Lenzing (VIE:LNZ shareholders incur further losses as stock declines 7.7% this week, taking three-year losses to 66%

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of Lenzing Aktiengesellschaft (VIE:LNZ) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 72% drop in the share price over that period. And over the last year the share price fell 51%, so we doubt many shareholders are delighted. And the share price decline continued over the last week, dropping some 7.7%.

After losing 7.7% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Lenzing

Lenzing isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

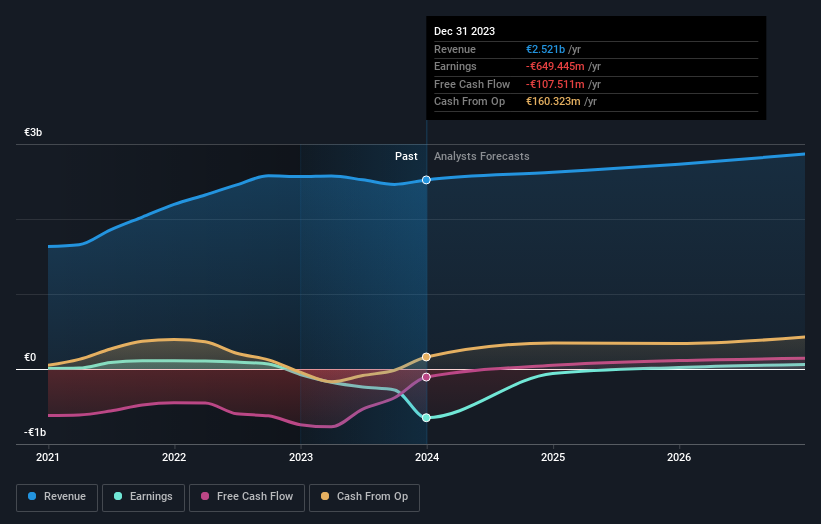

In the last three years, Lenzing saw its revenue grow by 14% per year, compound. That's a fairly respectable growth rate. So it seems unlikely the 20% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Lenzing's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Lenzing's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Lenzing hasn't been paying dividends, but its TSR of -66% exceeds its share price return of -72%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in Lenzing had a tough year, with a total loss of 44%, against a market gain of about 9.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Lenzing you should be aware of, and 2 of them are a bit unpleasant.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Austrian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:LNZ

Lenzing

Produces and markets regenerated cellulosic fibers for textiles and nonwovens.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives