- Australia

- /

- Industrial REITs

- /

- ASX:DXI

ASX Undervalued Small Caps With Insider Action To Enhance Your Portfolio

Reviewed by Simply Wall St

The Australian market has recently experienced a mix of gains and losses, with the ASX200 closing down 0.56% amid sector-specific fluctuations, notably in materials and real estate. In this environment, small-cap stocks can present intriguing opportunities for investors seeking growth potential, particularly when there is notable insider action indicating confidence in these companies' prospects. Identifying small caps that are perceived as undervalued requires careful consideration of their financial health and market position amidst broader economic dynamics.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infomedia | 40.5x | 3.6x | 38.22% | ★★★★★★ |

| Iluka Resources | 7.9x | 1.8x | 7.79% | ★★★★★☆ |

| SHAPE Australia | 14.7x | 0.3x | 29.65% | ★★★★☆☆ |

| Healius | NA | 0.6x | 13.96% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.6x | 3.29% | ★★★★☆☆ |

| Coventry Group | 229.0x | 0.4x | -17.89% | ★★★☆☆☆ |

| Corporate Travel Management | 23.2x | 2.8x | 43.18% | ★★★☆☆☆ |

| Dexus Industria REIT | NA | 9.5x | 33.19% | ★★★☆☆☆ |

| BSP Financial Group | 7.8x | 2.8x | 0.67% | ★★★☆☆☆ |

| Eureka Group Holdings | 18.9x | 6.1x | 29.45% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

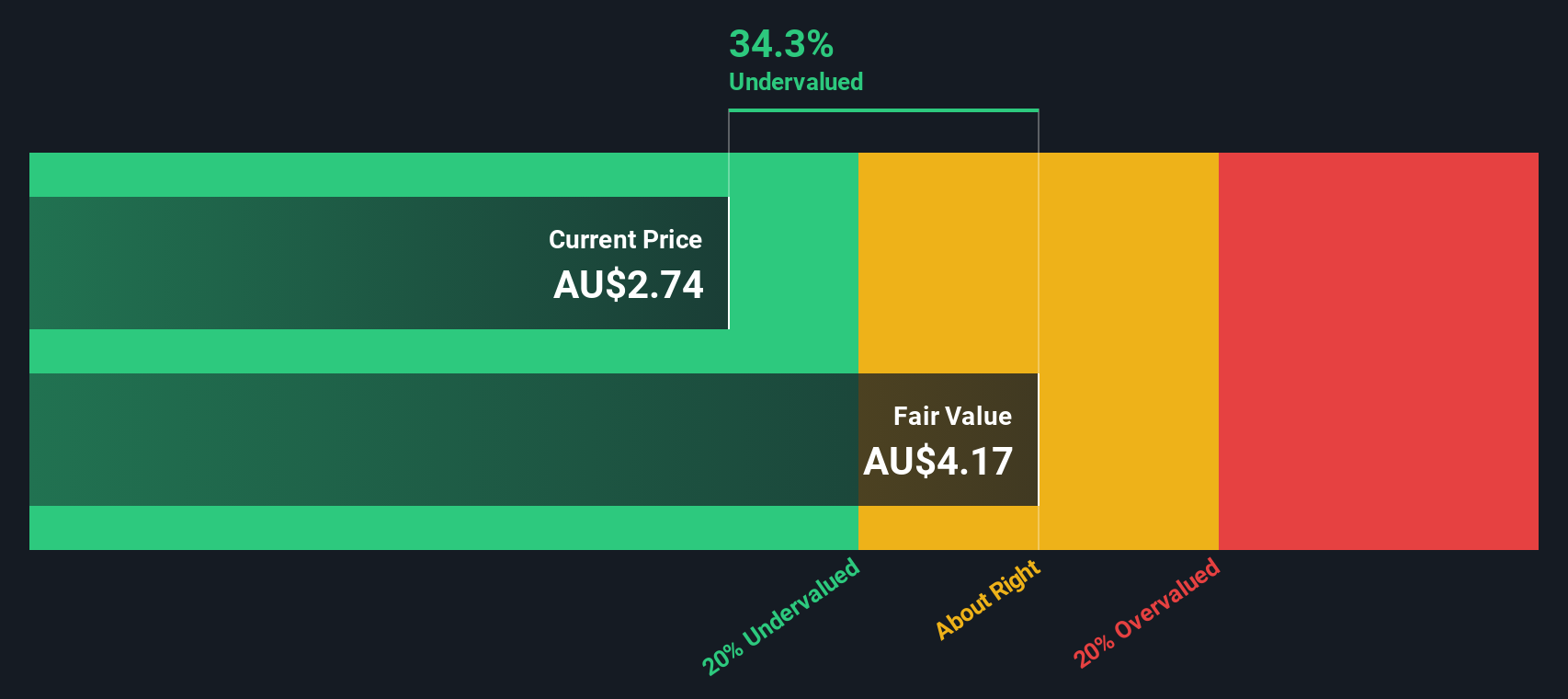

BSP Financial Group (ASX:BFL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BSP Financial Group operates as a leading financial services provider in Papua New Guinea and the Pacific region, with a market capitalization of PGK 10.34 billion.

Operations: The company's revenue is primarily derived from PNG Bank, contributing PGK 2.13 billion, followed by Pacific Markets at PGK 638.68 million and Non-Bank Entities at PGK 112.27 million. Operating expenses have varied over time, with a recent figure of PGK 1.13 billion as of June 2024. The net income margin has shown fluctuations, reaching a high of approximately 44% in December 2021 and standing at around 35% in June 2024.

PE: 7.8x

BSP Financial Group, a small player in the Australian market, is catching attention for its potential value. Insider confidence is evident with recent share purchases by executives over the past year. However, they face challenges with a 4% bad loans ratio, indicating room for improvement in asset quality. The appointment of Ms. Vandhna Devi Narayan as Company Secretary brings seasoned legal and compliance expertise to their leadership team, potentially strengthening governance and strategic direction moving forward.

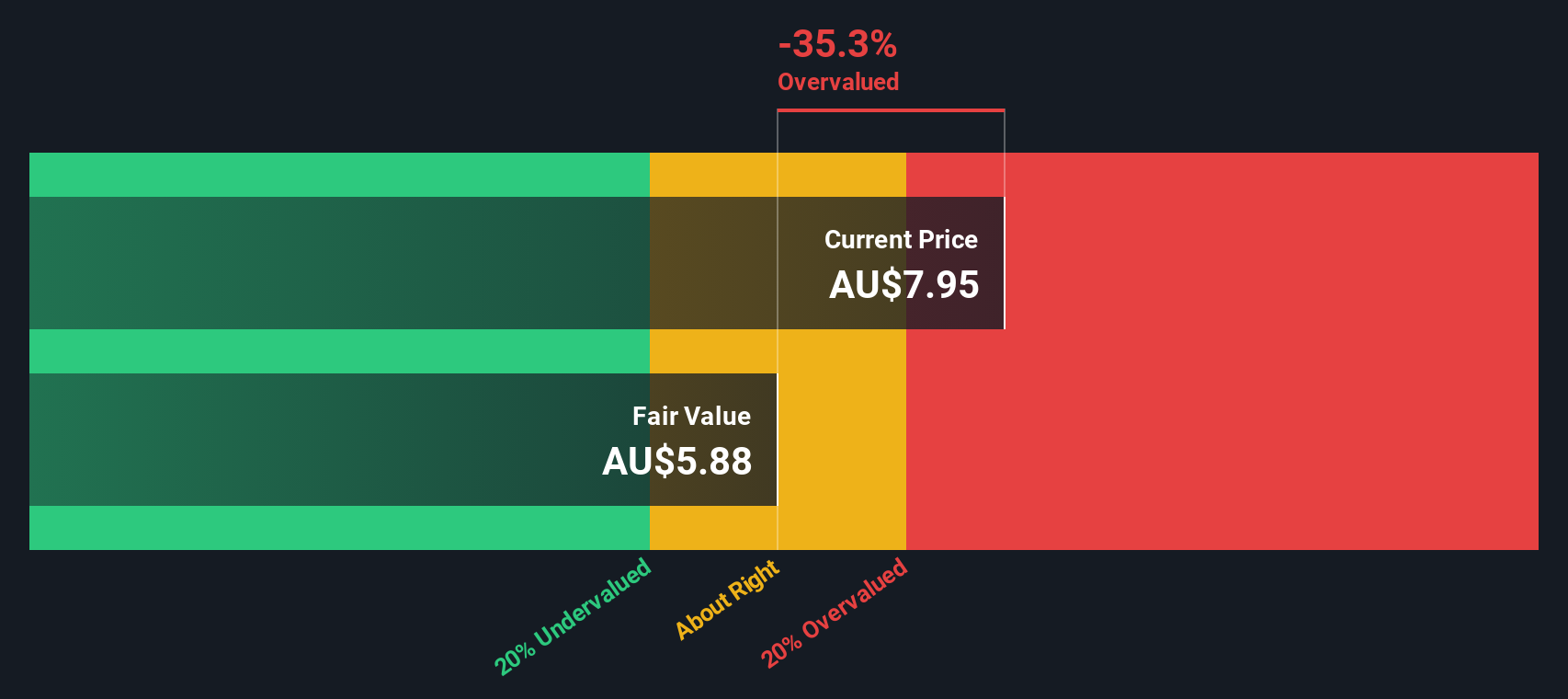

Dexus Industria REIT (ASX:DXI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dexus Industria REIT is an Australian real estate investment trust focused on investing in industrial properties, with a market capitalization of A$1.24 billion.

Operations: Dexus Industria REIT generates revenue primarily from its investment in properties, with recent figures showing A$85.48 million. The company has experienced fluctuations in net income margin, which ranged from 0.19% to -4.02% over the analyzed periods. Gross profit margin has been relatively stable, recently recorded at 77.55%. Operating expenses have remained low relative to revenue, contributing to the overall financial performance of the company.

PE: -237.3x

Dexus Industria REIT, a smaller player in the Australian market, recently saw a significant transaction with an undisclosed buyer acquiring a 15.1% stake from Growthpoint Properties Australia on October 2, 2024. This move could suggest renewed interest and potential insider confidence in its prospects. The company declared a quarterly dividend of A$0.041 for September 2024, highlighting its commitment to shareholder returns despite relying solely on external borrowing for funding. Earnings are projected to grow by 43% annually, offering promising growth potential amidst these developments.

- Unlock comprehensive insights into our analysis of Dexus Industria REIT stock in this valuation report.

Understand Dexus Industria REIT's track record by examining our Past report.

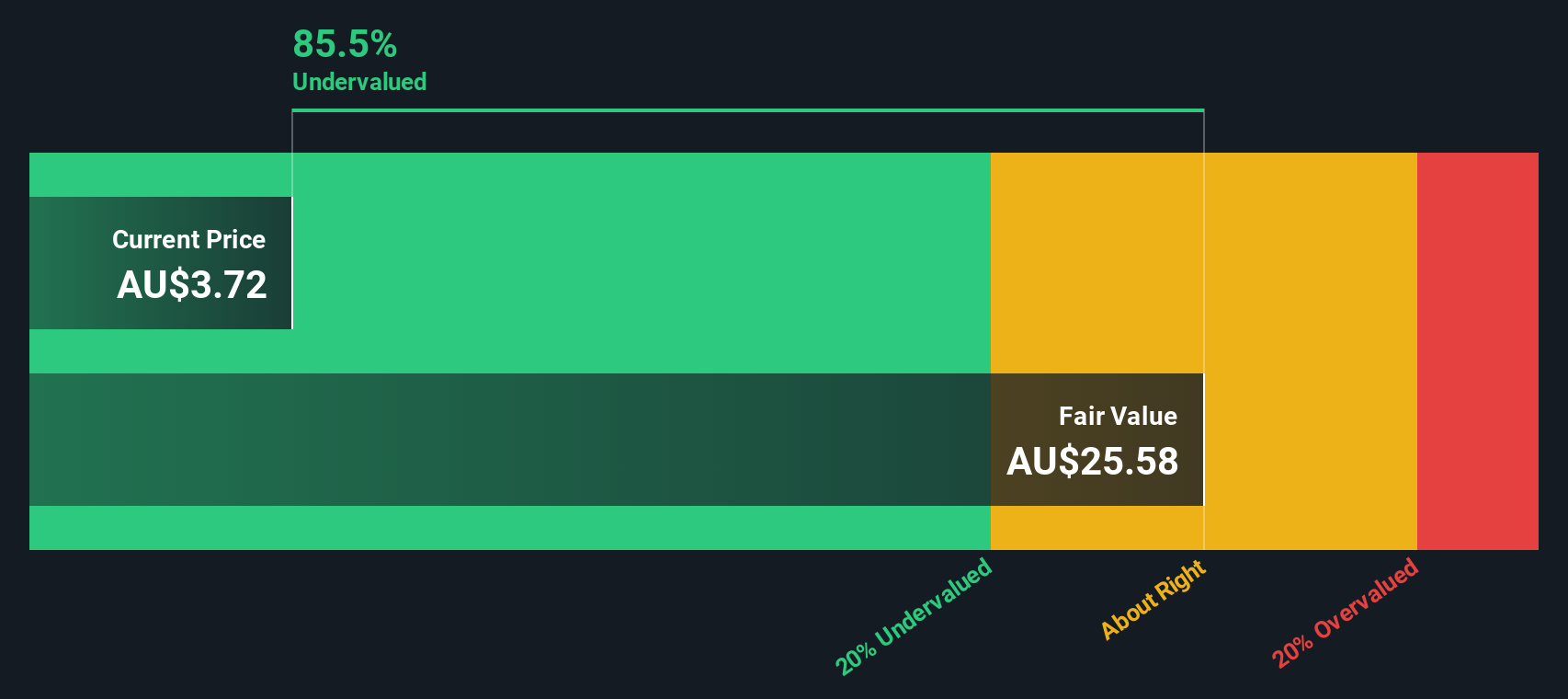

Iluka Resources (ASX:ILU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Iluka Resources is a leading global producer of mineral sands, primarily zircon and titanium dioxide products, with operations in Australia and Sierra Leone and a market capitalization of A$5.12 billion.

Operations: Iluka Resources generates revenue primarily from its Cataby/South West and Jacinth-Ambrosia/Mid West segments, with recent revenues reaching A$1.22 billion. The company's gross profit margin has shown a decreasing trend, moving from 65.04% in late 2022 to 59.76% by mid-2024.

PE: 7.9x

Iluka Resources, a notable player in Australia's market, is currently navigating the small cap landscape with a mix of challenges and opportunities. Despite its higher risk funding structure reliant on external borrowing, the company is poised for growth with earnings projected to increase by 2.76% annually. Recent insider confidence was demonstrated through share purchases between September and November 2024. Additionally, positive discussions with the Australian Government may enhance financing for their Eneabba rare earths refinery project.

- Dive into the specifics of Iluka Resources here with our thorough valuation report.

Gain insights into Iluka Resources' past trends and performance with our Past report.

Taking Advantage

- Take a closer look at our Undervalued ASX Small Caps With Insider Buying list of 25 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DXI

Dexus Industria REIT

Dexus Industria REIT (ASX code: DXI) is a listed Australian real estate investment trust which is primarily invested in high-quality industrial warehouses.

Moderate growth potential with acceptable track record.

Market Insights

Community Narratives