What Did Rosenbauer International's (VIE:ROS) CEO Take Home Last Year?

Dieter Siegel has been the CEO of Rosenbauer International AG (VIE:ROS) since 2011, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Rosenbauer International

How Does Total Compensation For Dieter Siegel Compare With Other Companies In The Industry?

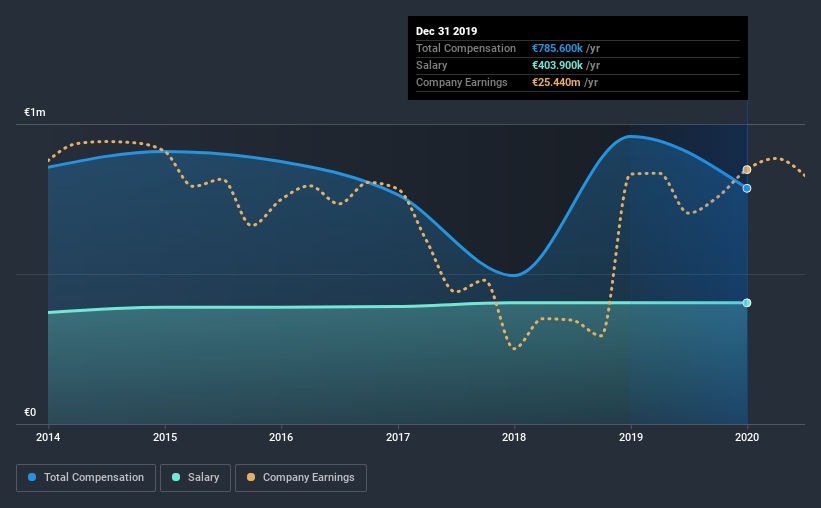

According to our data, Rosenbauer International AG has a market capitalization of €220m, and paid its CEO total annual compensation worth €786k over the year to December 2019. We note that's a decrease of 18% compared to last year. In particular, the salary of €403.9k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from €85m to €339m, we found that the median CEO total compensation was €661k. So it looks like Rosenbauer International compensates Dieter Siegel in line with the median for the industry.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €404k | €404k | 51% |

| Other | €382k | €555k | 49% |

| Total Compensation | €786k | €959k | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. Rosenbauer International is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Rosenbauer International AG's Growth

Rosenbauer International AG's earnings per share (EPS) grew 23% per year over the last three years. In the last year, its revenue is up 9.8%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Rosenbauer International AG Been A Good Investment?

With a three year total loss of 39% for the shareholders, Rosenbauer International AG would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As previously discussed, Dieter is compensated close to the median for companies of its size, and which belong to the same industry. At the same time, the company has logged negative shareholder returns over the last three years. However, EPS growth is positive over the same time frame. Overall, we wouldn't say Dieter is paid an unjustified compensation, but shareholders might not favor a raise before shareholder returns show a positive trend.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for Rosenbauer International (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Important note: Rosenbauer International is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Rosenbauer International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WBAG:ROS

Rosenbauer International

Engages in the production and sale of systems for firefighting and disaster protection worldwide.

Reasonable growth potential with questionable track record.