Does Ottakringer Getränke's (VIE:OTS) Returns On Capital Reflect Well On The Business?

When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. Trends like this ultimately mean the business is reducing its investments and also earning less on what it has invested. So after glancing at the trends within Ottakringer Getränke (VIE:OTS), we weren't too hopeful.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Ottakringer Getränke:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.018 = €2.1m ÷ (€221m - €105m) (Based on the trailing twelve months to June 2020).

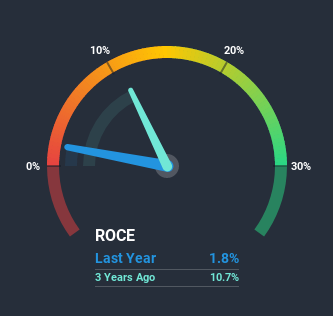

So, Ottakringer Getränke has an ROCE of 1.8%. In absolute terms, that's a low return and it also under-performs the Beverage industry average of 9.0%.

Check out our latest analysis for Ottakringer Getränke

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Ottakringer Getränke's past further, check out this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

We are a bit worried about the trend of returns on capital at Ottakringer Getränke. About five years ago, returns on capital were 6.4%, however they're now substantially lower than that as we saw above. Meanwhile, capital employed in the business has stayed roughly the flat over the period. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect Ottakringer Getränke to turn into a multi-bagger.

On a side note, Ottakringer Getränke's current liabilities have increased over the last five years to 47% of total assets, effectively distorting the ROCE to some degree. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

The Key Takeaway

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Yet despite these concerning fundamentals, the stock has performed strongly with a 50% return over the last five years, so investors appear very optimistic. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

Ottakringer Getränke does come with some risks though, we found 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant...

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

When trading Ottakringer Getränke or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WBAG:OTS

Ottakringer Getränke

Ottakringer Getränke AG engages in the production and bottling of beer, mineral water, and other non-alcoholic beverages in Austria.

Weak fundamentals or lack of information.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.