It's A Story Of Risk Vs Reward With AT & S Austria Technologie & Systemtechnik Aktiengesellschaft (VIE:ATS)

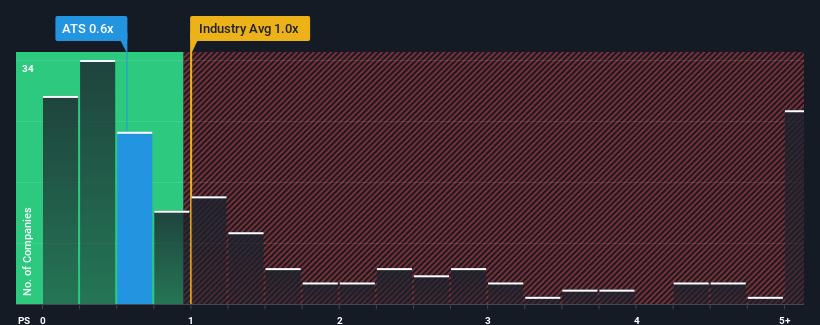

With a median price-to-sales (or "P/S") ratio of close to 1x in the Electronic industry in Austria, you could be forgiven for feeling indifferent about AT & S Austria Technologie & Systemtechnik Aktiengesellschaft's (VIE:ATS) P/S ratio of 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for AT & S Austria Technologie & Systemtechnik

How Has AT & S Austria Technologie & Systemtechnik Performed Recently?

While the industry has experienced revenue growth lately, AT & S Austria Technologie & Systemtechnik's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AT & S Austria Technologie & Systemtechnik.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AT & S Austria Technologie & Systemtechnik's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 30% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 27% per year over the next three years. That's shaping up to be materially higher than the 9.7% each year growth forecast for the broader industry.

In light of this, it's curious that AT & S Austria Technologie & Systemtechnik's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On AT & S Austria Technologie & Systemtechnik's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, AT & S Austria Technologie & Systemtechnik's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for AT & S Austria Technologie & Systemtechnik that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:ATS

AT & S Austria Technologie & Systemtechnik

Manufactures, distributes, and sells printed circuit boards in Austria, Germany, rest of Europe, China, rest of Asia, and the Americas.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026