Austin Engineering And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian stock market recently closed with a modest gain, buoyed by strong performances in the Real Estate and Healthcare sectors, while investors continue to grapple with concerns over high inflation as highlighted by the Reserve Bank of Australia's recent meeting minutes. Amidst these broader economic conditions, penny stocks remain an intriguing investment area for those seeking growth opportunities in smaller or newer companies. Despite being considered somewhat outdated terminology, penny stocks can still offer significant potential when backed by robust financial fundamentals. This article will explore several promising penny stocks on the ASX that stand out for their financial strength and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$317.49M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.17 | A$146.32M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$199.48M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$105.46M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Austin Engineering (ASX:ANG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Austin Engineering Limited, with a market cap of A$316.27 million, operates in the industrial and resources sectors by manufacturing, repairing, overhauling, and supplying mining attachment products and related services.

Operations: The company generates its revenue from three geographical segments: Asia-Pacific contributing A$166.14 million, North America with A$95.53 million, and South America at A$51.58 million.

Market Cap: A$316.27M

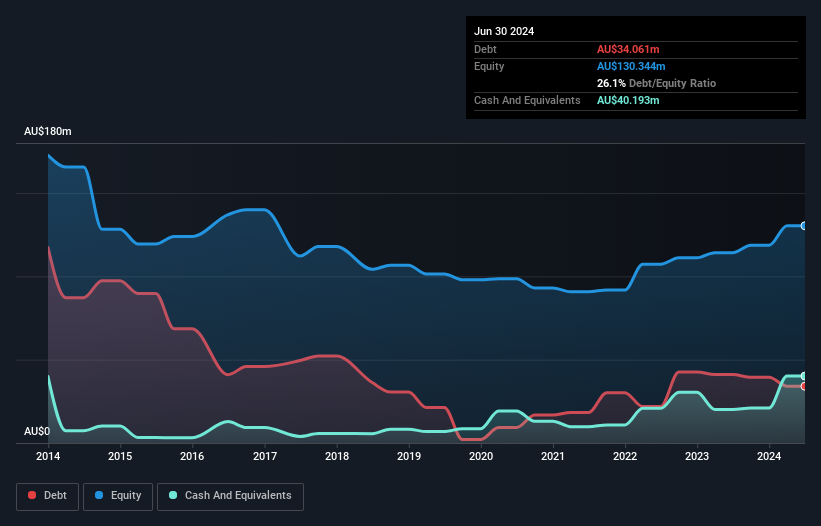

Austin Engineering Limited, with a market cap of A$316.27 million, operates in the industrial and resources sectors, generating significant revenues across Asia-Pacific (A$166.14 million), North America (A$95.53 million), and South America (A$51.58 million). The company has demonstrated substantial earnings growth of 317.3% over the past year, surpassing its 5-year average growth rate and outperforming the broader machinery industry. Its short-term assets exceed both short- and long-term liabilities, highlighting financial stability despite an increase in debt-to-equity ratio over five years. However, shareholders have experienced dilution with a 5.8% increase in shares outstanding recently.

- Dive into the specifics of Austin Engineering here with our thorough balance sheet health report.

- Explore Austin Engineering's analyst forecasts in our growth report.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix (ECM) technology in the United States and internationally, with a market cap of A$255.23 million.

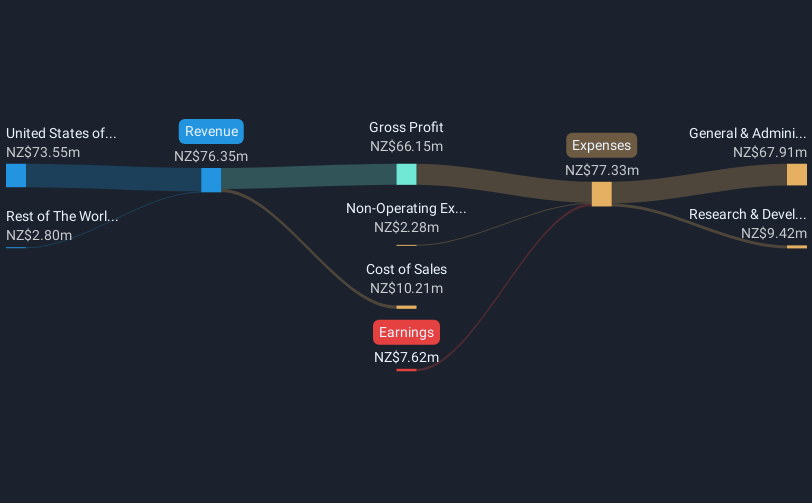

Operations: The company generates revenue of NZ$76.35 million from its operations focused on the development, manufacturing, and sale of soft tissue repair products.

Market Cap: A$255.23M

Aroa Biosurgery Limited, with a market cap of A$255.23 million, has shown financial resilience despite being unprofitable. The company reported half-year sales of NZ$39.16 million, an increase from NZ$31.87 million the previous year, and reduced its net loss to NZ$3.29 million from NZ$6.31 million, indicating improved operational efficiency. Its short-term assets significantly exceed liabilities, ensuring liquidity stability while remaining debt-free enhances its financial flexibility. Analysts anticipate earnings growth at 59.67% annually; however, the stock trades at a significant discount to estimated fair value and remains volatile in the penny stock category due to inherent industry risks.

- Get an in-depth perspective on Aroa Biosurgery's performance by reading our balance sheet health report here.

- Understand Aroa Biosurgery's earnings outlook by examining our growth report.

MFF Capital Investments (ASX:MFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.71 billion.

Operations: The company's revenue is primarily derived from its equity investment segment, totaling A$659.96 million.

Market Cap: A$2.71B

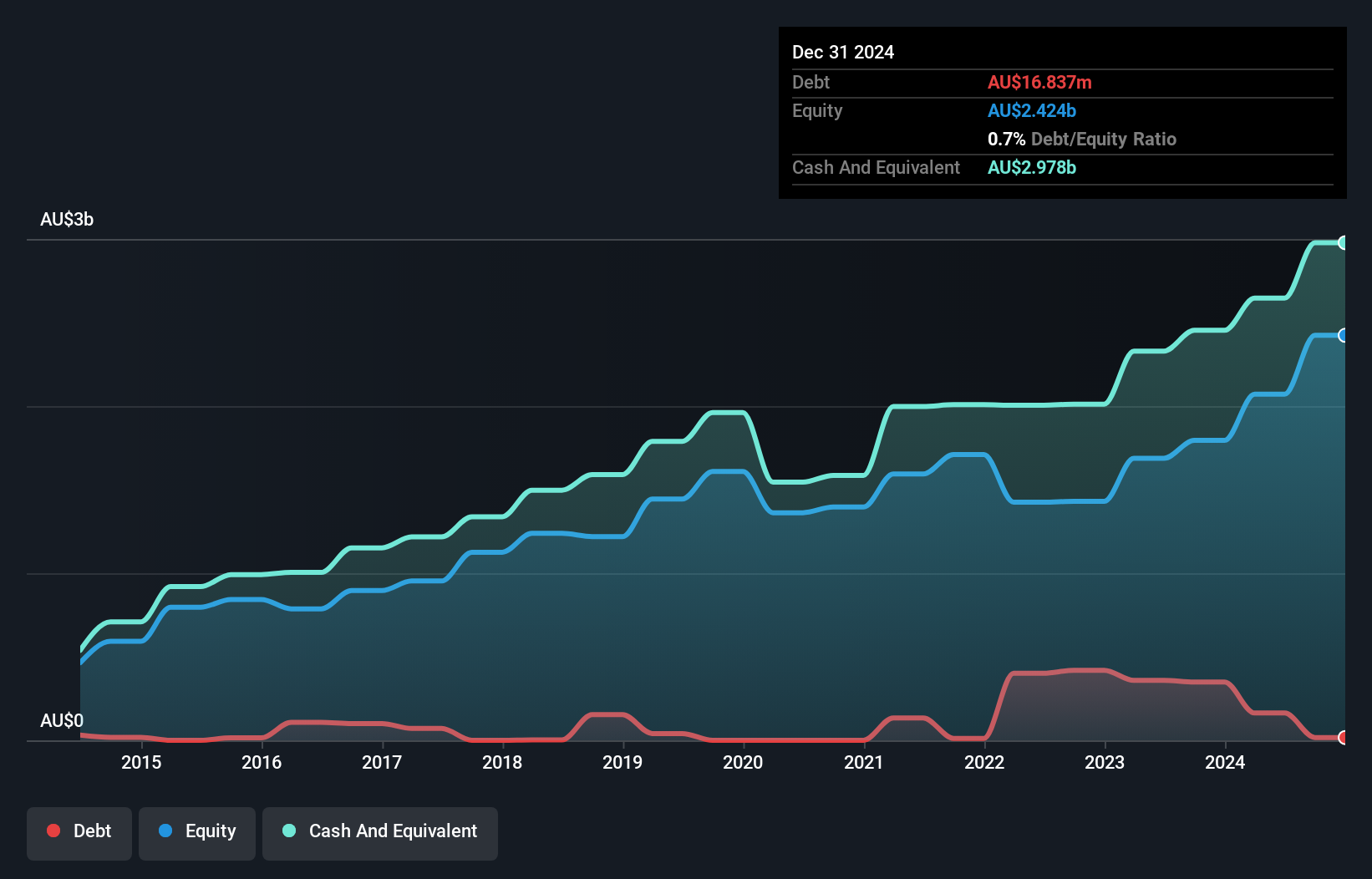

MFF Capital Investments Limited, with a market cap of A$2.71 billion, exhibits strong financial health and growth potential. Its earnings have grown by 38.3% over the past year, outpacing the industry average and its own five-year growth rate of 11%. The company's high return on equity (21.6%) and substantial net profit margins (67.8%) underscore its profitability. MFF's short-term assets significantly exceed both short- and long-term liabilities, ensuring robust liquidity. Despite an increased debt-to-equity ratio over five years, MFF maintains more cash than total debt, with interest payments well covered by EBIT at 28.2 times coverage.

- Navigate through the intricacies of MFF Capital Investments with our comprehensive balance sheet health report here.

- Assess MFF Capital Investments' previous results with our detailed historical performance reports.

Where To Now?

- Embark on your investment journey to our 1,053 ASX Penny Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ANG

Austin Engineering

Manufactures, repairs, overhauls, and supplies mining attachment products, and other related products and services for the industrial and resources-related business sectors.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives