- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

ASX Penny Stocks Spotlight: DroneShield And Two More

Reviewed by Simply Wall St

As the Australian market faces a slight downturn, influenced by global trade tensions and new tariffs, investors are keeping a close eye on opportunities that might arise. Penny stocks, despite their old-fashioned name, continue to offer intriguing prospects for those willing to explore smaller or emerging companies. By focusing on stocks with strong financial foundations and growth potential, investors can uncover hidden value in this sector.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.15 | A$101.42M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.395 | A$75.31M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.97 | A$457.92M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.67 | A$3.04B | ✅ 5 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.05 | A$1.03B | ✅ 4 ⚠️ 2 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.375 | A$137.06M | ✅ 4 ⚠️ 1 View Analysis > |

| Austin Engineering (ASX:ANG) | A$0.305 | A$189.26M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.825 | A$146.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Reckon (ASX:RKN) | A$0.645 | A$73.08M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 458 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

DroneShield (ASX:DRO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$3.46 billion.

Operations: The company generates revenue primarily from its Aerospace & Defense segment, which accounts for A$58.01 million.

Market Cap: A$3.46B

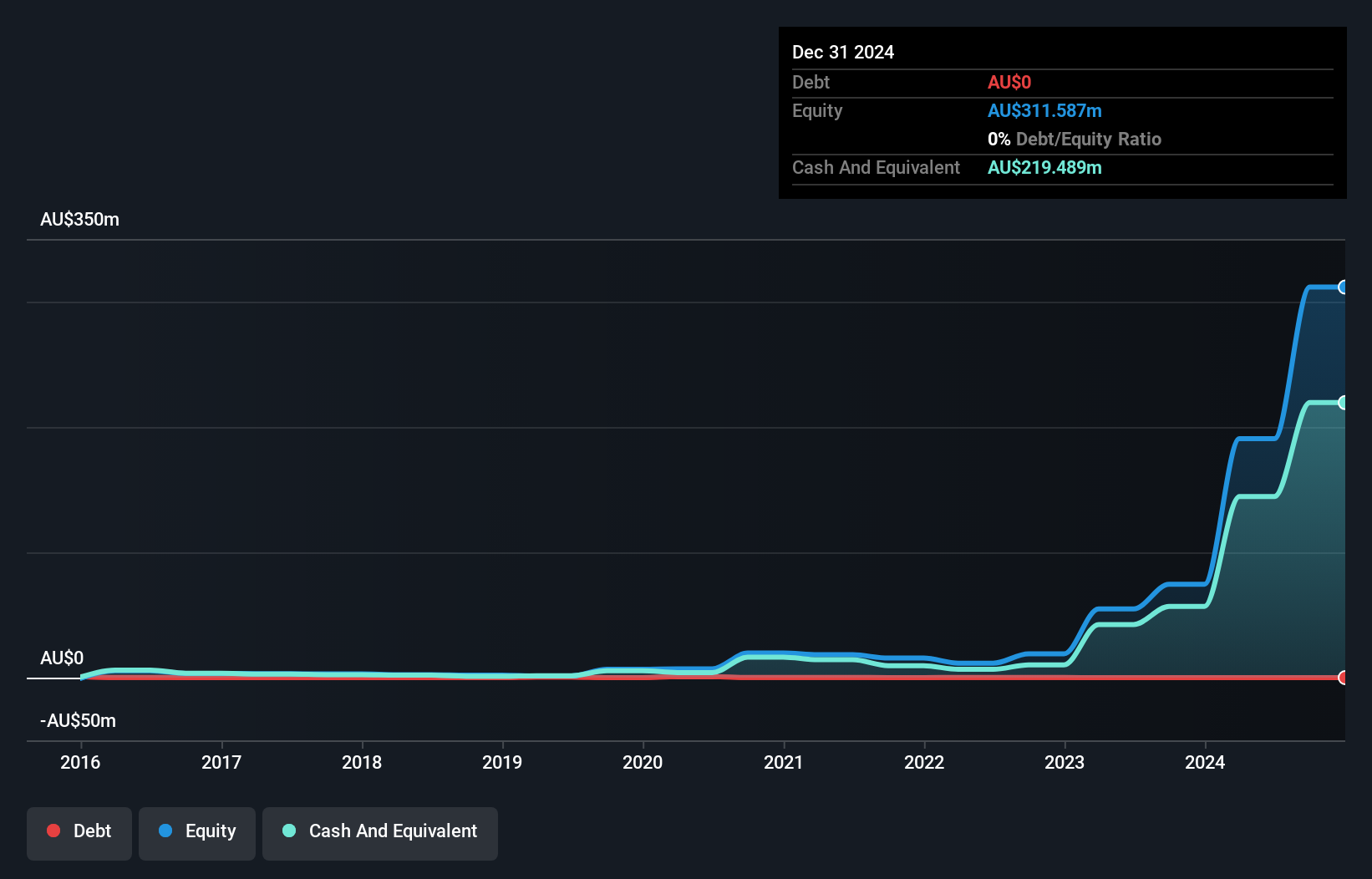

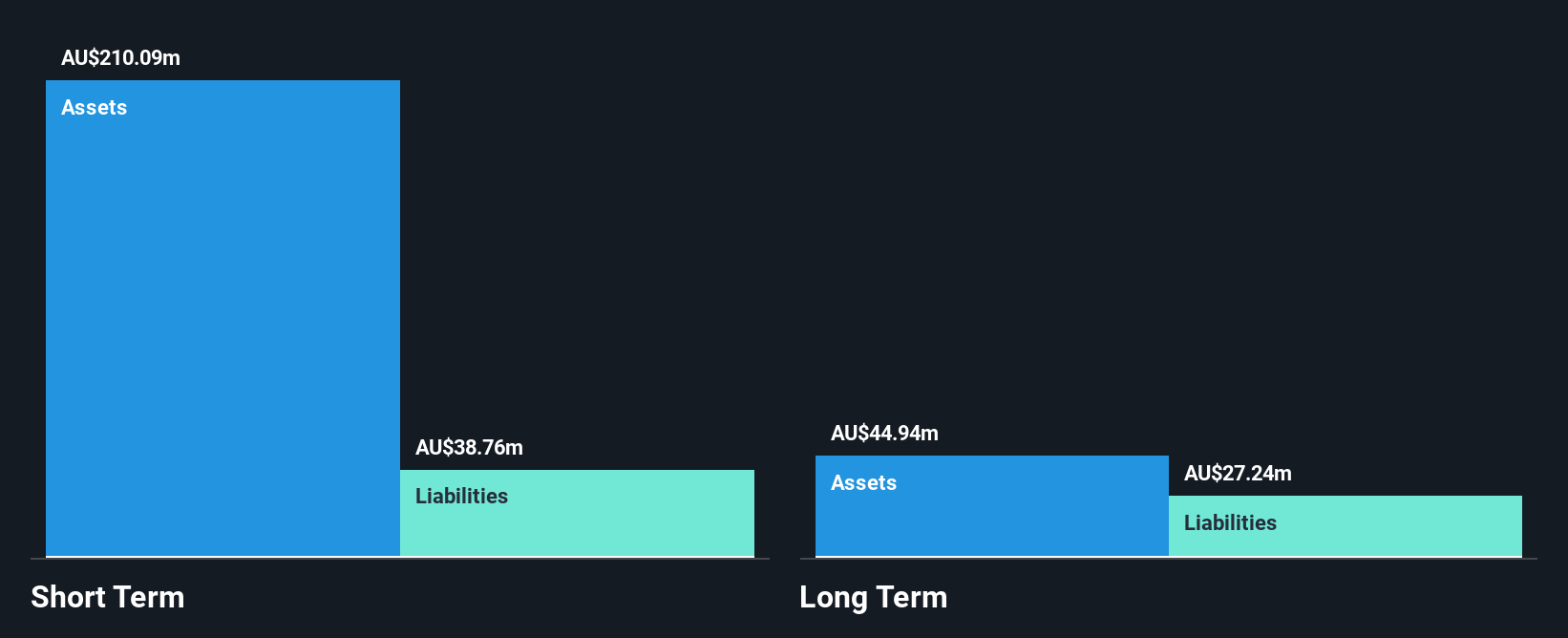

DroneShield Limited, with a market cap of A$3.46 billion, operates in the Aerospace & Defense sector and has shown resilience despite being unprofitable. The company generates A$58.01 million in revenue and is debt-free, which is a positive sign for potential investors wary of financial liabilities. Its experienced management team and board provide stability, while its short-term assets significantly exceed both short-term and long-term liabilities. However, investors should note the high share price volatility and negative return on equity. Earnings are forecasted to grow substantially at 57.51% per year according to analyst estimates.

- Click here and access our complete financial health analysis report to understand the dynamics of DroneShield.

- Understand DroneShield's earnings outlook by examining our growth report.

GWA Group (ASX:GWA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GWA Group Limited is involved in the research, design, manufacture, import, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, and international markets with a market cap of A$684.23 million.

Operations: The company's revenue is primarily derived from its Water Solutions segment, which generated A$417.40 million.

Market Cap: A$684.23M

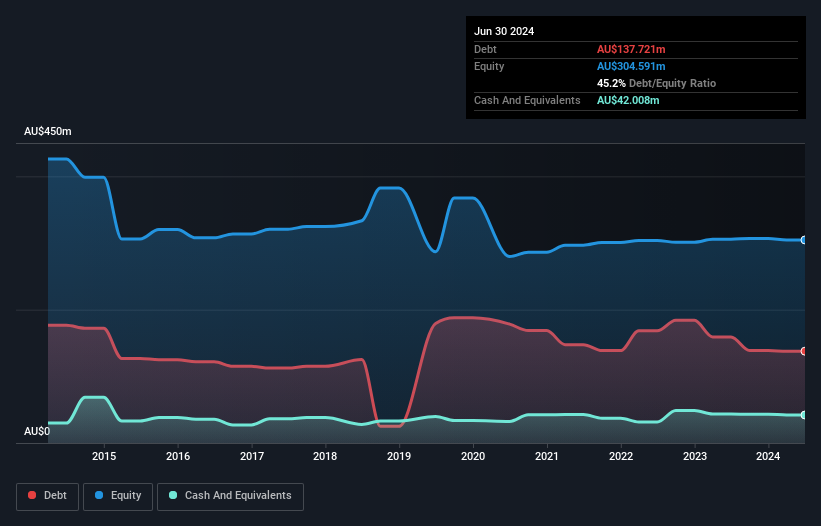

GWA Group Limited, with a market cap of A$684.23 million, is primarily driven by its Water Solutions segment generating A$417.40 million in revenue. The company has high-quality earnings and satisfactory debt levels, with operating cash flow covering 44% of its debt and interest payments well-covered by EBIT at 8.1x coverage. However, GWA's dividend yield of 6.01% is not well covered by earnings, and the board's average tenure suggests inexperience at just 2.8 years. Recent executive changes include Stephen Roche's retirement as a Non-Executive Director effective August 31, 2025.

- Jump into the full analysis health report here for a deeper understanding of GWA Group.

- Assess GWA Group's future earnings estimates with our detailed growth reports.

Nanosonics (ASX:NAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanosonics Limited is a global infection prevention company with a market capitalization of A$1.20 billion.

Operations: The company generates revenue from its Healthcare Equipment segment, totaling A$183.97 million.

Market Cap: A$1.2B

Nanosonics Limited, with a market cap of A$1.20 billion, is debt-free and trades at 23.3% below its estimated fair value. The company generates A$183.97 million in revenue from its Healthcare Equipment segment and has high-quality earnings despite a current net profit margin of 9%, slightly down from last year’s 9.6%. Earnings growth over the past year was modest at 5.6%, lower than the industry average, yet it maintains strong financial health with short-term assets exceeding liabilities significantly and no shareholder dilution recently observed. Earnings are forecast to grow by 22.9% annually, indicating potential future performance improvements.

- Unlock comprehensive insights into our analysis of Nanosonics stock in this financial health report.

- Evaluate Nanosonics' prospects by accessing our earnings growth report.

Taking Advantage

- Investigate our full lineup of 458 ASX Penny Stocks right here.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives