- Australia

- /

- Capital Markets

- /

- ASX:MFF

Bendigo And Adelaide Bank And 2 Top ASX Dividend Stocks

Reviewed by Simply Wall St

The Australian market has remained flat over the last week, but it has experienced a significant 22% rise over the past year, with earnings projected to grow by 12% annually in the coming years. In this context, identifying strong dividend stocks like Bendigo and Adelaide Bank can be crucial for investors seeking reliable income and potential growth amidst these dynamic conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 6.75% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.61% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.19% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.32% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.60% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.26% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.38% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.45% | ★★★★★☆ |

| Santos (ASX:STO) | 6.59% | ★★★★☆☆ |

| CTI Logistics (ASX:CLX) | 5.79% | ★★★★☆☆ |

Click here to see the full list of 37 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Bendigo and Adelaide Bank (ASX:BEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bendigo and Adelaide Bank Limited provides banking and financial services to retail customers and small to medium-sized businesses in Australia, with a market cap of A$6.88 billion.

Operations: Bendigo and Adelaide Bank's revenue is primarily derived from its Consumer segment at A$1.12 billion, followed by the Business & Agribusiness segment at A$761.10 million, and the Corporate segment at A$67.50 million.

Dividend Yield: 5.2%

Bendigo and Adelaide Bank's dividend profile shows a mixed picture. The bank recently increased its fully franked full-year dividend to A$0.63 per share, up from A$0.61 the previous year, indicating growth despite a historically volatile and unreliable dividend track record. With a current payout ratio of 65.4%, dividends are covered by earnings, though the yield remains below top-tier Australian payers at 5.19%. Recent board changes might influence future strategic directions.

- Get an in-depth perspective on Bendigo and Adelaide Bank's performance by reading our dividend report here.

- The analysis detailed in our Bendigo and Adelaide Bank valuation report hints at an deflated share price compared to its estimated value.

Lycopodium (ASX:LYL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lycopodium Limited offers engineering and project delivery services across the resources, rail infrastructure, and industrial processes sectors in Australia, with a market cap of A$442.07 million.

Operations: Lycopodium Limited's revenue is primarily derived from its resources segment, which generated A$366.49 million, complemented by contributions of A$11.45 million from process industries and A$10.21 million from rail infrastructure.

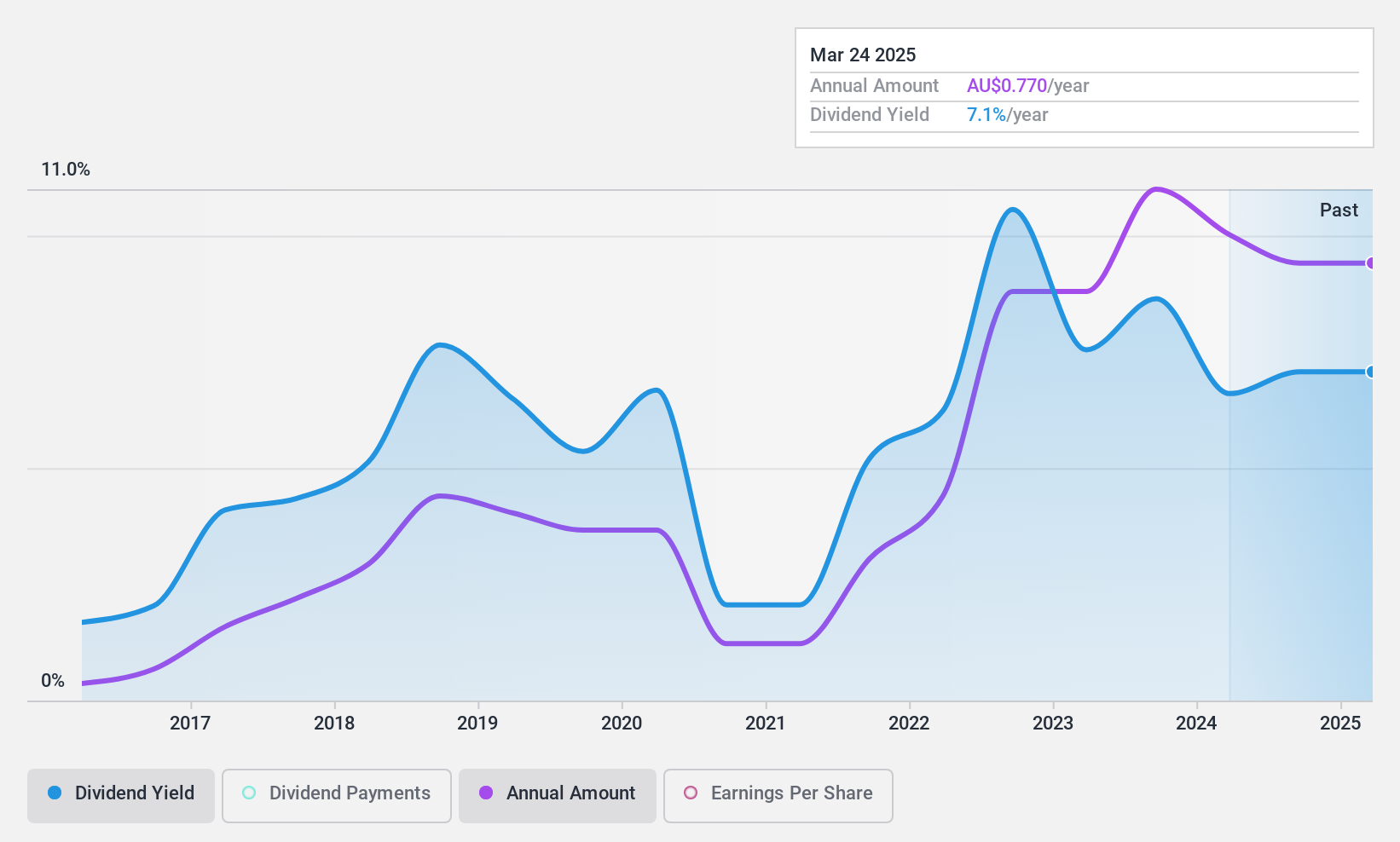

Dividend Yield: 6.8%

Lycopodium's dividend yield of 6.8% places it among the top 25% of Australian dividend payers, yet its dividends have been historically volatile and unreliable. While recent earnings growth is notable, with net income rising to A$50.71 million, the company's high cash payout ratio of 122.9% suggests dividends aren't well covered by free cash flows. Despite a reasonable payout ratio of 60.3%, sustainability concerns persist due to non-cash earnings and coverage issues.

- Unlock comprehensive insights into our analysis of Lycopodium stock in this dividend report.

- According our valuation report, there's an indication that Lycopodium's share price might be on the expensive side.

MFF Capital Investments (ASX:MFF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.25 billion.

Operations: MFF Capital Investments Limited generates revenue primarily from its equity investments, amounting to A$659.96 million.

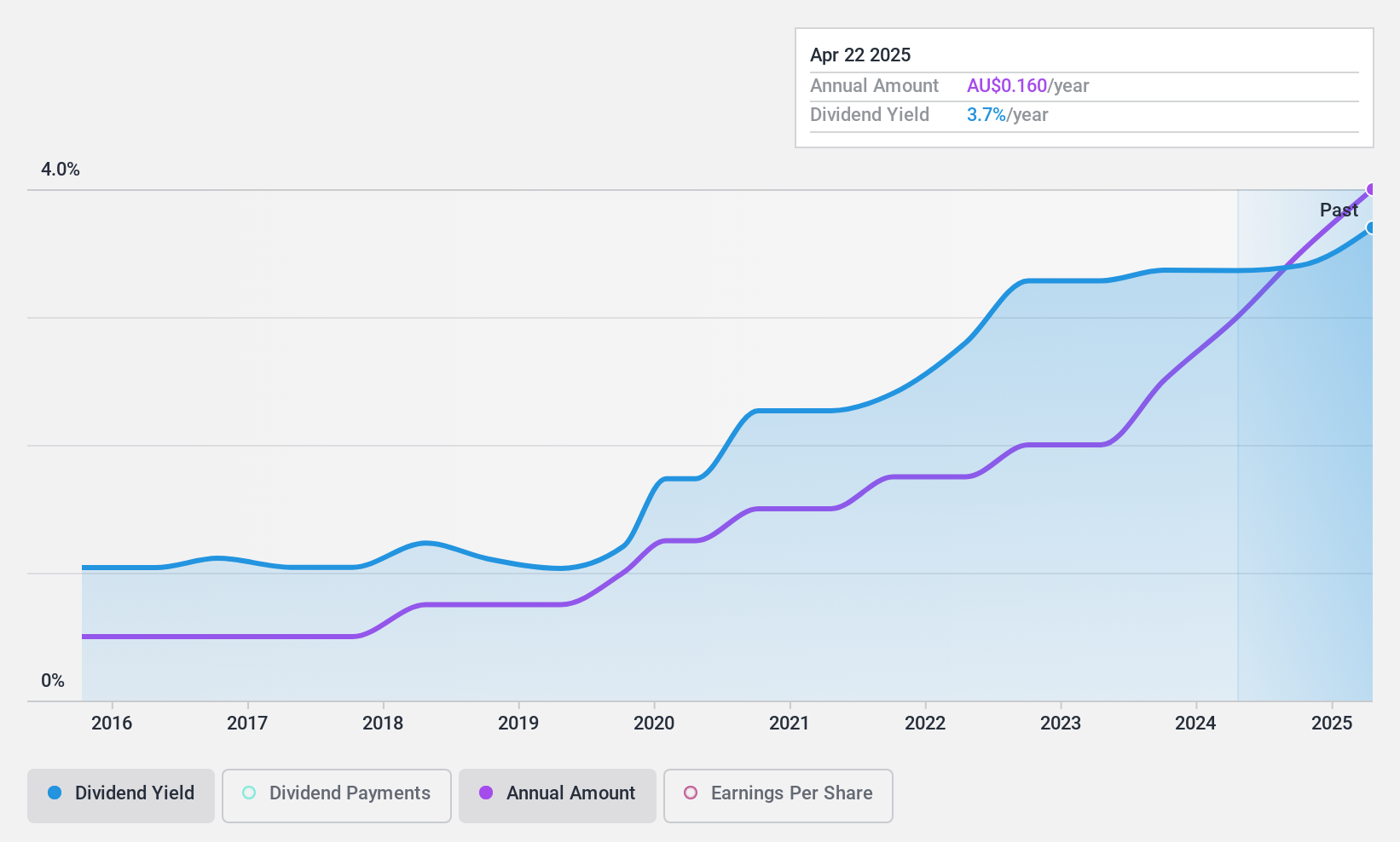

Dividend Yield: 3.6%

MFF Capital Investments offers a stable and growing dividend, supported by a low payout ratio of 16.8% and cash payout ratio of 24.1%, indicating strong earnings and cash flow coverage. Recent financials show impressive growth, with net income rising to A$447.36 million for the year ended June 30, 2024. Despite a reliable dividend yield of 3.6%, it remains below the top quartile in Australia. The final dividend is set at A$0.07 per share, payable on November 1, 2024.

- Click to explore a detailed breakdown of our findings in MFF Capital Investments' dividend report.

- The valuation report we've compiled suggests that MFF Capital Investments' current price could be quite moderate.

Where To Now?

- Take a closer look at our Top ASX Dividend Stocks list of 37 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Solid track record with excellent balance sheet and pays a dividend.