Exploring 3 Undervalued Small Caps In Global With Insider Action

Reviewed by Simply Wall St

As global markets navigate the anticipation of interest rate decisions and mixed economic signals, small-cap stocks have shown resilience, with the Russell 2000 Index rising by 0.84% in early December. Amid these conditions, investors often seek opportunities in small-cap companies that demonstrate potential for growth and stability despite broader market uncertainties. Identifying such stocks involves looking at factors like strong fundamentals, market position, and insider activity that might indicate confidence from those closest to the company’s operations.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 0.9x | 28.90% | ★★★★★★ |

| Senior | 24.2x | 0.8x | 28.79% | ★★★★★☆ |

| Centurion | 3.6x | 3.0x | -53.25% | ★★★★☆☆ |

| PSC | 9.7x | 0.4x | 21.09% | ★★★★☆☆ |

| Chinasoft International | 21.7x | 0.7x | -1199.38% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.53% | ★★★★☆☆ |

| Gooch & Housego | 45.2x | 1.1x | 24.15% | ★★★☆☆☆ |

| Kendrion | 28.6x | 0.7x | 42.79% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.1x | 0.4x | -399.00% | ★★★☆☆☆ |

| CVS Group | 45.9x | 1.3x | 26.44% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

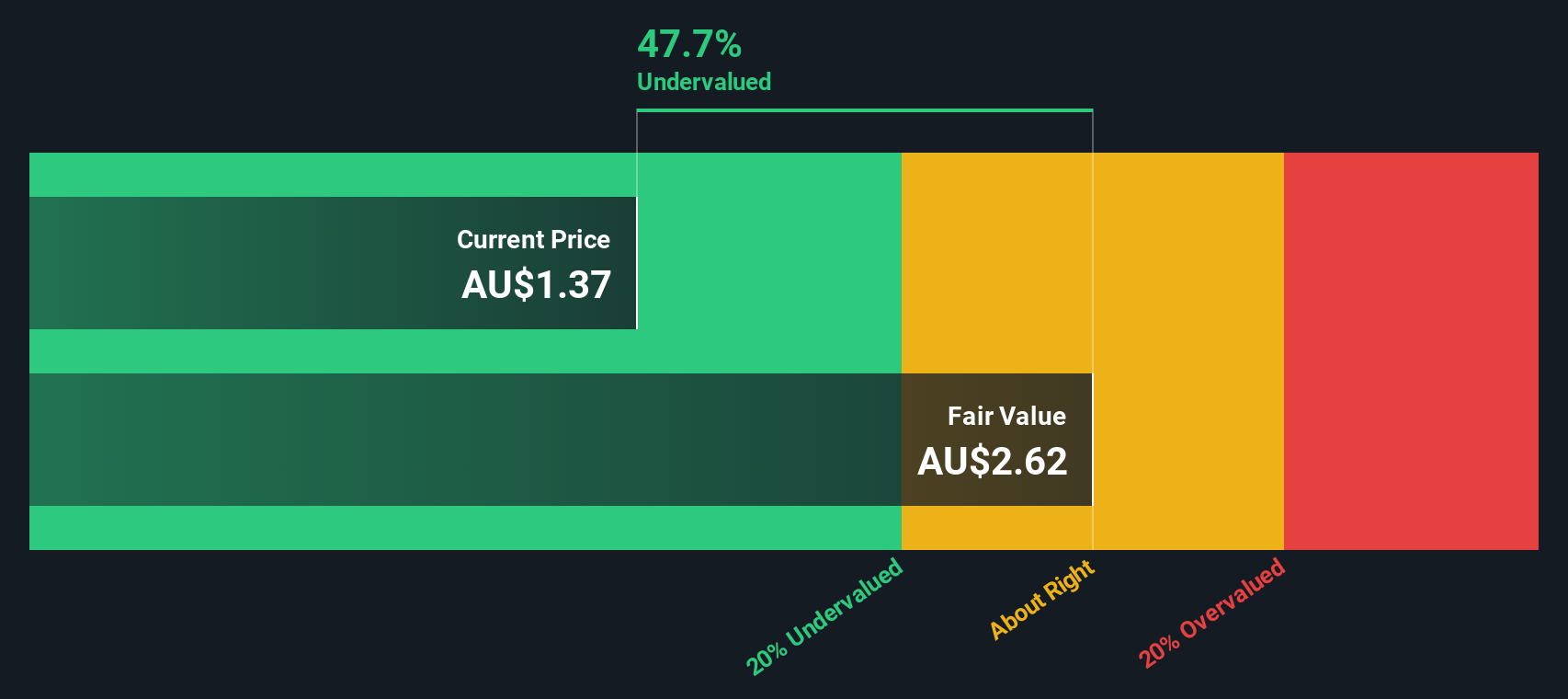

Civmec (ASX:CVL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Civmec is an integrated, multi-disciplinary construction and engineering services provider with a focus on the energy, resources, infrastructure, marine, and defence sectors, boasting a market cap of A$0.58 billion.

Operations: The company's revenue streams are primarily derived from Resources, followed by Infrastructure, Marine & Defence, and Energy. The gross profit margin has shown variability over time, reaching 13.14% in the most recent period. Operating expenses have generally fluctuated around A$30 million with notable non-operating expenses impacting net income margins.

PE: 16.7x

Civmec, a company with potential for growth, has caught attention in the small-cap space. Despite relying entirely on external borrowing, which presents higher risk compared to customer deposits, their forecasted earnings growth of 13.97% annually suggests a promising trajectory. Insider confidence is evident as key figures have been purchasing shares throughout 2025. Recent discussions at the Annual General Meeting in September also indicate active engagement with stakeholders about future strategies and financial health.

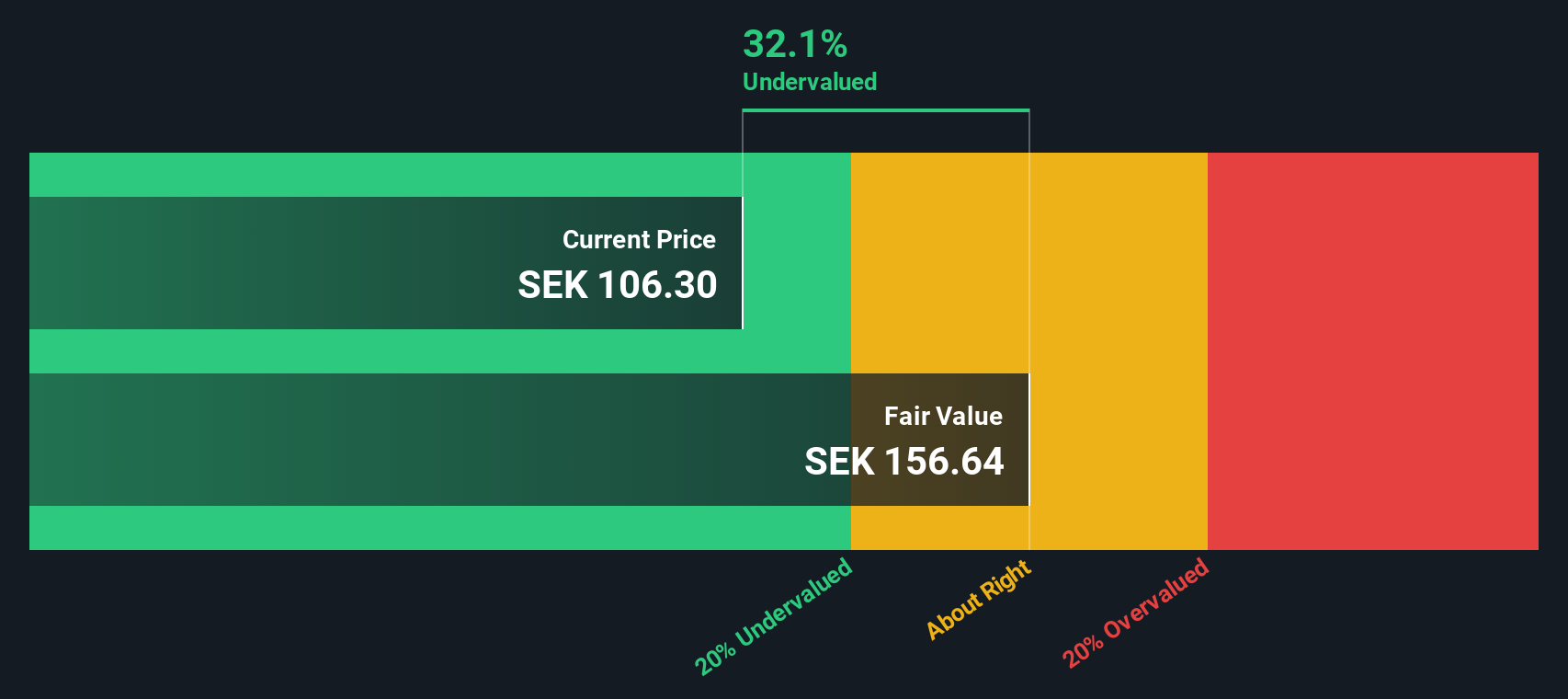

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BioGaia is a Swedish company specializing in the development and sale of probiotic products for pediatric and adult health, with a market cap of approximately SEK 10.65 billion.

Operations: BioGaia generates revenue primarily from its Pediatrics and Adult Health segments, with the Pediatrics segment being the larger contributor. The company's cost structure includes significant expenses in sales and marketing as well as research and development. Over recent periods, BioGaia's gross profit margin has shown some variation, reaching 73.84% in Q2 2024 before slightly decreasing to 72.45% by Q4 2024.

PE: 31.4x

BioGaia, a company with a small market presence, is gaining traction through innovative probiotic solutions like their Prodentis FRESH BREATH lozenges. Recent earnings for Q3 2025 showed sales of SEK 326.64 million and net income of SEK 65.88 million, both improved from the previous year. The company's research on serotonin-producing bacteria highlights its focus on gut-brain health connections, potentially boosting future growth prospects despite reliance on external funding sources.

- Navigate through the intricacies of BioGaia with our comprehensive valuation report here.

Evaluate BioGaia's historical performance by accessing our past performance report.

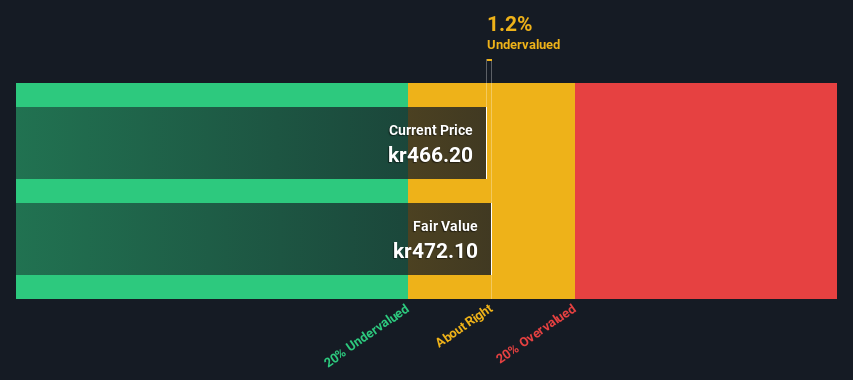

Vitec Software Group (OM:VIT B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vitec Software Group specializes in developing and delivering software solutions primarily for niche markets, with a focus on the software and programming sector, and has a market capitalization of approximately SEK 15.93 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, reporting a revenue of SEK 3.58 billion for the latest period. It has experienced fluctuations in its gross profit margin, reaching 47.66% most recently. Operating expenses have been significant, with general and administrative expenses accounting for SEK 405.88 million in the latest quarter.

PE: 30.7x

Vitec Software Group, operating in a competitive industry, recently reported third-quarter sales of SEK 773.22 million, up from SEK 717.76 million the previous year. Despite this growth, net income slightly decreased to SEK 112.15 million from SEK 108.42 million. Notably, insider confidence is evident as Independent Director Jan Friedman purchased 1,000 shares for approximately SEK 314,800 in September 2025. The company's earnings are projected to grow at an annual rate of nearly 19%, though it relies heavily on external borrowing for funding which poses higher risk compared to customer deposits.

Seize The Opportunity

- Take a closer look at our Undervalued Global Small Caps With Insider Buying list of 135 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

BioGaia

A healthcare company, develops, manufactures, markets and sells probiotic products for gut, oral, and immune health in Europe, the Middle East, Africa, the United States, the Asia-Pacific, Australia, and New Zealand.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026