- Australia

- /

- Trade Distributors

- /

- ASX:CYG

Shareholders Would Not Be Objecting To Coventry Group Ltd's (ASX:CYG) CEO Compensation And Here's Why

It would be hard to discount the role that CEO Robert Bulluss has played in delivering the impressive results at Coventry Group Ltd (ASX:CYG) recently. Coming up to the next AGM on 21 October 2021, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

Check out our latest analysis for Coventry Group

Comparing Coventry Group Ltd's CEO Compensation With the industry

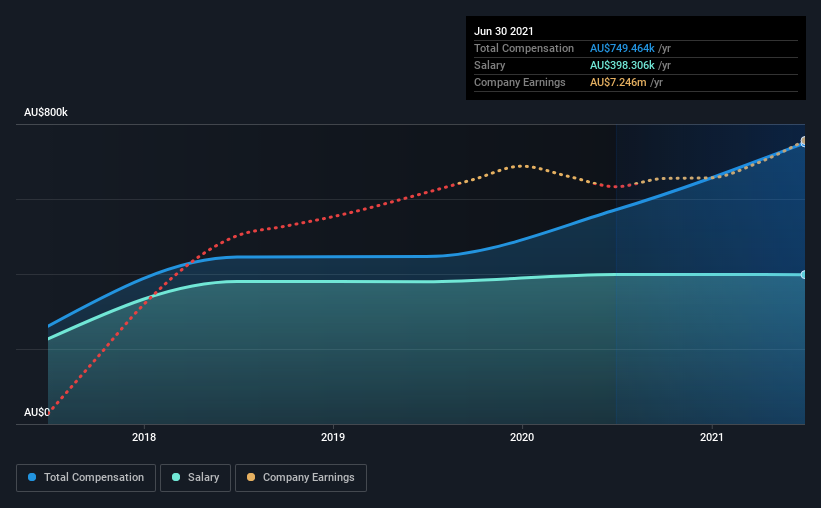

Our data indicates that Coventry Group Ltd has a market capitalization of AU$164m, and total annual CEO compensation was reported as AU$749k for the year to June 2021. That's a notable increase of 31% on last year. Notably, the salary which is AU$398.3k, represents a considerable chunk of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below AU$270m, reported a median total CEO compensation of AU$629k. This suggests that Coventry Group remunerates its CEO largely in line with the industry average. Moreover, Robert Bulluss also holds AU$1.2m worth of Coventry Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$398k | AU$399k | 53% |

| Other | AU$351k | AU$172k | 47% |

| Total Compensation | AU$749k | AU$571k | 100% |

Speaking on an industry level, nearly 56% of total compensation represents salary, while the remainder of 44% is other remuneration. Our data reveals that Coventry Group allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Coventry Group Ltd's Growth Numbers

Coventry Group Ltd has seen its earnings per share (EPS) increase by 133% a year over the past three years. Its revenue is up 17% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Coventry Group Ltd Been A Good Investment?

We think that the total shareholder return of 77%, over three years, would leave most Coventry Group Ltd shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Given the improved performance, shareholders may be more forgiving of CEO compensation in the upcoming AGM. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Coventry Group that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:CYG

Coventry Group

Distributes industrial products and services in Australia and New Zealand.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.