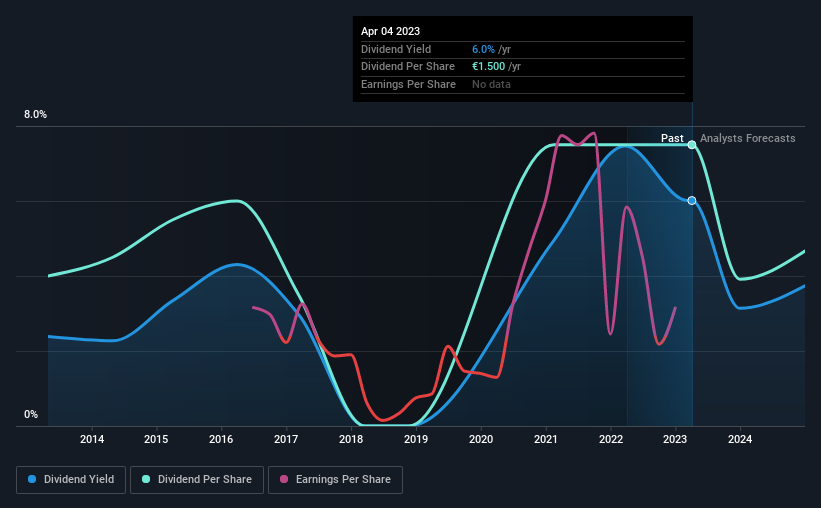

Semperit Aktiengesellschaft Holding's (VIE:SEM) investors are due to receive a payment of €1.50 per share on 3rd of May. This means the annual payment is 6.0% of the current stock price, which is above the average for the industry.

View our latest analysis for Semperit Holding

Semperit Holding's Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, Semperit Holding was paying out a fairly large proportion of earnings, and it wasn't generating positive free cash flows either. We think that this practice can make the dividend quite risky in the future.

EPS is set to fall by 7.0% over the next 12 months. However, if the dividend continues along recent trends, we estimate the payout ratio could reach 95%, meaning that most of the company's earnings are being paid out to shareholders.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2013, the annual payment back then was €0.80, compared to the most recent full-year payment of €1.50. This implies that the company grew its distributions at a yearly rate of about 6.5% over that duration. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Semperit Holding's Dividend Might Lack Growth

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. We are encouraged to see that Semperit Holding has grown earnings per share at 51% per year over the past five years. Earnings per share is growing nicely, but the company is paying out most of its earnings as dividends. This might be sustainable, but we wonder why Semperit Holding is not retaining those earnings to reinvest in growth.

Semperit Holding's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 3 warning signs for Semperit Holding you should be aware of, and 1 of them is potentially serious. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:SEM

Semperit Holding

Develops, produces, and sells rubber products for the medical and industrial sectors worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026