- Australia

- /

- Trade Distributors

- /

- ASX:CYG

ASX Penny Stocks Spotlight Pier 12 Capital And Two Others

Reviewed by Simply Wall St

The Australian share market is poised for a downturn, with futures indicating a slight decline following Wall Street's cautious stance amid rising US 10-year yields and seasonal trends like 'sell in May and go away.' In such a climate, investors may turn their attention to penny stocks, which, despite being somewhat of an outdated term, remain relevant for those seeking growth opportunities in smaller or newer companies. When these stocks are supported by solid financial health, they can offer potential value and stability; this article will explore three such examples on the ASX that might hold long-term promise.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.75 | A$140.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.865 | A$1.06B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.53 | A$72.17M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.65 | A$408.58M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.67M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.28 | A$2.6B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.33 | A$158.01M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.15 | A$722.75M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.565 | A$766.97M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.67 | A$1.22B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 990 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Pier 12 Capital (ASX:AVC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pier 12 Capital, trading as Auctus Investment Group Limited (ASX:AVC), is a private equity and venture capital firm focusing on mid-market growth sectors, real estate, and infrastructure, with a market cap of A$43.27 million.

Operations: The company's revenue segment is Information Technology, generating A$12.68 million.

Market Cap: A$43.27M

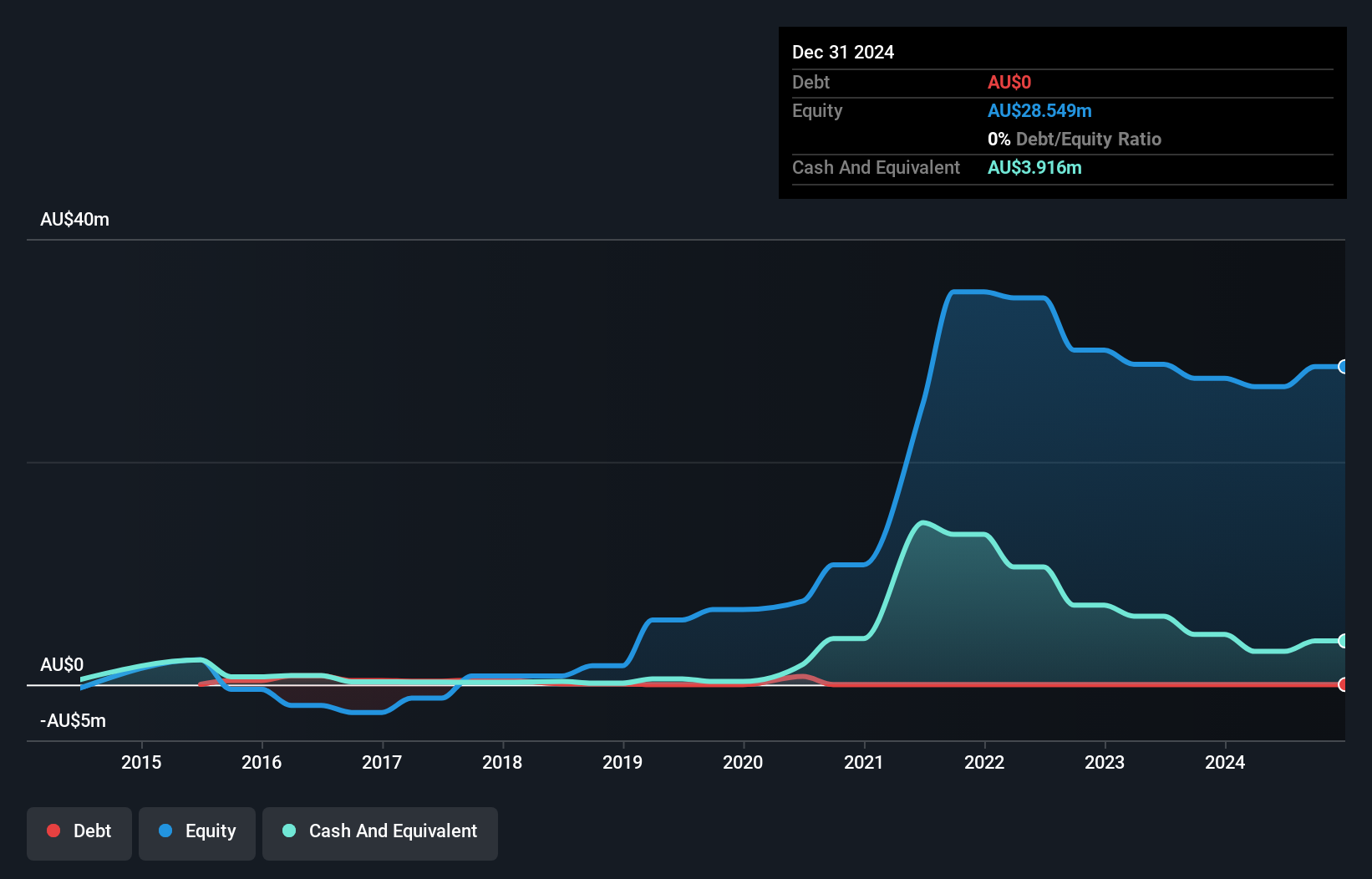

Auctus Investment Group Limited, with a market cap of A$43.27 million, has demonstrated financial resilience and growth potential. The company recently transitioned to profitability, reporting net income of A$1.65 million for the half-year ending December 31, 2024. Its short-term assets exceed both short- and long-term liabilities, highlighting a strong liquidity position without debt concerns. Despite high share price volatility over the past three months, its low Price-To-Earnings ratio suggests potential undervaluation compared to the broader Australian market. Additionally, a share buyback program aims to repurchase up to 9.4% of its issued capital by May 5, 2025.

- Take a closer look at Pier 12 Capital's potential here in our financial health report.

- Evaluate Pier 12 Capital's historical performance by accessing our past performance report.

Coventry Group (ASX:CYG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Coventry Group Ltd operates in the distribution of industrial products and services across Australia and New Zealand, with a market cap of A$113.33 million.

Operations: The company's revenue is derived from Fluid Systems, contributing A$155.01 million, and Trade Distribution, which adds A$216.28 million.

Market Cap: A$113.33M

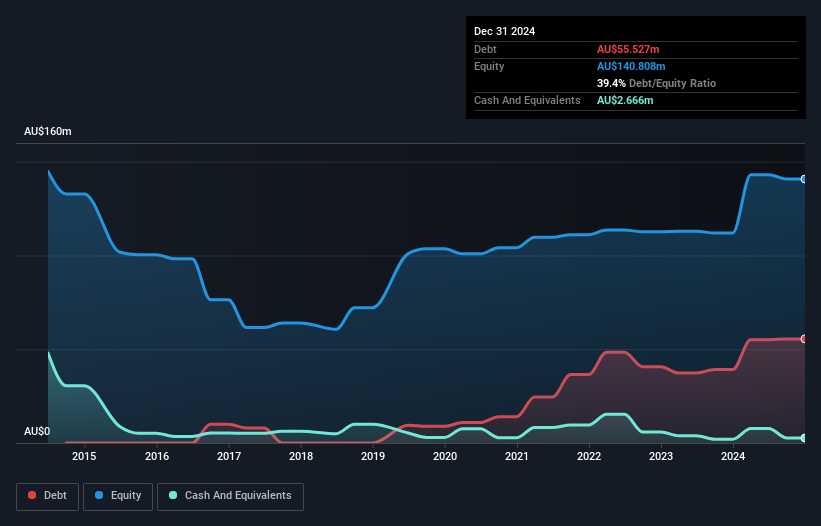

Coventry Group Ltd, with a market cap of A$113.33 million, shows mixed prospects in the penny stock arena. While its short-term assets cover both short- and long-term liabilities, providing financial stability, recent earnings reveal challenges with a net loss of A$0.68 million for the half-year ending December 2024. The company's return on equity is low at 0.3%, and profit margins have declined to 0.1%. Despite stable weekly volatility and satisfactory debt levels, significant insider selling raises concerns about internal confidence amidst management changes aimed at enhancing operational efficiency through experienced leadership appointments in key divisions.

- Jump into the full analysis health report here for a deeper understanding of Coventry Group.

- Explore historical data to track Coventry Group's performance over time in our past results report.

Reef Casino Trust (ASX:RCT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Reef Casino Trust operates as an owner and lessor of the Reef Hotel Casino complex in Cairns, North Queensland, Australia, with a market capitalization of A$81.42 million.

Operations: The trust generates revenue of A$25.52 million from its Casinos & Resorts segment.

Market Cap: A$81.42M

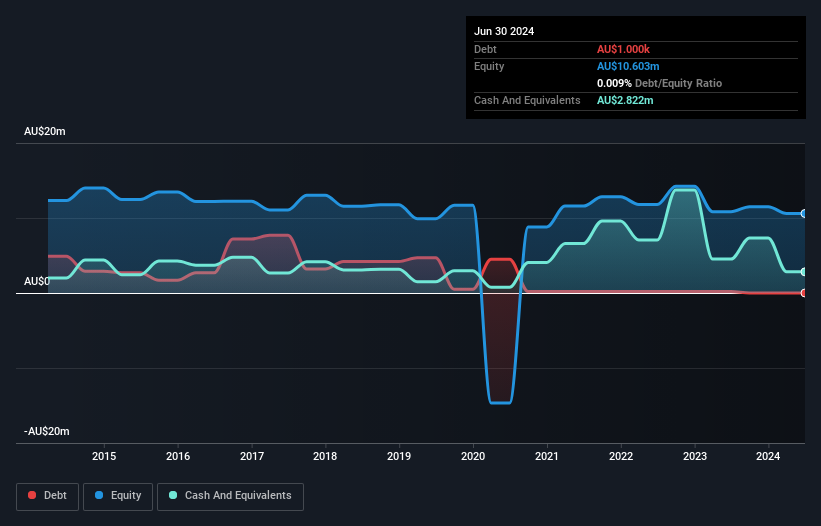

Reef Casino Trust, with a market cap of A$81.42 million, presents a mixed picture in the penny stock landscape. Despite high-quality earnings and an outstanding return on equity of 44.8%, the trust faces challenges such as negative earnings growth over the past year and interest payments not well covered by EBIT. Its dividend yield of 6.24% is not adequately supported by earnings, raising sustainability concerns. Recent events include its removal from the S&P/ASX All Ordinaries Index and slight declines in revenue and net income for 2024 compared to the previous year, indicating potential volatility ahead for investors.

- Click to explore a detailed breakdown of our findings in Reef Casino Trust's financial health report.

- Understand Reef Casino Trust's track record by examining our performance history report.

Where To Now?

- Access the full spectrum of 990 ASX Penny Stocks by clicking on this link.

- Ready For A Different Approach? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Coventry Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYG

Coventry Group

Primarily engages in the distribution of industrial products and services in Australia and New Zealand.

Good value with adequate balance sheet.

Market Insights

Community Narratives