- Austria

- /

- Telecom Services and Carriers

- /

- WBAG:TKA

Investors Don't See Light At End Of Telekom Austria AG's (VIE:TKA) Tunnel

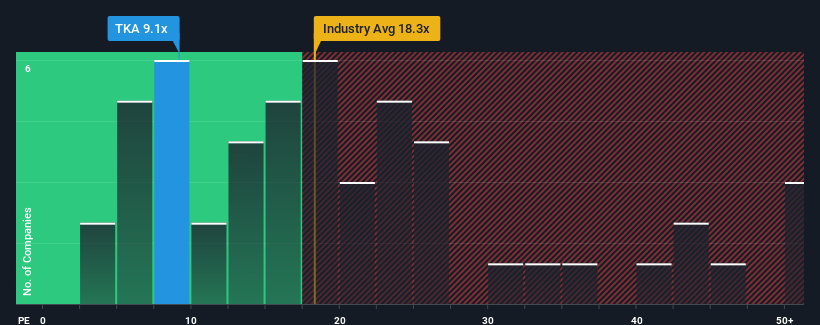

When close to half the companies in Austria have price-to-earnings ratios (or "P/E's") above 12x, you may consider Telekom Austria AG (VIE:TKA) as an attractive investment with its 9.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Telekom Austria could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Telekom Austria

Is There Any Growth For Telekom Austria?

The only time you'd be truly comfortable seeing a P/E as low as Telekom Austria's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 1.7% decrease to the company's bottom line. Even so, admirably EPS has lifted 54% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 11% per annum over the next three years. With the market predicted to deliver 13% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Telekom Austria's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Telekom Austria's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Telekom Austria's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Telekom Austria with six simple checks on some of these key factors.

You might be able to find a better investment than Telekom Austria. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Telekom Austria, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Telekom Austria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:TKA

Telekom Austria

Provides fixed-line and mobile communications solutions to individuals, commercial and non-commercial organizations, and other national and foreign carriers in Austria, Belarus, Bulgaria, Croatia, North Macedonia, Serbia, and Slovenia.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives