- Australia

- /

- Specialty Stores

- /

- ASX:MHJ

ASX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The Australian market has seen a slight uptick, with the ASX200 rising by 0.1% to 8,212 points, as sectors like Staples and Discretionary show resilience amidst broader economic challenges. Penny stocks, though an outdated term for some, still represent a viable investment area by highlighting smaller or less-established companies that may offer significant value. By focusing on those with strong financial foundations and clear growth potential, investors can uncover opportunities in these lesser-known stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.61 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$833.14M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Austin Engineering (ASX:ANG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Austin Engineering Limited, with a market cap of A$310.07 million, is involved in the manufacturing, repair, overhaul, and supply of mining attachment products and related services for industrial and resource-related sectors.

Operations: The company's revenue is derived from its operations in the Asia-Pacific region, which contribute A$166.14 million, North America with A$95.53 million, and South America generating A$51.58 million.

Market Cap: A$310.07M

Austin Engineering has demonstrated robust financial growth, with earnings increasing by 317.3% over the past year and a net profit margin improvement from 2.7% to 9.4%. The company is trading at a significant discount to its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in the penny stock sector. Despite shareholder dilution in the past year, Austin maintains a strong balance sheet with short-term assets exceeding liabilities and cash surpassing total debt. Recent events include changes in company bylaws and an increase in dividends, reflecting ongoing corporate developments and shareholder engagement.

- Click to explore a detailed breakdown of our findings in Austin Engineering's financial health report.

- Examine Austin Engineering's earnings growth report to understand how analysts expect it to perform.

Michael Hill International (ASX:MHJ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Michael Hill International Limited operates jewelry stores and offers related services across Australia, New Zealand, and Canada, with a market cap of A$196.22 million.

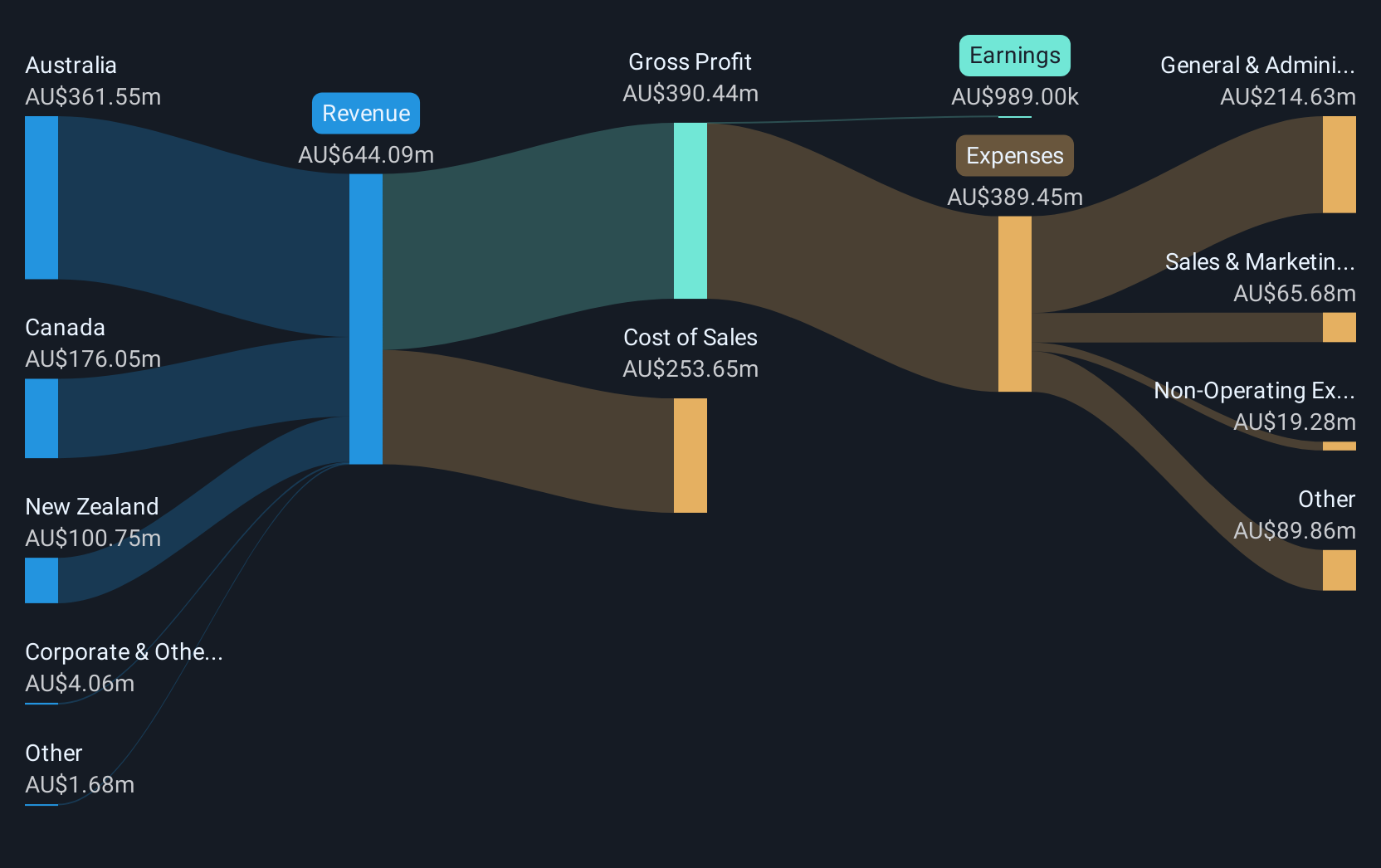

Operations: The company generated A$646.60 million in revenue from its jewelry retail operations.

Market Cap: A$196.22M

Michael Hill International faces challenges as a penny stock with its unprofitable status and negative return on equity. Despite this, the company shows potential through stable weekly volatility and satisfactory net debt to equity ratio of 23.2%. Recent sales growth of 4.3% in the first fourteen weeks of fiscal year 2025 indicates operational resilience, particularly in Australian and Canadian markets. Although no final dividend was declared for the last fiscal year, Michael Hill's experienced board and management team could navigate towards profitability, supported by strong short-term assets exceeding both long- and short-term liabilities.

- Jump into the full analysis health report here for a deeper understanding of Michael Hill International.

- Learn about Michael Hill International's future growth trajectory here.

Xanadu Mines (ASX:XAM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xanadu Mines Limited focuses on the exploration and development of mineral projects in Mongolia, with a market cap of A$125.27 million.

Operations: Xanadu Mines Limited has not reported any revenue segments.

Market Cap: A$125.27M

Xanadu Mines, a pre-revenue company with a market cap of A$125.27 million, recently announced an updated Mineral Resource Estimate and Maiden Ore Reserve for its Kharmagtai copper-gold project in Mongolia. The Pre-Feasibility Study highlights Kharmagtai's potential as a low-cost, long-life mine with significant copper and gold reserves. Despite being unprofitable and having less than one year of cash runway if current free cash flow trends persist, Xanadu's short-term assets exceed its liabilities. The company is debt-free but has experienced shareholder dilution over the past year as it continues to explore funding options for further development stages.

- Click here and access our complete financial health analysis report to understand the dynamics of Xanadu Mines.

- Understand Xanadu Mines' earnings outlook by examining our growth report.

Key Takeaways

- Get an in-depth perspective on all 1,031 ASX Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MHJ

Michael Hill International

Owns and operates jewelry stores and provides related services in Australia, New Zealand, and Canada.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives