Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, PWR Holdings Limited (ASX:PWH) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for PWR Holdings

How Much Debt Does PWR Holdings Carry?

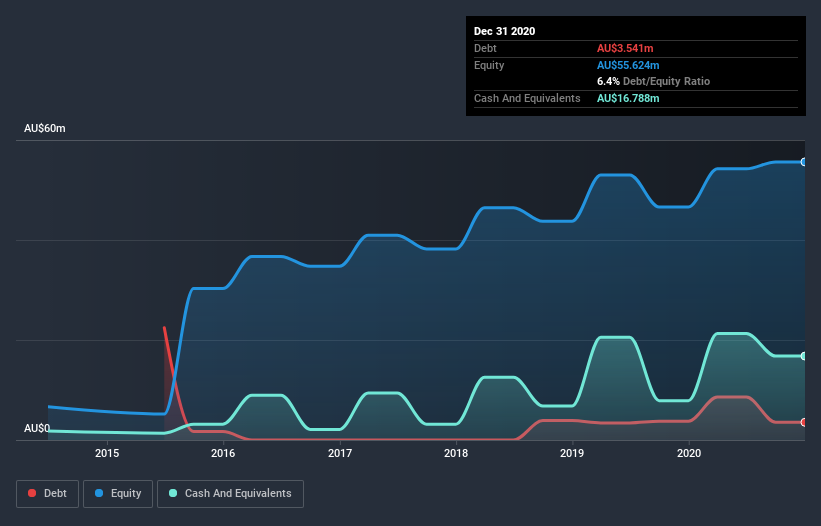

The image below, which you can click on for greater detail, shows that PWR Holdings had debt of AU$3.54m at the end of December 2020, a reduction from AU$3.75m over a year. But on the other hand it also has AU$16.8m in cash, leading to a AU$13.2m net cash position.

How Healthy Is PWR Holdings' Balance Sheet?

According to the last reported balance sheet, PWR Holdings had liabilities of AU$13.1m due within 12 months, and liabilities of AU$14.1m due beyond 12 months. On the other hand, it had cash of AU$16.8m and AU$7.04m worth of receivables due within a year. So it has liabilities totalling AU$3.32m more than its cash and near-term receivables, combined.

Having regard to PWR Holdings' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the AU$586.1m company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, PWR Holdings also has more cash than debt, so we're pretty confident it can manage its debt safely.

But the bad news is that PWR Holdings has seen its EBIT plunge 16% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine PWR Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While PWR Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, PWR Holdings produced sturdy free cash flow equating to 69% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

We could understand if investors are concerned about PWR Holdings's liabilities, but we can be reassured by the fact it has has net cash of AU$13.2m. The cherry on top was that in converted 69% of that EBIT to free cash flow, bringing in AU$16m. So we don't have any problem with PWR Holdings's use of debt. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of PWR Holdings's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade PWR Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:PWH

PWR Holdings

Engages in the design, prototyping, production, testing, validation, and sale of cooling products and solutions in Australia, the United States, the United Kingdom, Italy, Germany, France, Japan, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives