Here's Why I Think Vmoto (ASX:VMT) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Vmoto (ASX:VMT), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Vmoto

Vmoto's Improving Profits

In the last three years Vmoto's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Vmoto's EPS shot from AU$0.015 to AU$0.029, over the last year. Year on year growth of 93% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Vmoto is growing revenues, and EBIT margins improved by 3.1 percentage points to 7.3%, over the last year. That's great to see, on both counts.

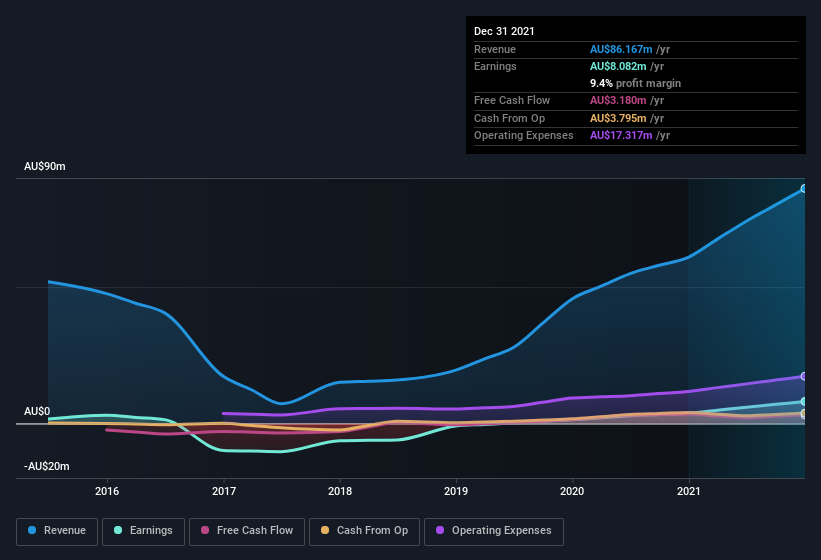

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Vmoto's forecast profits?

Are Vmoto Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Vmoto shareholders can gain quiet confidence from the fact that insiders shelled out AU$517k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Malaky Kazem for AU$413k worth of shares, at about AU$0.42 per share.

On top of the insider buying, we can also see that Vmoto insiders own a large chunk of the company. In fact, they own 40% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about AU$37m riding on the stock, at current prices. That's nothing to sneeze at!

Does Vmoto Deserve A Spot On Your Watchlist?

Vmoto's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Vmoto belongs on the top of your watchlist. We don't want to rain on the parade too much, but we did also find 3 warning signs for Vmoto (1 is a bit unpleasant!) that you need to be mindful of.

As a growth investor I do like to see insider buying. But Vmoto isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:VMT

Vmoto

Engages in the development, manufacture, marketing, and distribution of electric two-wheel vehicles worldwide.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives