- Austria

- /

- Energy Services

- /

- WBAG:SBO

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious earnings reports and mixed economic signals, investors are seeking stability amid volatility. With major indices like the S&P 500 and Nasdaq Composite experiencing fluctuations, dividend stocks offer a compelling option for those looking to balance risk with steady income potential. In such an environment, selecting dividend stocks involves considering factors such as consistent payout histories and the ability to weather economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.82% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.16% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

Click here to see the full list of 1991 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Nippon Fine Chemical (TSE:4362)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Fine Chemical Co., Ltd. and its subsidiaries manufacture and sell fine chemical, cosmetic, and industrial chemical products both in Japan and internationally, with a market capitalization of ¥54.36 billion.

Operations: Nippon Fine Chemical Co., Ltd. generates revenue from its Functional Products segment, amounting to ¥27.65 billion, and its Environmental Hygiene Product segment, totaling ¥7.07 billion.

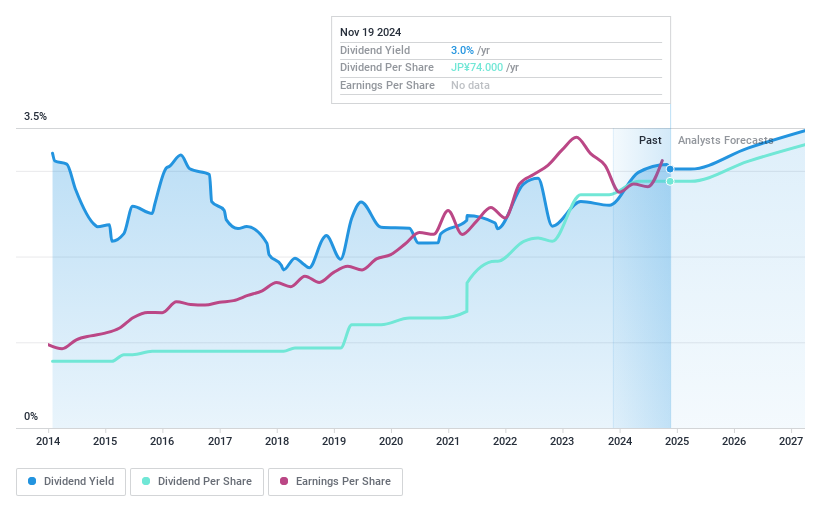

Dividend Yield: 3.1%

Nippon Fine Chemical offers a stable dividend profile with consistent growth over the past decade and a reliable 3.06% yield, though it's lower than the top 25% in Japan. The dividends are well-covered by earnings, with a low payout ratio of 21.8%, and cash flows, maintaining sustainability at a cash payout ratio of 49.2%. Trading significantly below its estimated fair value suggests potential for capital appreciation alongside dividend income.

- Dive into the specifics of Nippon Fine Chemical here with our thorough dividend report.

- Our expertly prepared valuation report Nippon Fine Chemical implies its share price may be too high.

Komatsu (TSE:6301)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Komatsu Ltd. is a global manufacturer and seller of construction, mining, and utility equipment with operations spanning Japan, the Americas, Europe, China, Asia, Oceania, the Middle East, Africa, and CIS countries; it has a market cap of ¥3.89 trillion.

Operations: Komatsu Ltd.'s revenue is primarily derived from its Construction Machinery/Vehicles segment, which accounts for ¥3.74 trillion, and its Industrial Machinery Others segment, contributing ¥207.34 billion, along with Retail Finance at ¥117.84 billion.

Dividend Yield: 4%

Komatsu has announced an interim dividend increase to JPY 83 per share, up from JPY 72. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 42.9% and 59.6%, respectively, despite a historically unstable dividend track record. Trading at a significant discount to its estimated fair value suggests potential for capital appreciation. Recent buybacks further enhance shareholder value, although past volatility in dividends may concern some investors seeking stability.

- Navigate through the intricacies of Komatsu with our comprehensive dividend report here.

- Our valuation report unveils the possibility Komatsu's shares may be trading at a discount.

Schoeller-Bleckmann Oilfield Equipment (WBAG:SBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Schoeller-Bleckmann Oilfield Equipment Aktiengesellschaft manufactures and sells steel products globally, with a market capitalization of €447.57 million.

Operations: Schoeller-Bleckmann Oilfield Equipment's revenue is primarily derived from its Oilfield Equipment segment, generating €292.20 million, and its Advanced Manufacturing & Services segment, contributing €447.52 million.

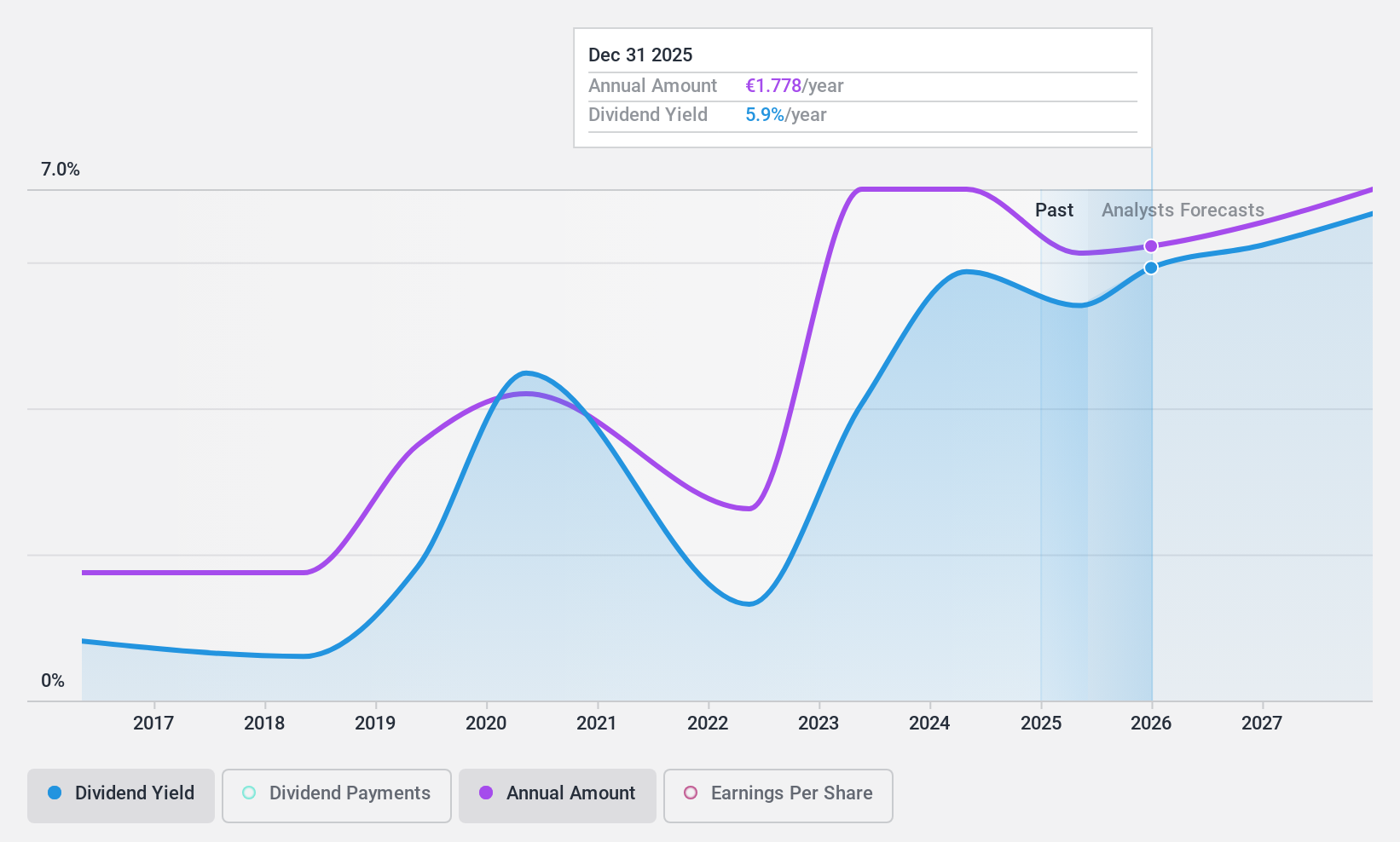

Dividend Yield: 6.8%

Schoeller-Bleckmann Oilfield Equipment's dividend yield ranks in the top 25% of Austrian payers, supported by a sustainable payout ratio of 58.9% and cash flow coverage at 64.7%. Despite a history of volatility, dividends have grown over the past decade. The stock trades significantly below fair value estimates, suggesting potential upside. However, recent earnings have declined with net income dropping to €10.01 million from €21.84 million year-on-year, highlighting challenges in maintaining profitability amidst market fluctuations.

- Unlock comprehensive insights into our analysis of Schoeller-Bleckmann Oilfield Equipment stock in this dividend report.

- Our expertly prepared valuation report Schoeller-Bleckmann Oilfield Equipment implies its share price may be lower than expected.

Summing It All Up

- Access the full spectrum of 1991 Top Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:SBO

Schoeller-Bleckmann Oilfield Equipment

Manufactures and sells steel products worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives