Are Österreichische Post's (VIE:POST) Statutory Earnings A Good Guide To Its Underlying Profitability?

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding Österreichische Post (VIE:POST).

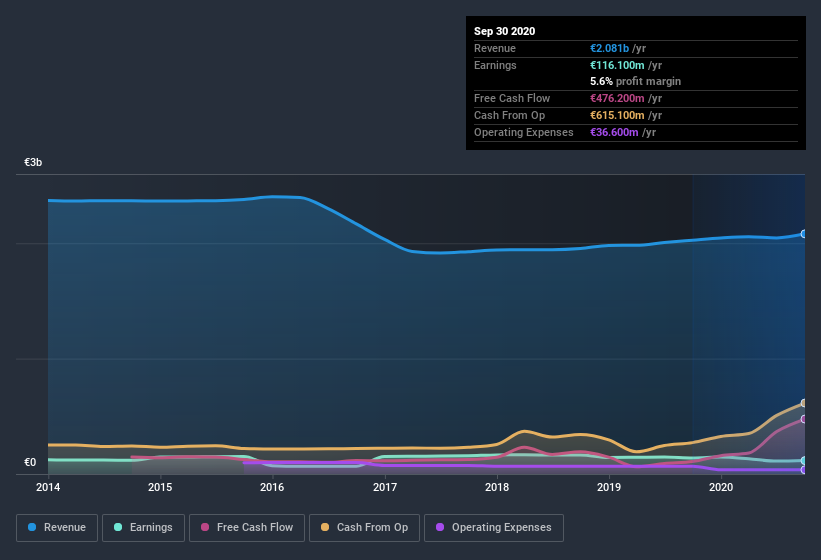

While Österreichische Post was able to generate revenue of €2.08b in the last twelve months, we think its profit result of €116.1m was more important. As you can see in the chart below, its profit has declined over the last three years, even though its revenue has increased.

Check out our latest analysis for Österreichische Post

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. So today we'll look at what Österreichische Post's cashflow and unusual items tell us about the quality of its earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Österreichische Post's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

For the year to September 2020, Österreichische Post had an accrual ratio of -0.96. Therefore, its statutory earnings were very significantly less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of €476m, well over the €116.1m it reported in profit. Österreichische Post shareholders are no doubt pleased that free cash flow improved over the last twelve months. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

The Impact Of Unusual Items On Profit

Surprisingly, given Österreichische Post's accrual ratio implied strong cash conversion, its paper profit was actually boosted by €18m in unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Österreichische Post's Profit Performance

Österreichische Post's profits got a boost from unusual items, which indicates they might not be sustained and yet its accrual ratio still indicated solid cash conversion, which is promising. Based on these factors, we think that Österreichische Post's profits are a reasonably conservative guide to its underlying profitability. If you'd like to know more about Österreichische Post as a business, it's important to be aware of any risks it's facing. You'd be interested to know, that we found 1 warning sign for Österreichische Post and you'll want to know about this.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Österreichische Post, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WBAG:POST

Österreichische Post

Provides postal and parcel services in Austria, Germany, Southeast and Eastern Europe, Türkiye, Azerbaijan, and internationally.

Undervalued with proven track record.