ASX Dividend Stocks Featuring ANZ Group Holdings And Two More

Reviewed by Simply Wall St

As the ASX200 faces a slight downturn, with investors expressing disappointment over recent Chinese stimulus measures and declining commodity prices impacting sectors like Materials and Energy, dividend stocks continue to be a focal point for those seeking stable income amidst market fluctuations. In this environment, identifying robust dividend stocks can be crucial for investors looking to balance growth potential with reliable returns; ANZ Group Holdings and two other noteworthy stocks offer compelling options in the current Australian market landscape.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 6.84% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.69% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.11% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.28% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.35% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.30% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.45% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.18% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.30% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.35% | ★★★★☆☆ |

Click here to see the full list of 36 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

ANZ Group Holdings (ASX:ANZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ANZ Group Holdings Limited offers a range of banking and financial products and services to retail, individual, and business customers in Australia and internationally, with a market cap of A$95.52 billion.

Operations: ANZ Group Holdings Limited's revenue segments include Pacific (A$222 million), New Zealand (A$3.51 billion), Institutional (A$6.90 billion), Australia Retail (A$5.82 billion), and Australia Commercial (A$3.43 billion).

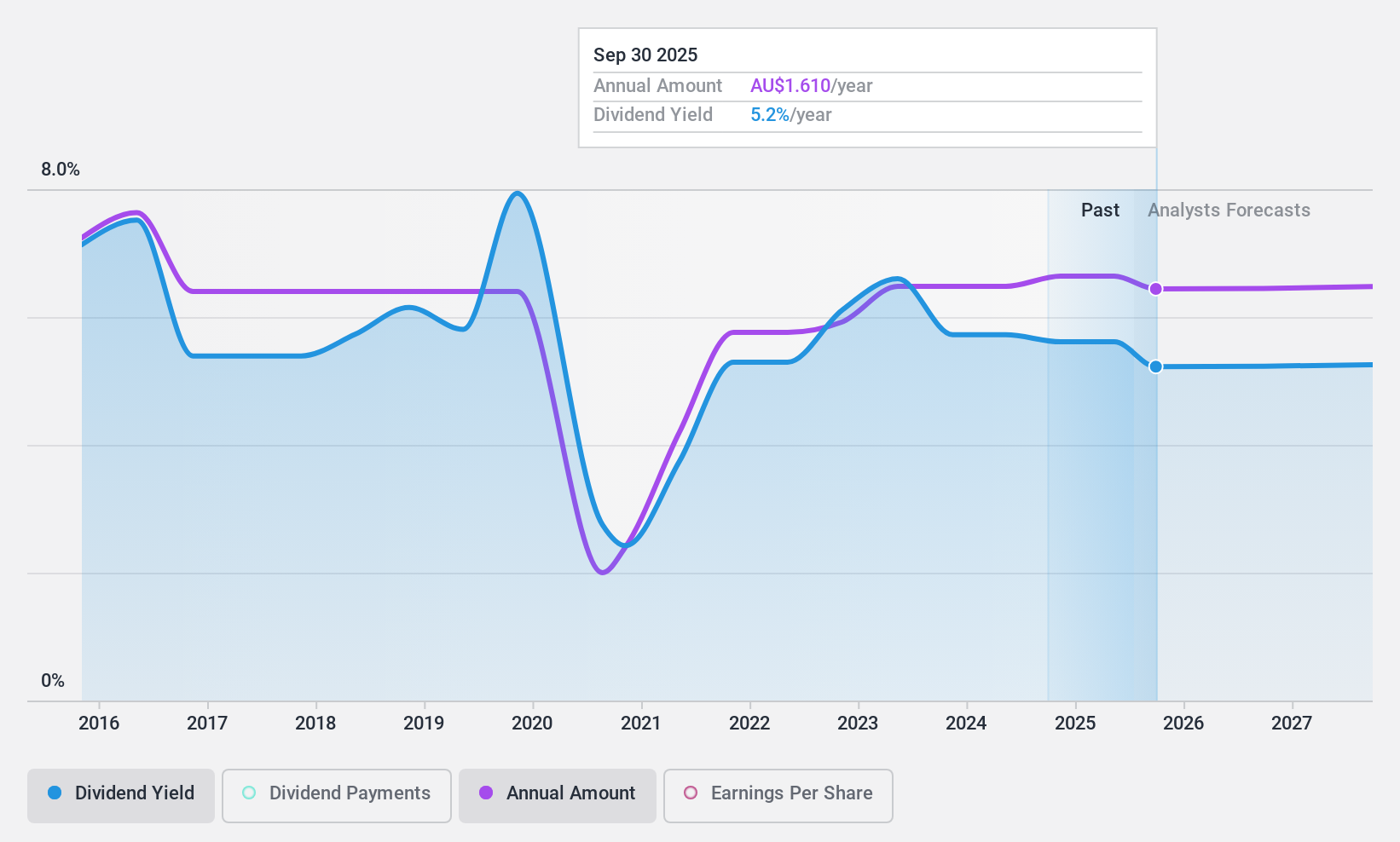

Dividend Yield: 5.2%

ANZ Group Holdings has shown a volatile dividend history over the past decade, with recent decreases in its final dividend to A$0.83 per share. Despite this volatility, dividends remain covered by earnings with a current payout ratio of 76.2%, forecasted to improve slightly to 73.1% in three years. The stock trades below estimated fair value, offering potential for capital appreciation alongside its moderate dividend yield of 5.17%.

- Get an in-depth perspective on ANZ Group Holdings' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that ANZ Group Holdings is priced lower than what may be justified by its financials.

Steadfast Group (ASX:SDF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Steadfast Group Limited operates as a general insurance brokerage company across Australasia, Asia, and Europe, with a market capitalization of A$6.26 billion.

Operations: Steadfast Group Limited generates revenue primarily from its Insurance Intermediary segment, accounting for A$1.55 billion, and Premium Funding, contributing A$113 million.

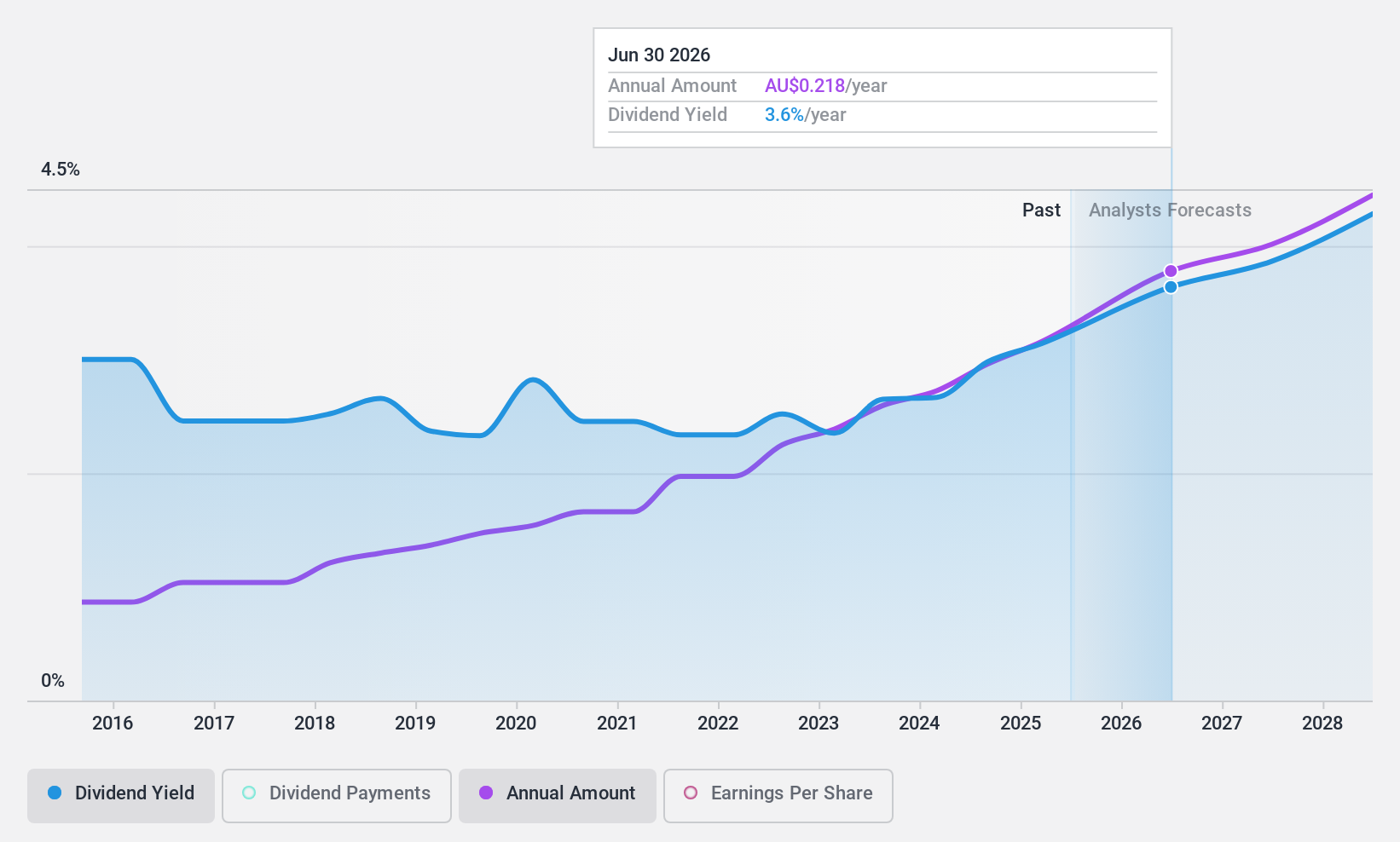

Dividend Yield: 3%

Steadfast Group's dividend profile shows some challenges, with a volatile history over the past decade. Despite this, recent earnings growth of 34% annually over five years supports its dividend coverage, with an 80.7% payout ratio from earnings and 65.6% from cash flows. The company announced a final franked dividend of A$0.1035 per share for the year ended June 2024. Trading at a discount to fair value might offer potential for capital gains alongside its modest yield of 3.02%.

- Take a closer look at Steadfast Group's potential here in our dividend report.

- The analysis detailed in our Steadfast Group valuation report hints at an inflated share price compared to its estimated value.

Smartgroup (ASX:SIQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Smartgroup Corporation Ltd, with a market cap of A$1.02 billion, offers employee management services in Australia.

Operations: Smartgroup's revenue is primarily derived from its Outsourced Administration segment at A$263.07 million, followed by Software, Distribution and Group Services at A$41.02 million, and Vehicle Services contributing A$19.53 million.

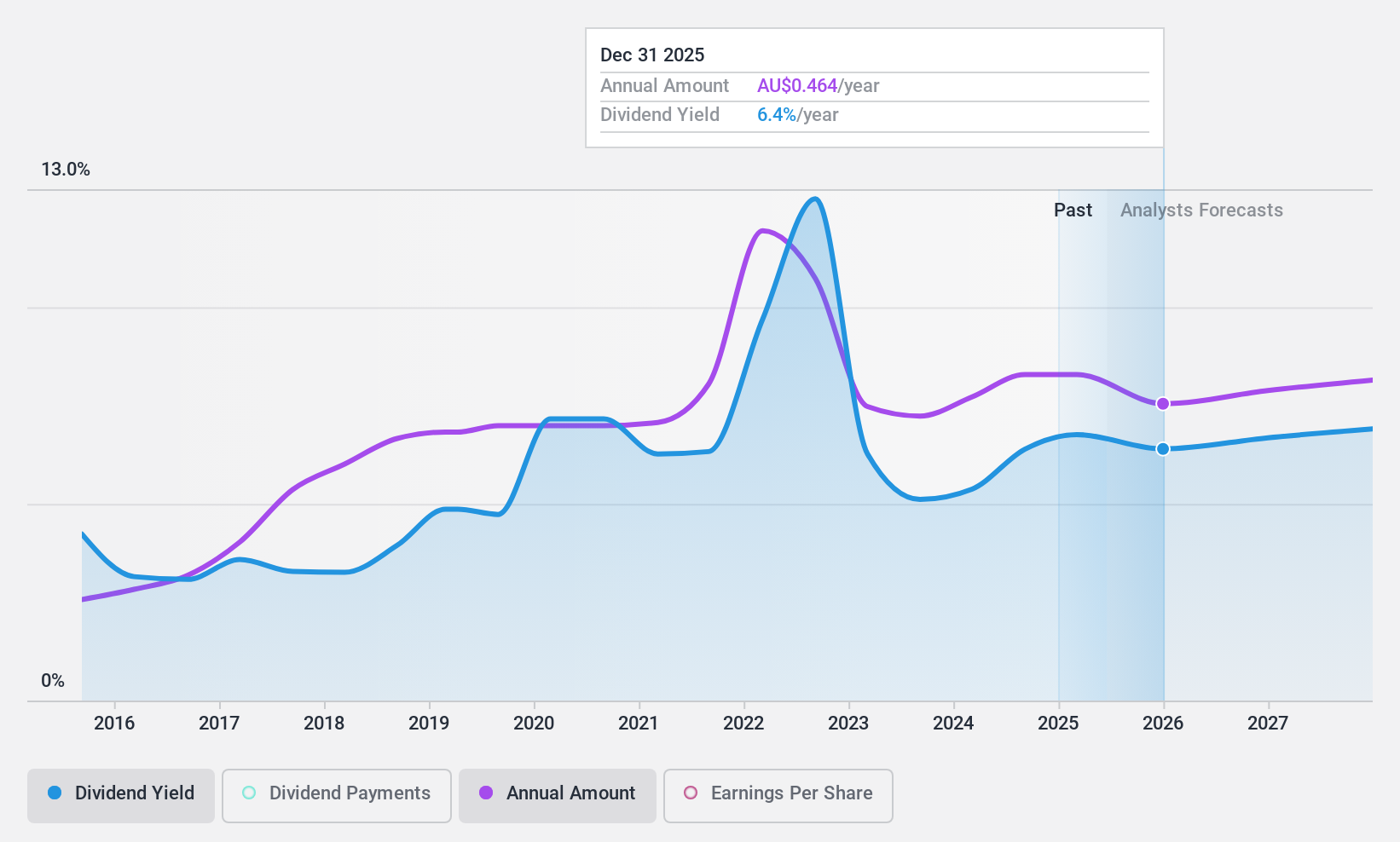

Dividend Yield: 6.5%

Smartgroup's dividend profile reveals both strengths and challenges. The company recently announced a cash dividend of A$0.175, reflecting an increase, yet its dividends have historically been volatile over the past decade. Despite a reasonable payout ratio of 64.6% from earnings, the high cash payout ratio of 131.2% raises concerns about sustainability from free cash flows. Trading at good value below fair estimates and offering a top-tier yield of 6.48%, it remains attractive for income-focused investors despite reliability issues in its dividend history.

- Click to explore a detailed breakdown of our findings in Smartgroup's dividend report.

- Our expertly prepared valuation report Smartgroup implies its share price may be lower than expected.

Seize The Opportunity

- Access the full spectrum of 36 Top ASX Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ANZ

ANZ Group Holdings

Provides various banking and financial products and services to retail, individuals and business customers in Australia and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives