- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

DroneShield (ASX:DRO) Soars on Surging Revenue and Leadership Shifts—Is Global Demand Sustainable?

Reviewed by Sasha Jovanovic

- Earlier this week, DroneShield Limited announced very large year-over-year revenue growth, strong international demand for its counter-drone technologies, and key leadership appointments including a new CTO and CPO to drive its next phase of innovation and expansion.

- DroneShield’s position as the only publicly listed counter-drone provider and its rapid traction among defense customers in multiple regions highlight its distinctive role in this expanding market.

- We’ll examine how DroneShield’s exceptional revenue growth and global defense adoption influence the current investment outlook for the company.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DroneShield Investment Narrative Recap

To be confident as a DroneShield shareholder today, you must believe the current surge in defense sector demand for counter-drone solutions offsets risks tied to contract timing and revenue variability. While recent leadership changes signal organizational strength and an ability to scale for global opportunity, this does not materially lessen the primary risk of deal unpredictability, which continues to drive short-term uncertainty. The upcoming Q3 earnings are likely to remain the central near-term catalyst, with contract flow closely watched.

The announced appointment of Angus Harris as CTO stands out in context of these catalysts, especially since DroneShield’s long-term outlook depends on quickly advancing its technology to meet evolving threats and client needs. His prior achievements spanning advanced AI, defense, and national infrastructure projects add further depth to the company’s technical capabilities as it competes for larger, more complex contracts. The strengthening of the engineering bench could prove essential as DroneShield navigates the next phase of its global push.

Yet, despite rapid customer adoption, investors should be aware that contract-driven revenue can be volatile and…

Read the full narrative on DroneShield (it's free!)

DroneShield's narrative projects A$359.8 million revenue and A$96.1 million earnings by 2028. This requires 49.7% yearly revenue growth and a A$90.5 million increase in earnings from A$5.6 million today.

Uncover how DroneShield's forecasts yield a A$4.45 fair value, a 8% downside to its current price.

Exploring Other Perspectives

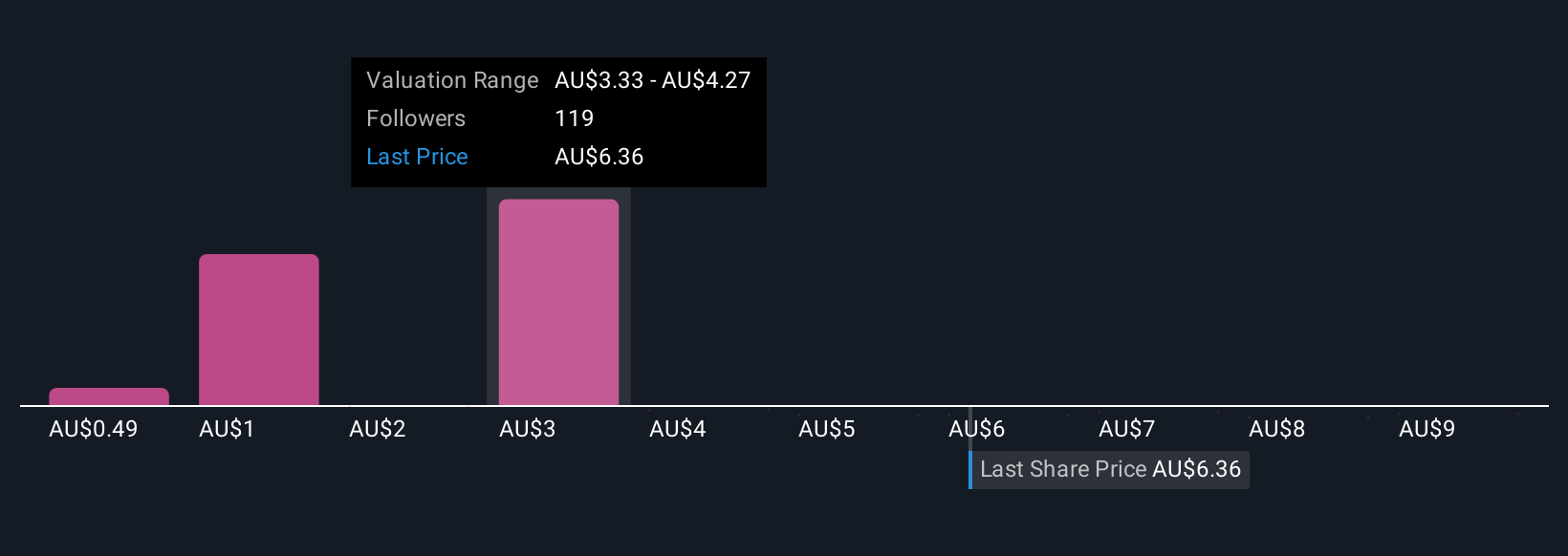

Community fair value estimates for DroneShield span from A$0.49 to A$9.95 across 46 contributors, reflecting wide-ranging expectations. With ongoing lumpiness in contract wins, your view on the company’s earnings predictability will likely shape your own outlook, explore the full spread of opinions from the Simply Wall St Community.

Explore 46 other fair value estimates on DroneShield - why the stock might be worth over 2x more than the current price!

Build Your Own DroneShield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DroneShield research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DroneShield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DroneShield's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives