Does Slower Profit Growth and Rising Costs Challenge the Investment Case for CBA (ASX:CBA)?

Reviewed by Sasha Jovanovic

- Earlier this month, Commonwealth Bank of Australia reported quarterly results reflecting limited profit growth and a 6.1% rise in costs, prompting increased scrutiny from analysts and investors.

- This development highlights persistent concerns over the bank's ability to sustain financial performance given its high valuation and ongoing cost pressures.

- We’ll explore how rising cost concerns and analyst outlook are influencing Commonwealth Bank of Australia’s investment narrative going forward.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Commonwealth Bank of Australia Investment Narrative Recap

To be a Commonwealth Bank of Australia shareholder today, you need to believe in the bank’s ability to balance high profitability and defensive qualities with emerging costs and scrutiny around its fee practices. The recent news, spotlighting CBA’s decision to maintain fees on low-income customers and the share price approaching bear market territory, underscores that the most important short term catalyst remains cost control, while the major risk is the bank’s ability to justify its premium valuation amid industry and regulatory pressures. The headline event intensifies these concerns but does not yet materially change the overall risk-return equation for investors.

Among CBA’s latest announcements, its August 2025 quarterly results are especially relevant, as they revealed limited profit growth and a 6.1% rise in costs at a time when investors are already wary of both valuation and regulatory scrutiny. Cost pressures and flat earnings put near term performance in focus, complementing the ongoing debate raised by recent fee controversies and analyst outlooks.

However, against assumptions of safety, shareholders should be alert to the risk that sustained cost growth may seriously constrain future earnings...

Read the full narrative on Commonwealth Bank of Australia (it's free!)

Commonwealth Bank of Australia's narrative projects A$31.9 billion revenue and A$11.2 billion earnings by 2028. This requires 4.9% yearly revenue growth and an increase of A$1.1 billion in earnings from A$10.1 billion today.

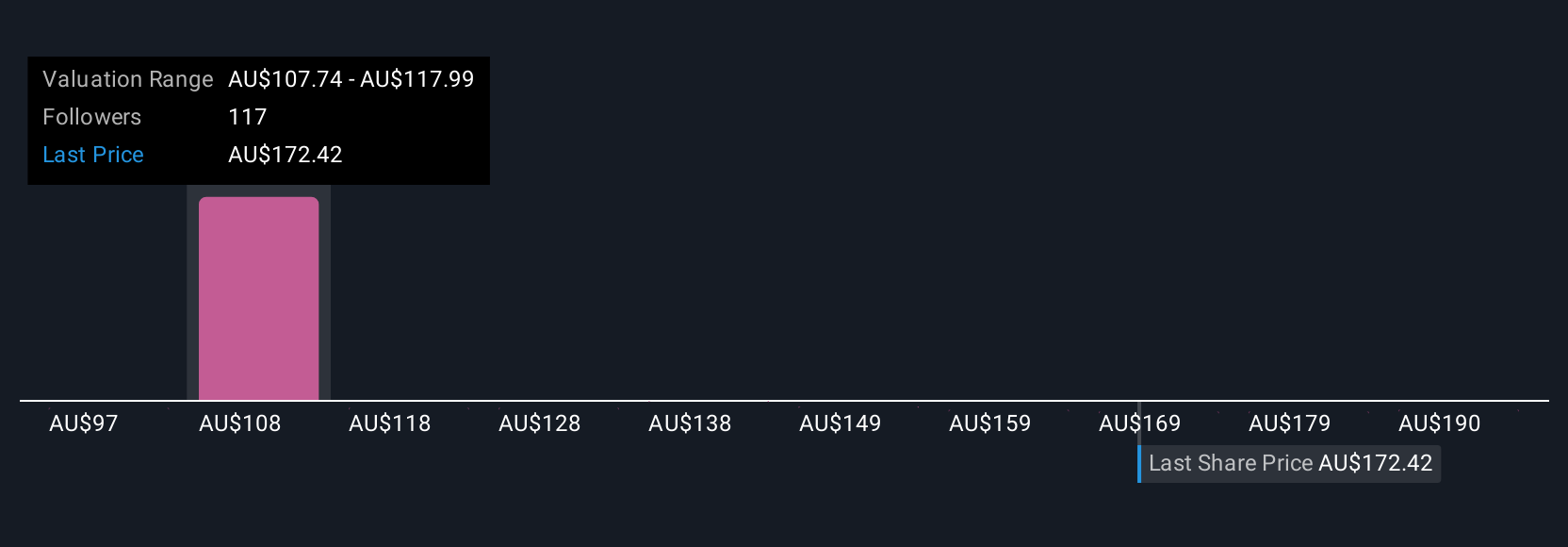

Uncover how Commonwealth Bank of Australia's forecasts yield a A$120.47 fair value, a 21% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s 13 fair value estimates for CBA range from A$100 to A$147.26, reflecting wide disagreement. Given analyst concerns about rising expenses outpacing growth, you should consider how diverging expectations could affect the share’s future performance.

Explore 13 other fair value estimates on Commonwealth Bank of Australia - why the stock might be worth as much as A$147.26!

Build Your Own Commonwealth Bank of Australia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commonwealth Bank of Australia research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commonwealth Bank of Australia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commonwealth Bank of Australia's overall financial health at a glance.

No Opportunity In Commonwealth Bank of Australia?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBA

Commonwealth Bank of Australia

Provides retail and commercial banking services in Australia, New Zealand, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives