Top Undervalued Small Caps In Australia With Insider Action August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 4.7%. In contrast to the last week, the market is up 4.0% over the past year and earnings are expected to grow by 13% per annum over the next few years. In this fluctuating environment, identifying undervalued small-cap stocks with insider action can provide promising opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| RAM Essential Services Property Fund | NA | 5.9x | 44.92% | ★★★★★☆ |

| Healius | NA | 0.6x | 46.95% | ★★★★★☆ |

| Dicker Data | 21.1x | 0.8x | 15.10% | ★★★★☆☆ |

| Eagers Automotive | 9.2x | 0.3x | 42.79% | ★★★★☆☆ |

| MFF Capital Investments | 4.9x | 3.3x | 46.58% | ★★★★☆☆ |

| Codan | 28.4x | 4.2x | 37.12% | ★★★★☆☆ |

| Coventry Group | 278.9x | 0.4x | 5.23% | ★★★★☆☆ |

| Deterra Royalties | 11.9x | 8.0x | 11.70% | ★★★☆☆☆ |

| Kelsian Group | 45.6x | 0.8x | 30.66% | ★★★☆☆☆ |

| BSP Financial Group | 8.7x | 2.9x | 1.61% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

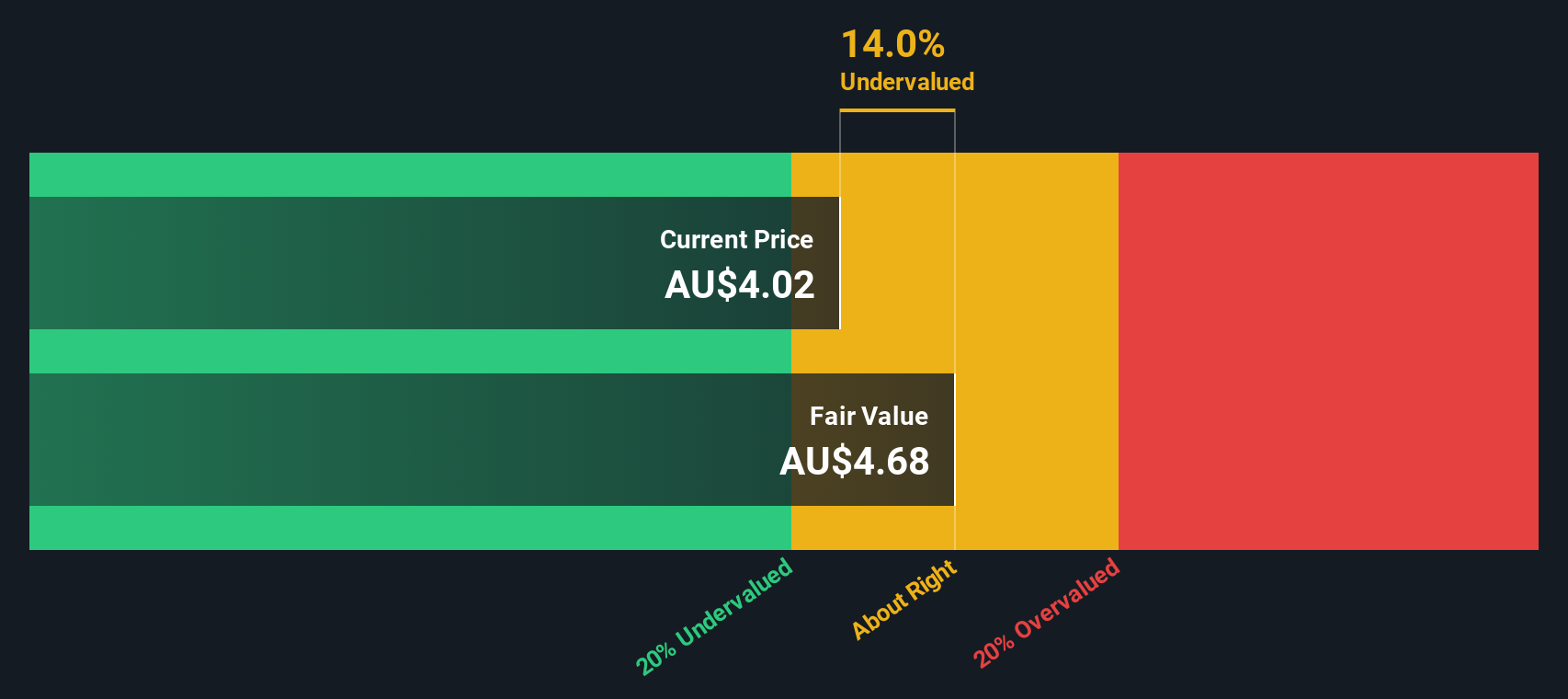

Aspen Group (ASX:APZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aspen Group is a property investment and management company with operations in parks, lifestyle, and residential sectors, boasting a market cap of A$0.34 billion.

Operations: The company generates revenue from three primary segments: Parks (A$35.34 million), Lifestyle (A$20.41 million), and Residential (A$19.84 million). Over the observed periods, net income margin has shown significant fluctuations, reaching a high of 1.61% and a low of -1.55%. The gross profit margin has varied between 39.61% and 79.49%, indicating variability in cost management efficiency across different periods.

PE: 7.7x

Aspen Group, a smaller Australian company, has shown insider confidence with notable share purchases in the past year. Despite no customer deposits and reliance on external borrowing, Aspen maintains a solid financial position. Earnings are projected to grow 18.35% annually, although profit margins have dipped to 66.8%. The company declared an increased final distribution of A$0.0425 per security for fiscal year 2024, totaling A$0.085 per security—a 10% rise from the previous year—demonstrating resilience and potential for future growth in dividends and earnings.

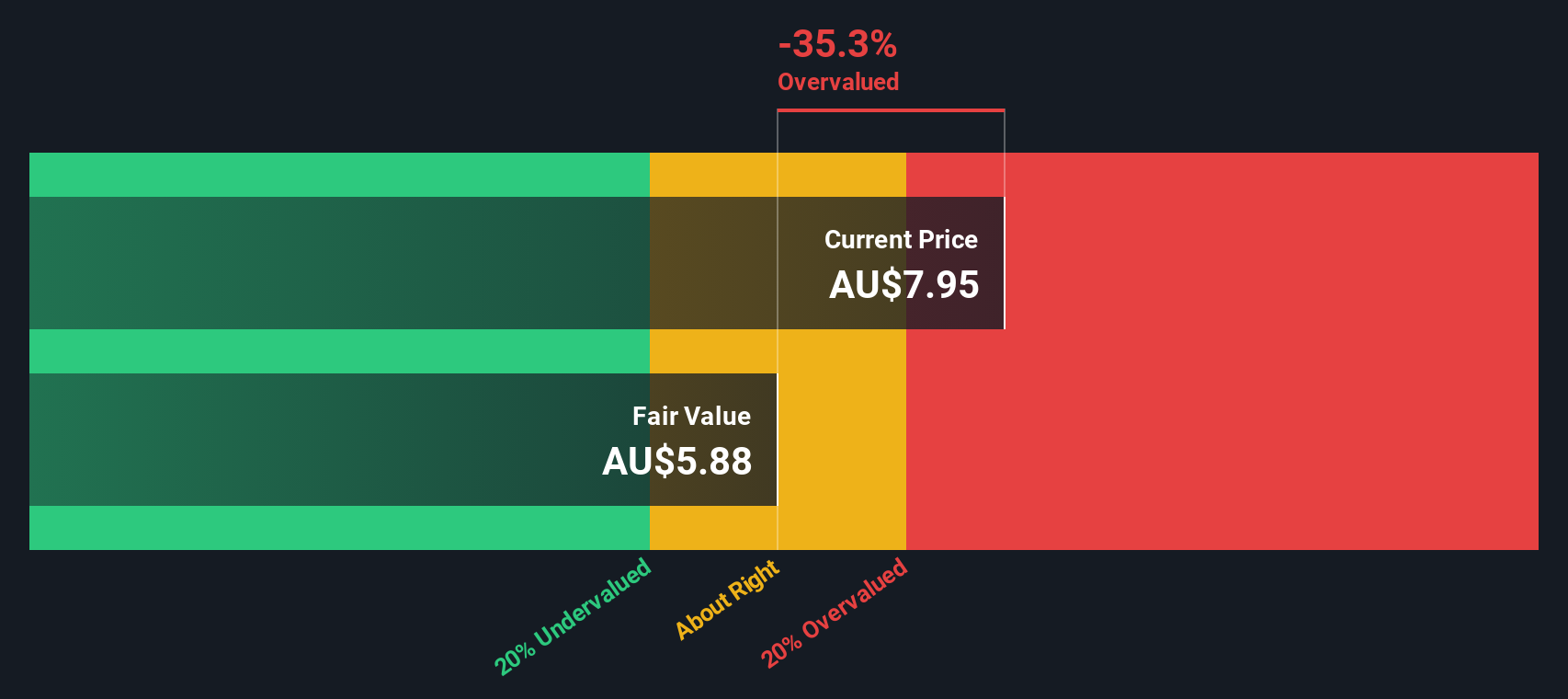

BSP Financial Group (ASX:BFL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BSP Financial Group operates as a financial services provider with banking operations in Papua New Guinea and other offshore locations, and has a market cap of PGK 10.50 billion.

Operations: The company generates revenue primarily from its PNG Bank segment (PGK 1.98 billion), Offshore Banks (PGK 599.52 million), and Non-Bank Entities (PGK 111.02 million). Operating expenses have shown fluctuations, with the most recent figure being PGK 1.09 billion for the period ending December 2023. Net income margin has varied over time, reaching as high as 44.53% in December 2021 before declining to 33.72% by December 2023.

PE: 8.7x

BSP Financial Group, a small-cap financial institution in Australia, recently saw insider confidence with significant share purchases by executives over the past six months. The company appointed Stephen Charles Beach as Director in May 2024, bringing over forty years of accounting and advisory experience. Despite a high level of non-performing loans at 4%, BSP's strategic leadership changes and insider buying suggest potential for growth within the market.

- Dive into the specifics of BSP Financial Group here with our thorough valuation report.

Assess BSP Financial Group's past performance with our detailed historical performance reports.

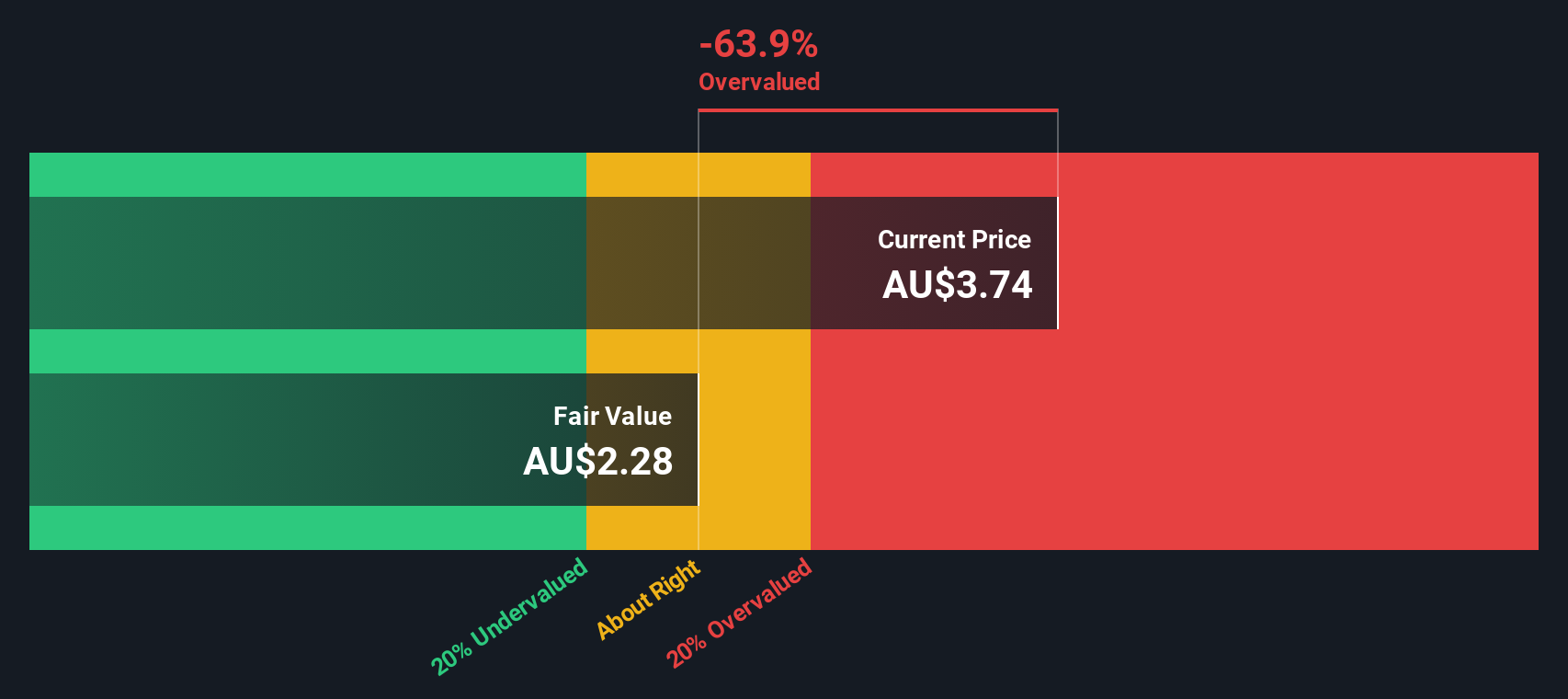

Kelsian Group (ASX:KLS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kelsian Group operates in the transportation sector, providing bus services in Australia and internationally, as well as marine and tourism services, with a market cap of A$1.19 billion.

Operations: The company generates revenue from three primary segments: Australian Bus, International Bus, and Marine and Tourism. For the period ending 2023-12-31, it reported a gross profit of A$441.02 million with a gross profit margin of 25.44%. Operating expenses were A$347.59 million, impacting the net income which stood at A$29.58 million with a net income margin of 1.71%.

PE: 45.6x

Kelsian Group, a small cap in Australia, has seen its profit margins dip from 3.8% to 1.7% over the past year. However, earnings are forecasted to grow by 25.53% annually. The company relies entirely on external borrowing for funding, which is riskier compared to customer deposits and interest payments aren't well covered by earnings currently. Notably, insider confidence is evident with recent share purchases between March and May 2024, signaling potential trust in future growth despite current financial challenges.

- Get an in-depth perspective on Kelsian Group's performance by reading our valuation report here.

Explore historical data to track Kelsian Group's performance over time in our Past section.

Turning Ideas Into Actions

- Access the full spectrum of 15 Undervalued ASX Small Caps With Insider Buying by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APZ

Aspen Group

Aspen is a leading provider of quality accommodation on competitive terms in residential, retirement and park communities.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives