Will Westpac’s Dividend Hike and Buyback Extension Reshape Its Capital Strategy Narrative (ASX:WBC)?

Reviewed by Sasha Jovanovic

- Westpac Banking Corporation recently announced an ordinary dividend of A$0.77 per share for the six months ended September 30, 2025, with the ex-dividend date on November 6, 2025, and extended its share buyback program through to November 10, 2026, after repurchasing A$2.48 billion in shares to date.

- This period has also seen heightened investor attention as Westpac released its New Zealand Banking Group Disclosure Statement, prompting fresh analysis of its business fundamentals and dividend outlook.

- We'll explore how Westpac's increased dividend and buyback extension influence its investment narrative in a competitive banking sector.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Westpac Banking Investment Narrative Recap

To be a shareholder in Westpac today, you have to believe the bank's stable earnings, solid capital position, and ongoing returns to shareholders will outweigh rising expenses and fierce margin pressure in a highly competitive sector. The latest dividend increase and buyback extension offer incremental support for returns, but neither fundamentally shifts the main near-term catalyst, Westpac's ability to contain cost growth as technology and regulatory investments accelerate, nor the biggest risk, that margins will keep compressing under consumer banking competition. These recent shareholder-friendly moves are positive, but don’t materially change the risk-reward equation at this stage.

Of all the latest announcements, the ordinary dividend of A$0.77 per share for the half-year stands out, reinforcing Westpac’s commitment to capital returns even as its net income moderated slightly year-on-year. This remains directly relevant to investors watching how reliably Westpac can generate cash flow amid persistent industry headwinds, particularly as sector-wide net interest margins continue to come under pressure from mortgage competition and changing deposit dynamics.

On the other hand, investors should be aware that even with these returns, the competitive mortgage market continues to put pressure on net margins and...

Read the full narrative on Westpac Banking (it's free!)

Westpac Banking's narrative projects A$24.7 billion revenue and A$6.8 billion earnings by 2028. This requires 4.5% yearly revenue growth and a decrease of A$0.3 billion in earnings from the current A$7.1 billion.

Uncover how Westpac Banking's forecasts yield a A$33.86 fair value, a 13% downside to its current price.

Exploring Other Perspectives

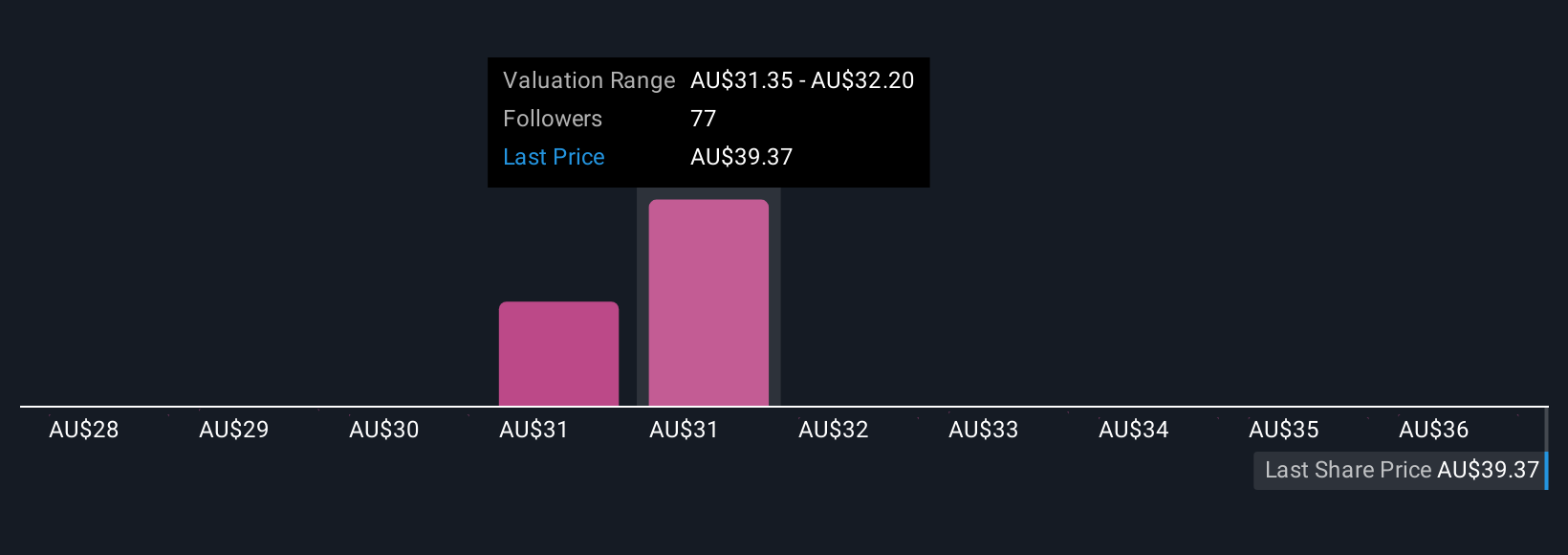

Our Simply Wall St Community fair value estimates for Westpac span from A$27.95 to A$36.45, with 11 separate views reflecting wide expectations. While some see upside, keep in mind that margin compression from consumer banking competition could have broader implications for future cash flows, explore all these viewpoints to better understand the range of possible outcomes.

Explore 11 other fair value estimates on Westpac Banking - why the stock might be worth as much as A$36.45!

Build Your Own Westpac Banking Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westpac Banking research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Westpac Banking research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westpac Banking's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westpac Banking might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WBC

Westpac Banking

Provides banking and other financial services in Australia, New Zealand, the Pacific Islands, Asia, the Americas, and Europe.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives