As European markets navigate the challenges of new U.S. trade tariffs and mixed economic signals, investors are keeping a close eye on dividend stocks that offer stability and income potential. In such uncertain times, stocks with strong dividend yields can provide a reliable income stream, making them an attractive option for those looking to balance risk with reward in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 5.00% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.66% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.50% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.91% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.29% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.96% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.96% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.53% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.21% | ★★★★★☆ |

Click here to see the full list of 242 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Ebro Foods (BME:EBRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ebro Foods, S.A. is a food company operating in Spain, the rest of Europe, the United States, Canada, and internationally with a market cap of €2.63 billion.

Operations: Ebro Foods generates its revenue primarily from its Rice Business, which accounts for €2.45 billion, and its Pasta Business, contributing €691.78 million.

Dividend Yield: 3.9%

Ebro Foods, S.A. offers a mixed dividend profile for investors. The company reported increased earnings with net income rising to €207.87 million for 2024, supporting its dividend payments through a reasonable payout ratio of 50.1%. However, despite trading at good value and analysts forecasting price growth, Ebro's dividends have been volatile over the past decade and yield is lower than top-tier Spanish market payers at 3.86%.

- Click to explore a detailed breakdown of our findings in Ebro Foods' dividend report.

- The analysis detailed in our Ebro Foods valuation report hints at an deflated share price compared to its estimated value.

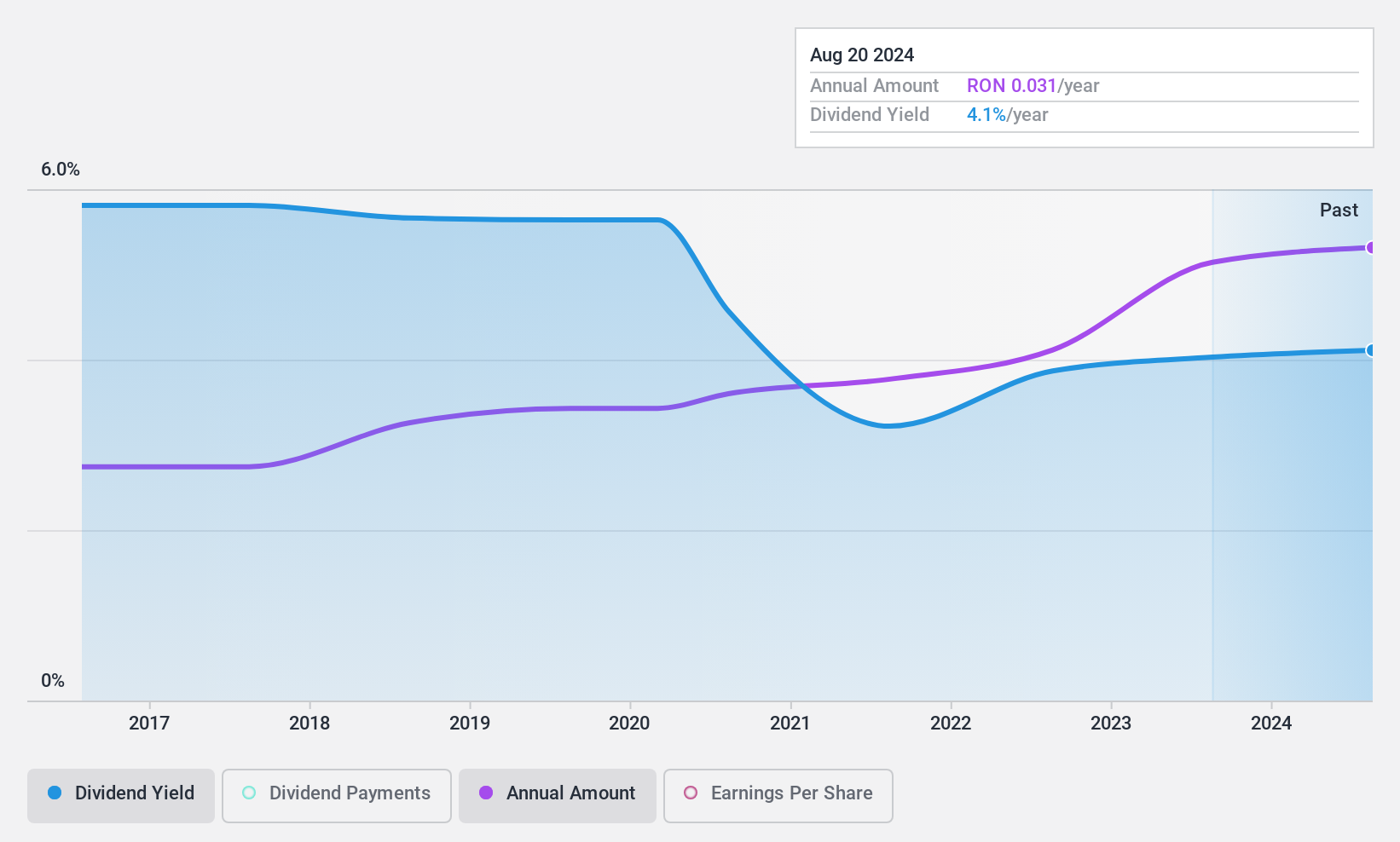

Biofarm (BVB:BIO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Biofarm S.A. is a Romanian company involved in the manufacture and sale of medicines, with a market capitalization of RON670.05 million.

Operations: Biofarm S.A. generates revenue primarily from its Pharmaceuticals segment, which accounts for RON286.77 million.

Dividend Yield: 4.6%

Biofarm's dividend profile shows stability and reliability, with dividends per share consistently growing over the past decade. However, a high cash payout ratio of 125.2% indicates dividends are not well covered by free cash flows, though a low payout ratio of 38% suggests earnings coverage is sufficient. The dividend yield of 4.56% is lower than top-tier Romanian market payers. Recent affirmations announced an annual dividend of RON 0.0310 per share for September 2025 payment.

- Click here and access our complete dividend analysis report to understand the dynamics of Biofarm.

- The analysis detailed in our Biofarm valuation report hints at an inflated share price compared to its estimated value.

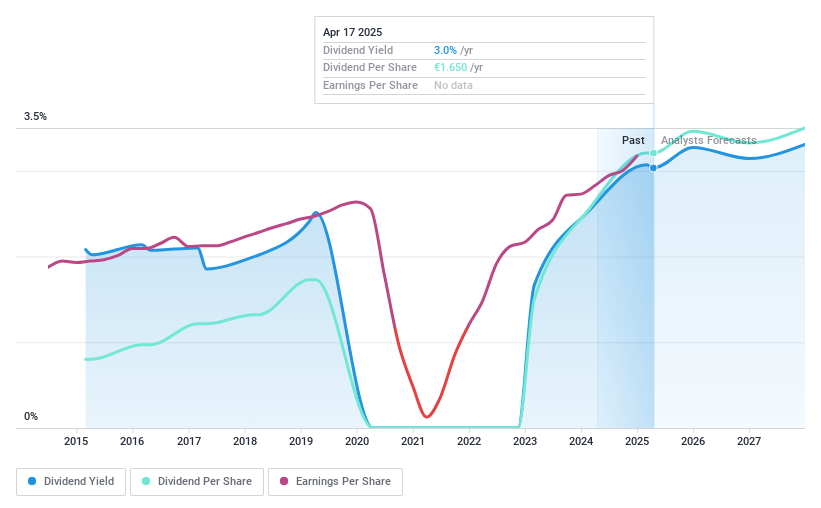

Flughafen Wien (WBAG:FLU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Flughafen Wien Aktiengesellschaft, with a market cap of €4.58 billion, operates and constructs civil airports and related facilities in Austria and Malta through its subsidiaries.

Operations: Flughafen Wien's revenue is derived from several segments, including €142.90 million from Malta operations, €506.60 million from its Airport segment, €203 million from Retail & Properties, and €177.80 million from Handling & Security Services.

Dividend Yield: 3%

Flughafen Wien's dividend profile is mixed, with a payout ratio of 64% and cash payout ratio of 54.5%, indicating dividends are well covered by earnings and cash flows. However, the dividend yield of 3.02% is below Austria's top-tier payers, and past payments have been volatile despite recent increases to EUR 1.65 per share for June 2025. Earnings grew significantly last year but the company's dividend history lacks stability over the decade.

- Unlock comprehensive insights into our analysis of Flughafen Wien stock in this dividend report.

- Our expertly prepared valuation report Flughafen Wien implies its share price may be too high.

Turning Ideas Into Actions

- Unlock our comprehensive list of 242 Top European Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ebro Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:EBRO

Ebro Foods

Operates as a food company in Spain, rest of Europe, the United States, Canada, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives