- Australia

- /

- Construction

- /

- ASX:DUR

ASX Stocks Possibly Trading Below Their Estimated Intrinsic Values

Reviewed by Simply Wall St

The Australian market has been experiencing a mix of optimism and uncertainty, with a surprise unemployment rate of 4.3% sparking hopes for potential interest rate cuts, while global trade tensions continue to cast a shadow over investor sentiment. In this environment, identifying stocks that may be trading below their intrinsic values can offer opportunities for investors seeking value amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Praemium (ASX:PPS) | A$0.75 | A$1.35 | 44.4% |

| PointsBet Holdings (ASX:PBH) | A$1.185 | A$2.10 | 43.5% |

| Lindsay Australia (ASX:LAU) | A$0.72 | A$1.17 | 38.4% |

| Judo Capital Holdings (ASX:JDO) | A$1.60 | A$2.84 | 43.6% |

| Integral Diagnostics (ASX:IDX) | A$2.67 | A$4.57 | 41.6% |

| Flight Centre Travel Group (ASX:FLT) | A$13.18 | A$20.94 | 37% |

| Fenix Resources (ASX:FEX) | A$0.29 | A$0.51 | 42.6% |

| Domino's Pizza Enterprises (ASX:DMP) | A$18.30 | A$29.72 | 38.4% |

| Collins Foods (ASX:CKF) | A$8.89 | A$15.67 | 43.3% |

| Charter Hall Group (ASX:CHC) | A$19.85 | A$35.43 | 44% |

Here's a peek at a few of the choices from the screener.

Duratec (ASX:DUR)

Overview: Duratec Limited, along with its subsidiaries, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia and has a market cap of A$401.30 million.

Operations: The company's revenue segments include Energy (A$62.54 million), Defence (A$193.48 million), Buildings & Facades (A$113.64 million), and Mining & Industrial (A$144.05 million).

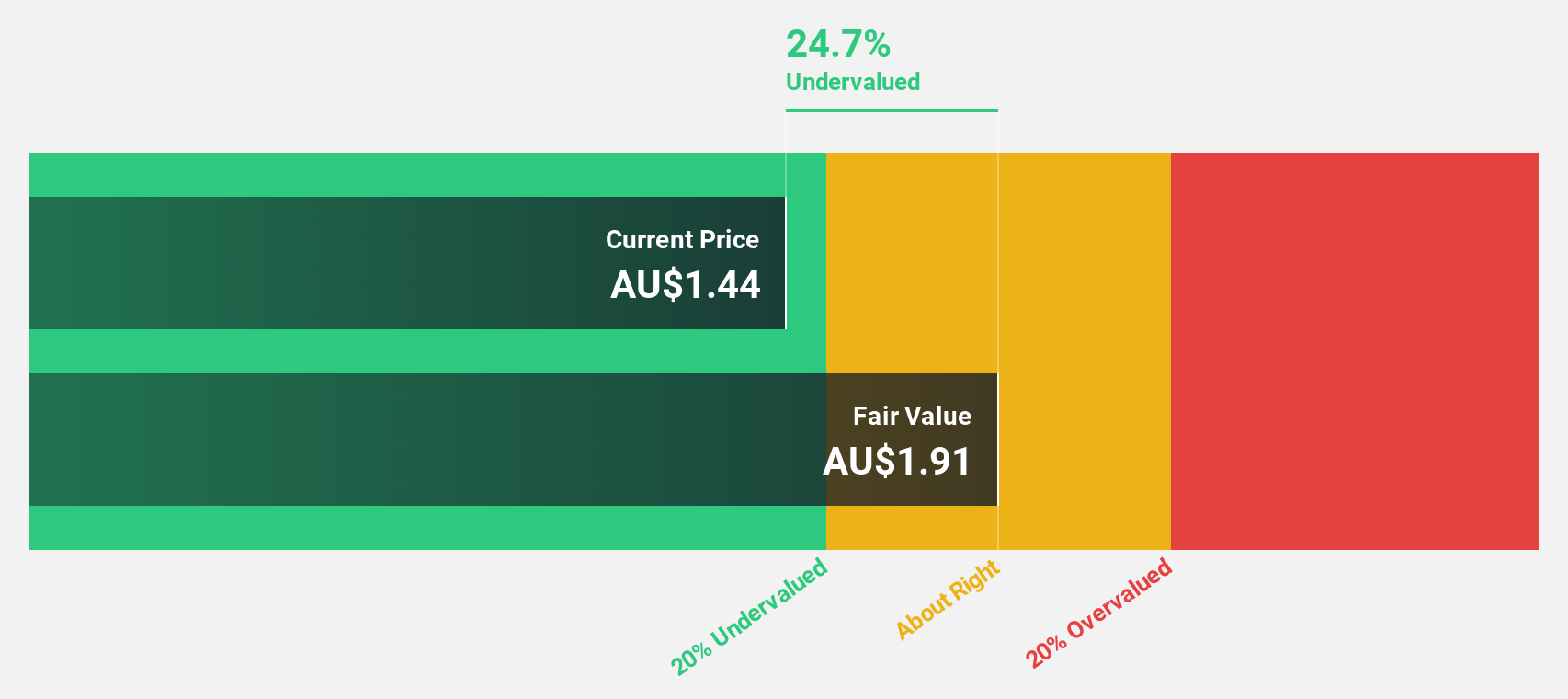

Estimated Discount To Fair Value: 18.9%

Duratec, trading at A$1.59, is considered undervalued based on cash flow analysis with its fair value estimated at A$1.96. The company forecasts earnings growth of 11.8% annually, outpacing the Australian market's 11%. Despite an unstable dividend track record and slower revenue growth than desired (7.7% per year), it surpasses the market average of 5.6%. Recent guidance revisions may impact future assessments but highlight ongoing business developments.

- In light of our recent growth report, it seems possible that Duratec's financial performance will exceed current levels.

- Get an in-depth perspective on Duratec's balance sheet by reading our health report here.

Kina Securities (ASX:KSL)

Overview: Kina Securities Limited operates in Papua New Guinea offering commercial banking, financial services, fund administration, investment management, and share brokerage with a market cap of A$386.99 million.

Operations: The company's revenue is primarily derived from its Banking & Finance segment, generating PGK 421.46 million, and Wealth Management services, contributing PGK 47.36 million.

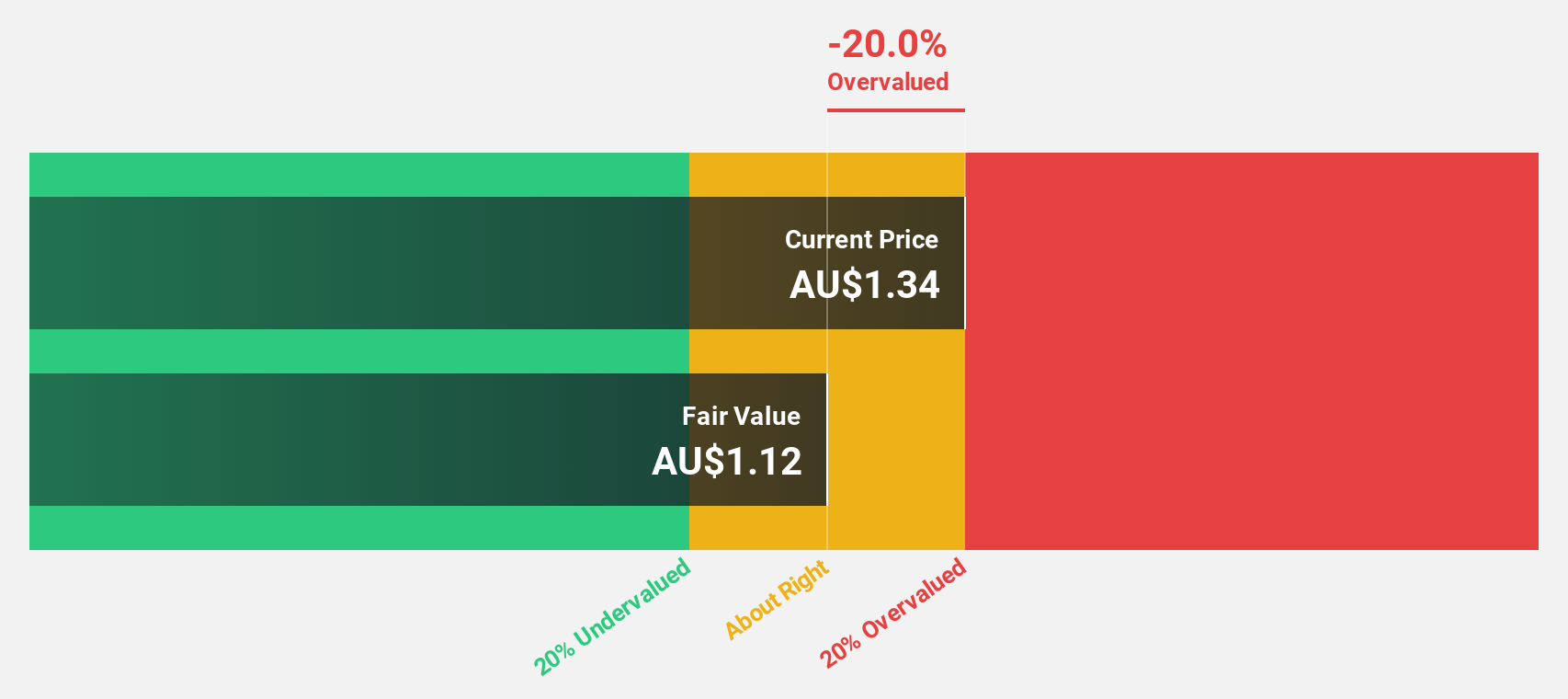

Estimated Discount To Fair Value: 11.7%

Kina Securities, trading at A$1.34, is undervalued with a fair value of A$1.52 based on cash flow analysis. Its earnings are projected to grow 18.3% annually, surpassing the Australian market's 11%. Revenue growth is expected at 7.6% per year, faster than the market average of 5.6%. Despite a high level of bad loans (11.1%) and low allowance for these loans (21%), its return on equity forecast remains strong at 20.5% in three years.

- According our earnings growth report, there's an indication that Kina Securities might be ready to expand.

- Unlock comprehensive insights into our analysis of Kina Securities stock in this financial health report.

Mader Group (ASX:MAD)

Overview: Mader Group Limited is a contracting company that offers specialist technical services in the mining, energy, and industrial sectors both in Australia and internationally, with a market cap of A$1.43 billion.

Operations: The company generates revenue of A$811.54 million from its Staffing & Outsourcing Services segment, serving the mining, energy, and industrial sectors globally.

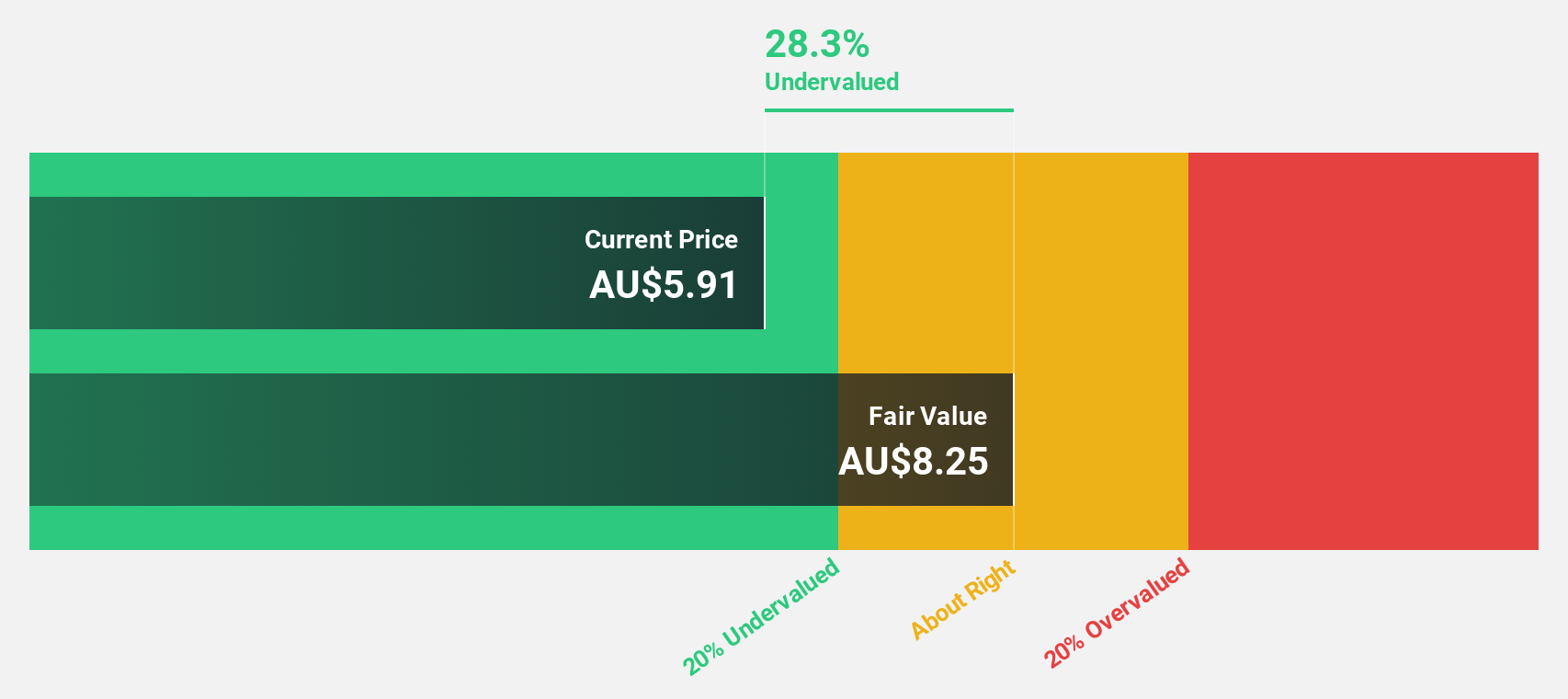

Estimated Discount To Fair Value: 20.1%

Mader Group, trading at A$7.08, is undervalued with a fair value of A$8.86 based on cash flow analysis. Earnings are expected to grow 13.5% annually, outpacing the Australian market's 11%, while revenue growth is projected at 11.1% per year, higher than the market average of 5.6%. Despite earnings growth not being significant and slower revenue growth compared to high-growth benchmarks, its return on equity forecast remains robust at 24.1% in three years.

- Insights from our recent growth report point to a promising forecast for Mader Group's business outlook.

- Dive into the specifics of Mader Group here with our thorough financial health report.

Make It Happen

- Unlock our comprehensive list of 32 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DUR

Duratec

Engages in the provision of assessment, protection, remediation, and refurbishment services to a range of assets, primarily steel and concrete infrastructure in Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives