- Australia

- /

- Trade Distributors

- /

- ASX:BOL

Boom Logistics Limited's (ASX:BOL) CEO Compensation Looks Acceptable To Us And Here's Why

Despite Boom Logistics Limited's (ASX:BOL) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 26 November 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Boom Logistics

Comparing Boom Logistics Limited's CEO Compensation With the industry

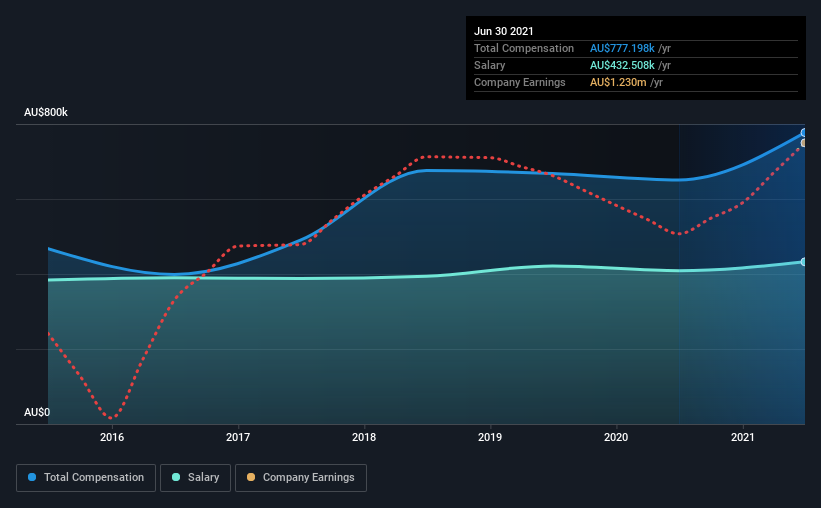

At the time of writing, our data shows that Boom Logistics Limited has a market capitalization of AU$77m, and reported total annual CEO compensation of AU$777k for the year to June 2021. That's a notable increase of 19% on last year. In particular, the salary of AU$432.5k, makes up a fairly large portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under AU$275m, the reported median total CEO compensation was AU$634k. This suggests that Boom Logistics remunerates its CEO largely in line with the industry average. Furthermore, Tony Spassopoulos directly owns AU$270k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$433k | AU$409k | 56% |

| Other | AU$345k | AU$242k | 44% |

| Total Compensation | AU$777k | AU$651k | 100% |

On an industry level, around 53% of total compensation represents salary and 47% is other remuneration. There isn't a significant difference between Boom Logistics and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Boom Logistics Limited's Growth Numbers

Boom Logistics Limited has reduced its earnings per share by 31% a year over the last three years. In the last year, its revenue is down 6.6%.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Boom Logistics Limited Been A Good Investment?

Boom Logistics Limited has served shareholders reasonably well, with a total return of 26% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 3 warning signs for Boom Logistics that investors should look into moving forward.

Switching gears from Boom Logistics, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Boom Logistics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BOL

Boom Logistics

Provides lifting solutions to mining and resources, infrastructure and construction, wind, energy, utilities, industrial maintenance, and telecommunications sectors in Australia and the Pacific region.

Undervalued with adequate balance sheet.