial health is robust. However, its debt-to-equity ratio has risen from 0.1% to 5% over five years and recent negative earnings growth of -6% contrasts with the industry average of 28%. Looking ahead, revenue for fiscal year 2025 is projected between A$600 million and A$640 million.

- Delve into the full analysis health report here for a deeper understanding of Duratec.

Evaluate Duratec's historical performance by accessing our past performance report.

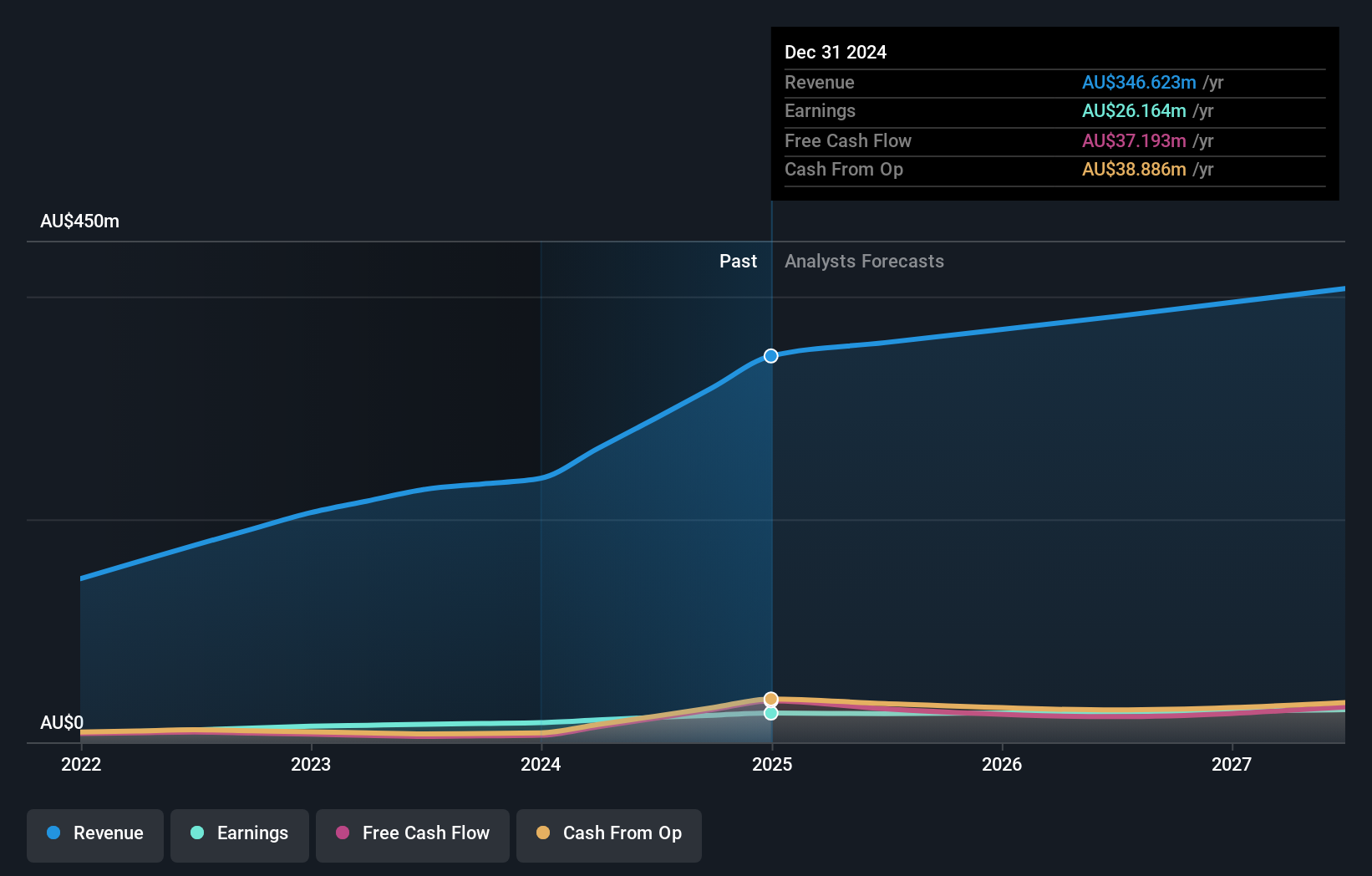

IPD Group (ASX:IPG)

Simply Wall St Value Rating: ★★★★★☆

Overview: IPD Group Limited is an Australian company that specializes in distributing electrical infrastructure, with a market capitalization of A$413.74 million.

Operations: IPD Group generates revenue primarily through its Products Division, contributing A$325.32 million, and its Services Division, adding A$21.30 million.

IPD Group's recent performance showcases its potential as a growing player in the Australian market. The company reported a net income of A$13.35 million for the half-year ending December 2024, up from A$9.55 million the previous year, reflecting robust earnings growth of 48.7%. Trading at 26.7% below its estimated fair value, IPD appears undervalued with satisfactory debt levels indicated by a net debt to equity ratio of just 1.4%. With strategic expansions into data centers and EV charging infrastructure, IPD is poised for further growth despite potential risks from reliance on acquisitions and key suppliers like ABB.

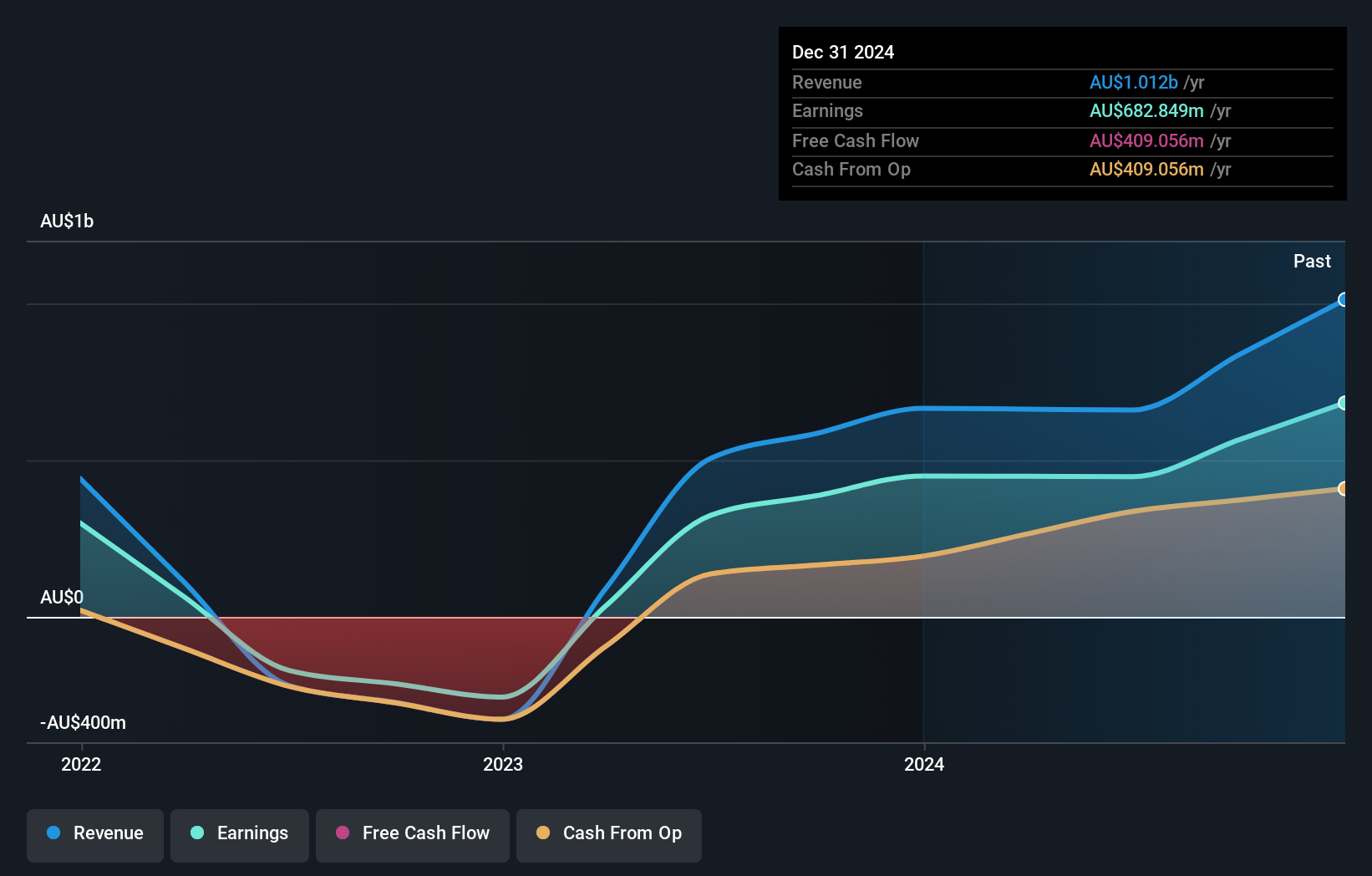

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.38 billion.

Operations: MFF Capital Investments generates revenue primarily from equity investments, amounting to A$1.01 billion. The firm operates with a market capitalization of A$2.38 billion.

MFF Capital Investments stands out with its robust financials, showcasing a 51.9% earnings growth over the past year, outperforming the industry average of 24.1%. Trading at 50.6% below fair value estimates, it seems undervalued in the market. The company's debt to equity ratio is modest at 0.7%, and interest payments are well-covered by EBIT at a multiple of 69.4x, indicating strong financial health. Recent performance highlights include net income rising to A$381 million from A$146 million year-on-year and an increased interim dividend from A$0.06 to A$0.08 per share for December 2024, reflecting shareholder confidence.

- Get an in-depth perspective on MFF Capital Investments' performance by reading our health report here.

Gain insights into MFF Capital Investments' past trends and performance with our Past report.

Key Takeaways

- Investigate our full lineup of 51 ASX Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPG

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives