- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

A Look at DroneShield (ASX:DRO) Valuation Following Strong Earnings and Swing to Profit

Reviewed by Simply Wall St

Most Popular Narrative: 15% Undervalued

According to the leading narrative, DroneShield shares are seen as undervalued against their fair value estimate. Analysts expect robust growth, projecting the company to outperform due to surging demand and expanding margins in the counter-drone technology space.

“Surging demand for counter-drone technologies is being driven by ongoing geopolitical instability and heightened security threats, as evidenced by record global and NATO-aligned defense spending and an escalating number of large procurement contracts in DroneShield's pipeline. This positions the company for robust, sustained revenue growth.”

Curious how this narrative justifies such a bold price target? The latest projections point to a powerful combination of top-line expansion and margin transformation. These numbers set the stage for a valuation shake-up many did not see coming. Want to know which aggressive growth forecasts and future profit multiples are at the heart of this bullish case? The details behind this story could surprise you.

Result: Fair Value of $3.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy dependence on large defense contracts and rapid R&D spending could trigger revenue swings and pressure future margins. This may challenge the bullish outlook.

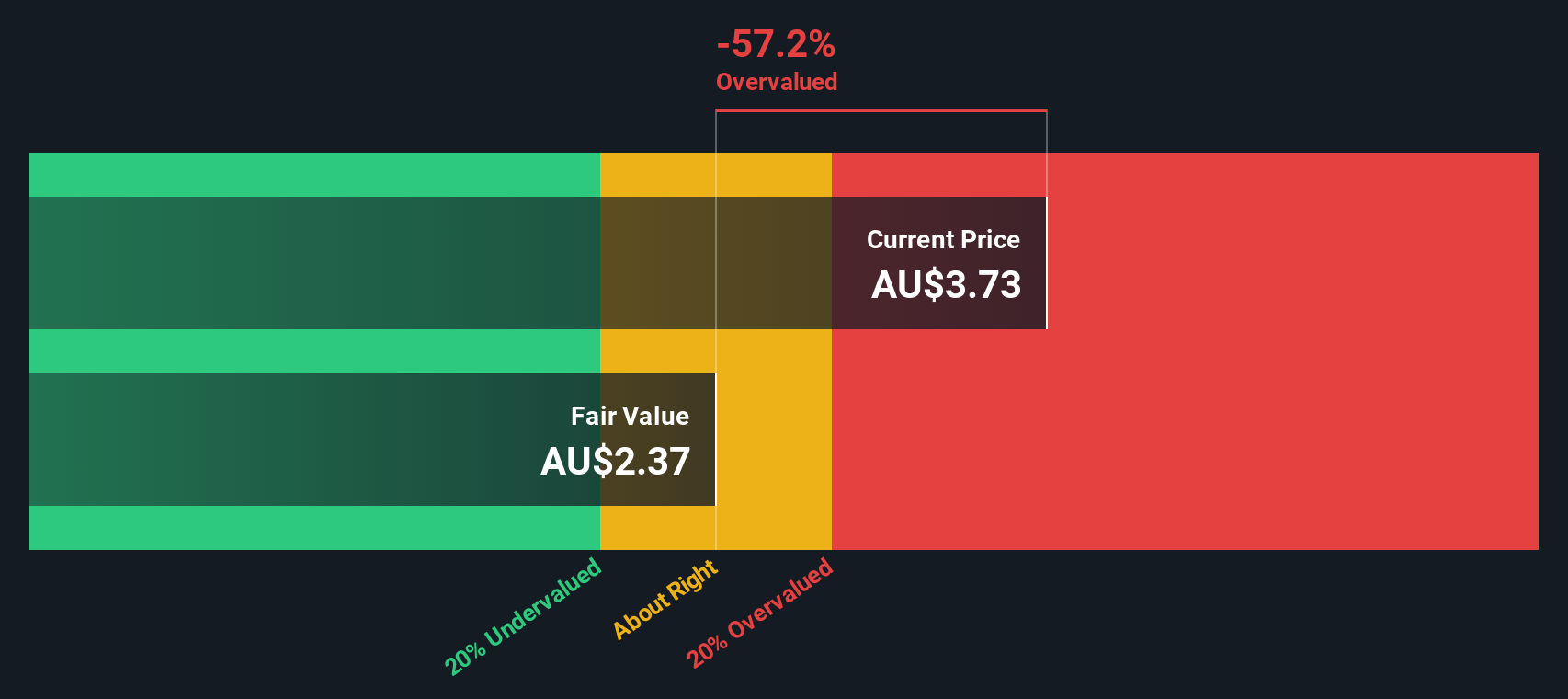

Find out about the key risks to this DroneShield narrative.Another View: What Does Our DCF Show?

Taking a step back, our DCF model paints a less optimistic picture. It suggests shares could be priced above fair value if forecasts play out differently. Which method will prove more accurate as expectations shift?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DroneShield Narrative

If this perspective does not align with your own or you want to dig deeper into the numbers, you can craft your own outlook on DroneShield’s story in just a few minutes. Do it your way

A great starting point for your DroneShield research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take the next step by uncovering standout stocks and fresh sectors that could shape your portfolio. These handpicked ideas let you spot opportunities others might overlook.

- Unlock the potential of early-stage companies showing real financial strength by checking out penny stocks with strong financials.

- Capitalize on the AI boom with companies making waves in intelligent automation using AI penny stocks.

- Find value gems trading below their cash flow-based worth with our tool for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives