- Australia

- /

- Metals and Mining

- /

- ASX:LEG

Civmec Leads The Way On ASX With 2 Other Penny Stocks

Reviewed by Simply Wall St

As the Australian market experiences a cautious start this Tuesday, all eyes are on the Reserve Bank's policy meeting and its potential impact on economic direction. In such uncertain times, investors often turn to penny stocks as a way to discover opportunities that larger companies might overlook. Although the term "penny stocks" may seem outdated, these smaller or newer firms can offer significant growth potential when backed by strong financials. This article highlights three standout penny stocks that demonstrate financial strength and could be promising for those seeking hidden gems in the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.48 | A$137.56M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.83 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.71 | A$417.98M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.31 | A$244.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.041 | A$47.96M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.31M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.94 | A$406.78M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.765 | A$365.45M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.32 | A$1.42B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Civmec (ASX:CVL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Civmec Limited is an investment holding company offering construction and engineering services across the energy, resources, infrastructure, marine, and defense sectors in Australia with a market cap of A$711.94 million.

Operations: The company's revenue is derived from three main segments: Energy (A$65.19 million), Resources (A$641.23 million), and Infrastructure, Marine & Defence (A$104.17 million).

Market Cap: A$711.94M

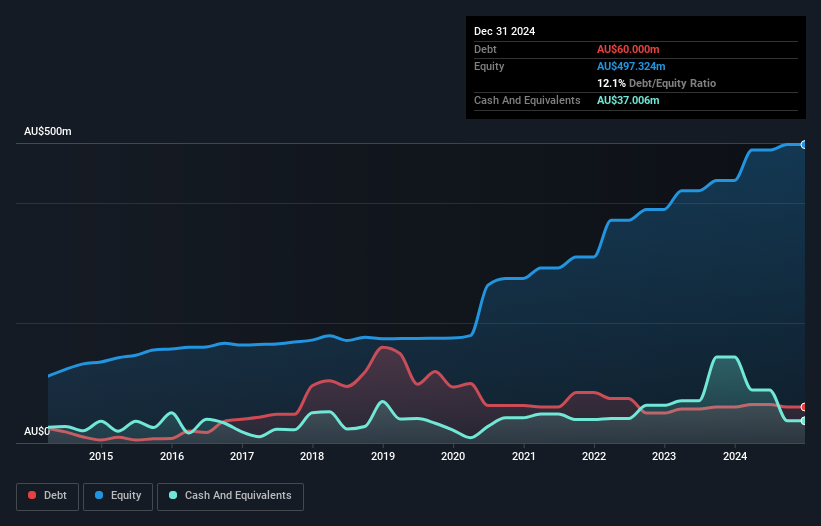

Civmec Limited, with a market cap of A$711.94 million, has shown resilience in the penny stock arena by securing significant contracts worth over A$600 million, reflecting its strategic focus on growth and diversification. Despite a decline in sales and net income for the year ended June 2025 compared to the previous year, Civmec's robust order book and recent acquisitions bolster its position in sectors like maritime defense. The company's financial stability is further supported by short-term assets exceeding liabilities and reduced debt levels over five years, although recent earnings growth has been negative.

- Unlock comprehensive insights into our analysis of Civmec stock in this financial health report.

- Review our growth performance report to gain insights into Civmec's future.

EDU Holdings (ASX:EDU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EDU Holdings Limited, with a market cap of A$87.98 million, operates in Australia through its subsidiaries to provide tertiary education services.

Operations: The company's revenue is derived from its subsidiaries, with Ikon Institute of Australia generating A$45.01 million and Australian Learning Group Pty Limited contributing A$16.50 million.

Market Cap: A$87.98M

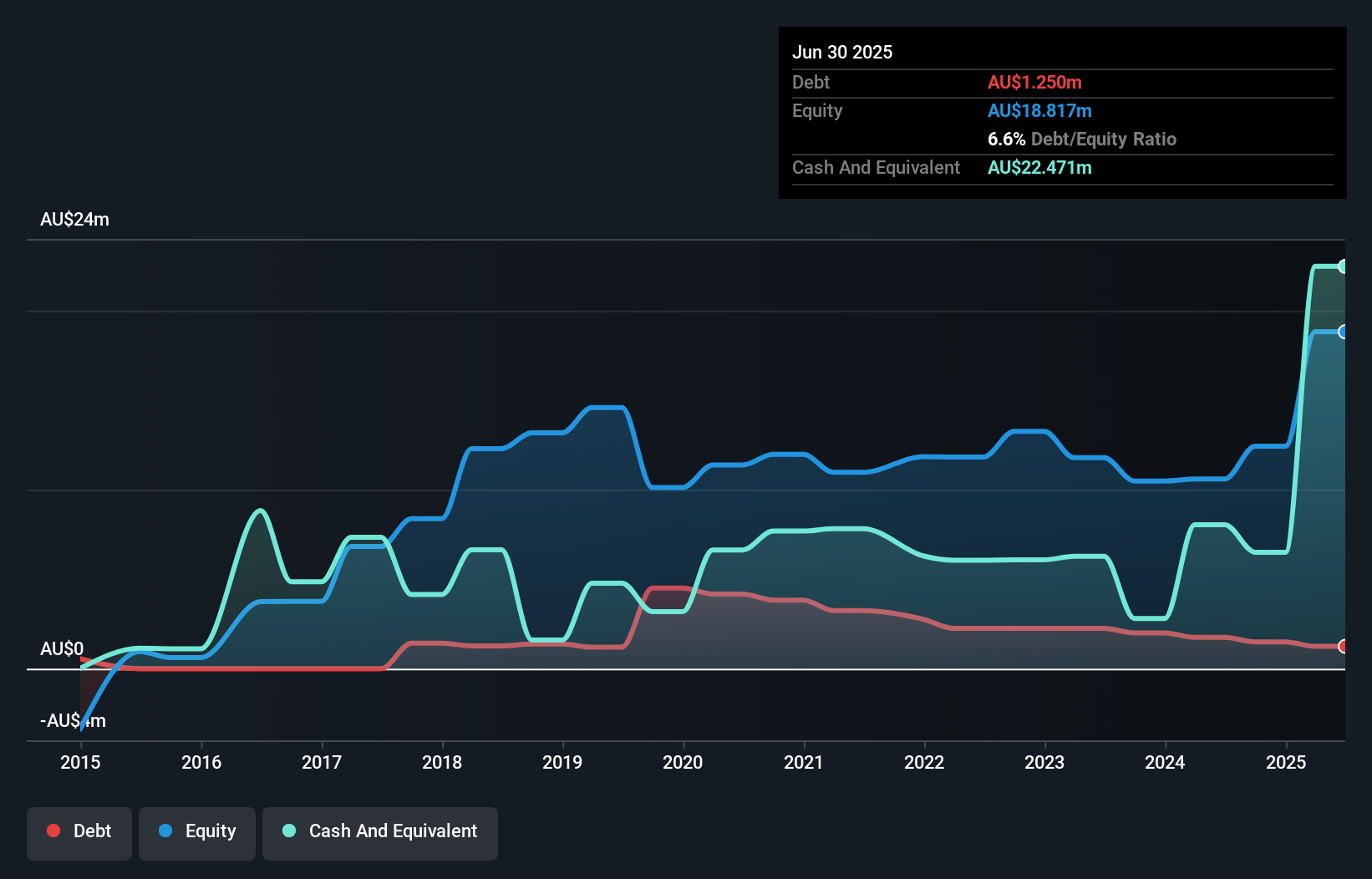

EDU Holdings Limited, with a market cap of A$87.98 million, has demonstrated significant financial improvement by becoming profitable over the past year. The company's revenue reached A$36.1 million for the half-year ending June 2025, a substantial increase from A$16.74 million in the previous year. EDU's return on equity is outstanding at 47%, and its debt is well-covered by operating cash flow, indicating strong financial health. However, short-term liabilities slightly exceed assets, which could pose challenges if not addressed promptly. Recent guidance suggests stable earnings with Ikon's growth counterbalancing ALG's revenue decline and increased operational costs for expansion support.

- Click here to discover the nuances of EDU Holdings with our detailed analytical financial health report.

- Examine EDU Holdings' past performance report to understand how it has performed in prior years.

Legend Mining (ASX:LEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Legend Mining Limited focuses on the exploration of nickel and copper deposits in Australia, with a market cap of A$29.14 million.

Operations: Legend Mining Limited has not reported any revenue segments.

Market Cap: A$29.14M

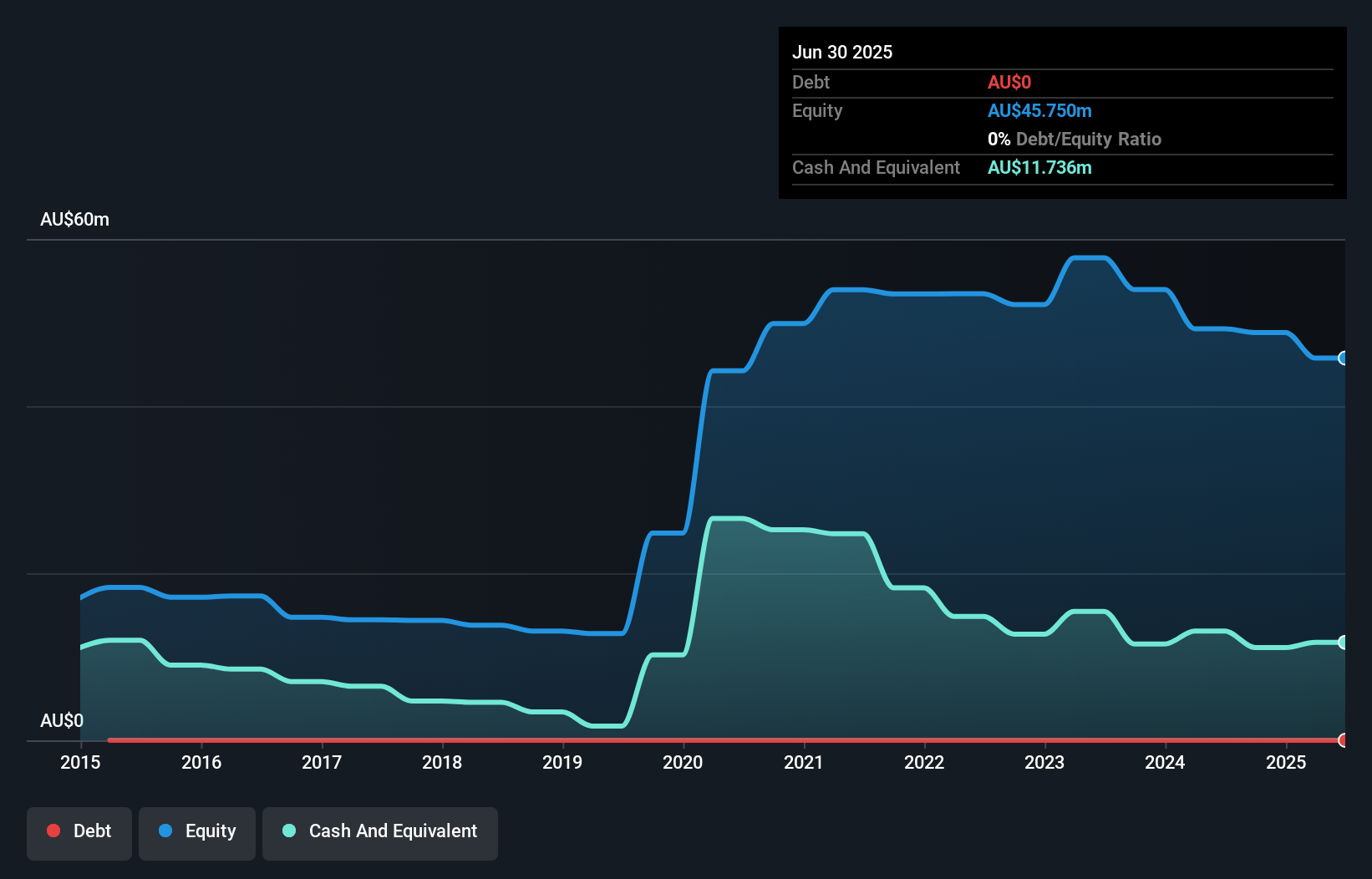

Legend Mining Limited, with a market cap of A$29.14 million, is focused on nickel and copper exploration and remains pre-revenue with earnings under US$1 million. Despite its unprofitability, the company has no debt and a cash runway exceeding three years, which provides financial stability for continued exploration activities. The stock's high volatility reflects the inherent risks associated with penny stocks. While losses have decreased from A$4.76 million to A$3.09 million year-over-year as of June 2025, Legend Mining's negative return on equity highlights ongoing challenges in achieving profitability amidst fluctuating market conditions and sector competition.

- Click here and access our complete financial health analysis report to understand the dynamics of Legend Mining.

- Gain insights into Legend Mining's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Access the full spectrum of 423 ASX Penny Stocks by clicking on this link.

- Seeking Other Investments? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LEG

Legend Mining

Engages in the exploration of nickel and copper deposits in Australia.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives