ANZ (ASX:ANZ) Rolls Out Storm Relief—What’s Next for Its Valuation?

Reviewed by Simply Wall St

ANZ Group Holdings (ASX:ANZ) has responded to severe storms in Southland and South Otago with a suite of relief measures, including temporary overdraft facilities, deferred loan payments, and new regrowth loans designed to support affected customers.

See our latest analysis for ANZ Group Holdings.

After a strong surge through the year, ANZ Group Holdings’ latest relief efforts come on the back of momentum that has continued to build, with a 28.9% year-to-date share price return and a one-year total shareholder return just shy of 25%. Even as recent storms prompted a short-term dip, the stock’s solid longer-term performance reflects resilient investor confidence and underlying growth potential.

If you’re keeping an eye out for fresh opportunities beyond the banking sector, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

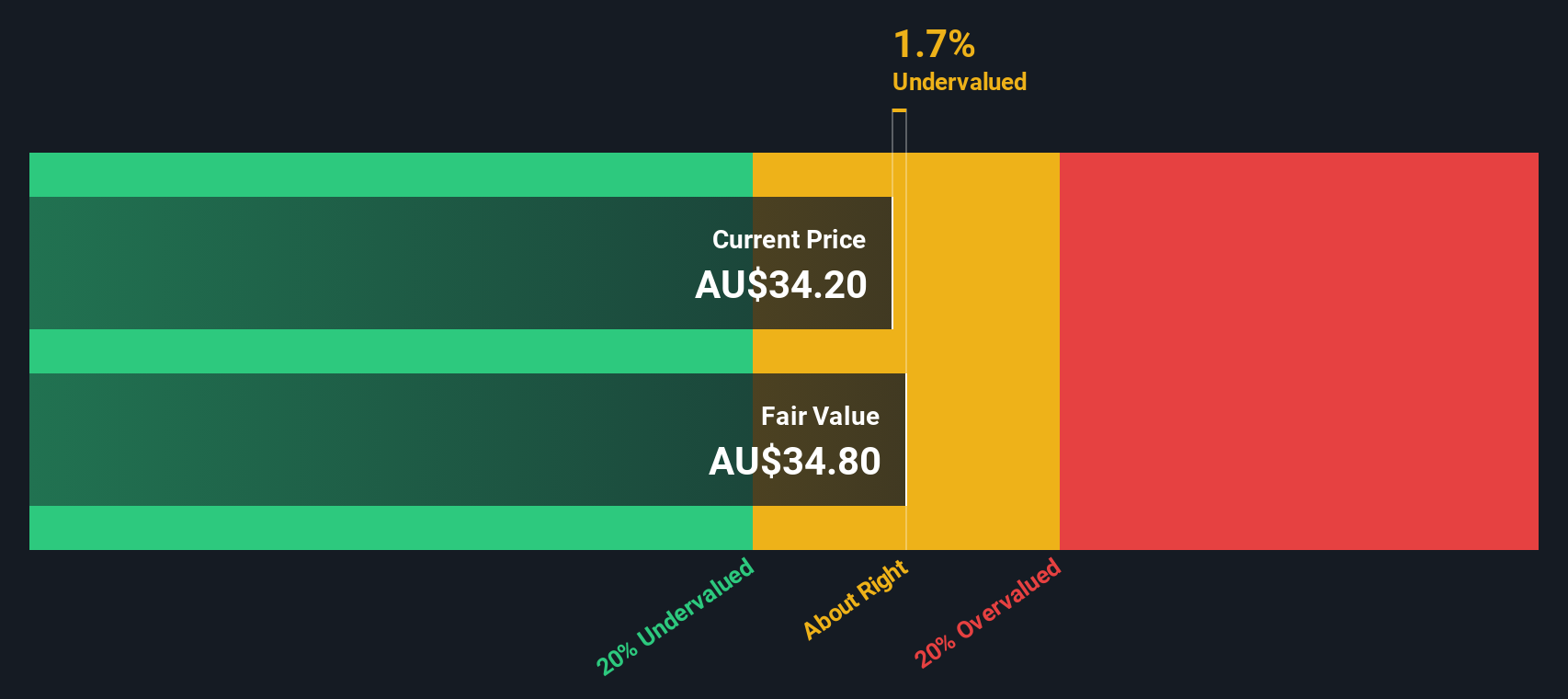

But with ANZ shares near recent highs and trading just above analyst targets, the critical question now is whether there is untapped value left for new investors or if the market is already factoring in future growth prospects.

Most Popular Narrative: 8.7% Overvalued

With ANZ Group Holdings closing at A$36.86, the most popular narrative’s intrinsic fair value estimate of A$33.91 suggests the share price is ahead of analyst expectations. The valuation narrative comes at a time when investors are weighing recent operational advances against some softening in revenue growth forecasts.

Bullish analysts highlight the company's improved profit margins and operational efficiency. These factors are viewed as central drivers behind their upward price target revisions.

Curious what’s fueling analyst optimism, even as revenue forecasts cool? The full narrative reveals the bold shifts in profit outlook and the numbers thought to justify this ambitious target. Don’t miss how this valuation hinges on just a handful of crucial growth assumptions. See what really tips the balance behind ANZ’s pricing.

Result: Fair Value of $33.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory scrutiny or delays in technology integration could challenge the optimistic outlook. These factors may put pressure on future earnings and margin expectations.

Find out about the key risks to this ANZ Group Holdings narrative.

Another View: A Different Take on Value

While analyst targets suggest ANZ Group Holdings is slightly overvalued, our SWS DCF model finds the stock trading about 2% below its estimated fair value of A$37.67. This result suggests the market may not be fully pricing in ANZ's future cash flows. Could this disconnect hint at untapped opportunity, or just reflect cautious forecasting?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ANZ Group Holdings Narrative

If these conclusions don't quite match your perspective, you can dive into the data yourself and shape your own view of ANZ Group Holdings in just a few minutes. Do it your way

A great starting point for your ANZ Group Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Level up your watchlist with strategies that go beyond the big banks, and don’t miss out on tomorrow’s top performers coming out of emerging trends.

- Lock in steady income as you target these 21 dividend stocks with yields > 3%, offering strong yields above 3% for growth plus reliable returns.

- Tap into the artificial intelligence wave by scanning these 26 AI penny stocks, where cutting-edge companies are rewriting the rules of smart technology.

- Capitalize on tomorrow's market leaders by chasing these 856 undervalued stocks based on cash flows, trading below their cash flow value and potentially set for a re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ANZ

ANZ Group Holdings

Provides various banking and financial products and services to retail, individuals and business customers in Australia and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives