- Austria

- /

- Metals and Mining

- /

- WBAG:AMAG

Forecast: Analysts Think AMAG Austria Metall AG's (VIE:AMAG) Business Prospects Have Improved Drastically

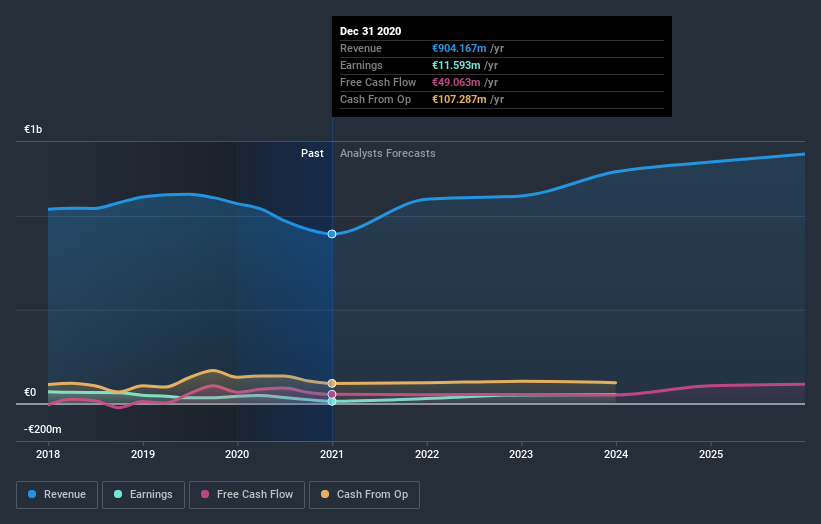

AMAG Austria Metall AG (VIE:AMAG) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance.

After this upgrade, AMAG Austria Metall's three analysts are now forecasting revenues of €1.1b in 2021. This would be a sizeable 20% improvement in sales compared to the last 12 months. Per-share earnings are expected to leap 127% to €0.75. Prior to this update, the analysts had been forecasting revenues of €973m and earnings per share (EPS) of €0.61 in 2021. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

See our latest analysis for AMAG Austria Metall

It will come as no surprise to learn that the analysts have increased their price target for AMAG Austria Metall 8.8% to €33.00 on the back of these upgrades. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic AMAG Austria Metall analyst has a price target of €34.50 per share, while the most pessimistic values it at €31.50. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting AMAG Austria Metall is an easy business to forecast or the underlying assumptions are obvious.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting AMAG Austria Metall's growth to accelerate, with the forecast 20% annualised growth to the end of 2021 ranking favourably alongside historical growth of 2.3% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 2.9% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect AMAG Austria Metall to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at AMAG Austria Metall.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 3 potential flags with AMAG Austria Metall, including its declining profit margins. You can learn more, and discover the 2 other flags we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade AMAG Austria Metall, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WBAG:AMAG

AMAG Austria Metall

Engages in the production, processing, and sale of aluminum, aluminum semi-finished, and cast products in Austria, Europe, North America, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives