- Austria

- /

- Electric Utilities

- /

- WBAG:EVN

Industry Analysts Just Made A Notable Upgrade To Their EVN AG (VIE:EVN) Revenue Forecasts

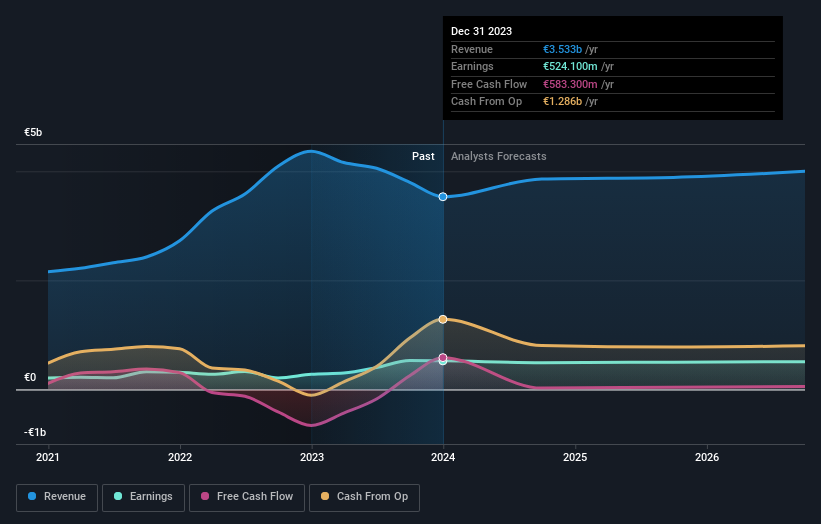

Celebrations may be in order for EVN AG (VIE:EVN) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline.

Following the upgrade, the current consensus from EVN's twin analysts is for revenues of €3.9b in 2024 which - if met - would reflect a decent 9.3% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of €3.5b in 2024. It looks like there's been a clear increase in optimism around EVN, given the substantial gain in revenue forecasts.

Check out our latest analysis for EVN

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that EVN's revenue growth is expected to slow, with the forecast 9.3% annualised growth rate until the end of 2024 being well below the historical 17% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 0.5% annually. So it's pretty clear that, while EVN's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for EVN this year. They're also forecasting more rapid revenue growth than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at EVN.

Need some more information? At least one of EVN's twin analysts has provided estimates out to 2026, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if EVN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:EVN

EVN

Provides energy and environmental services in Austria, Bulgaria, North Macedonia, Croatia, Germany, and Albania.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives