- Austria

- /

- Construction

- /

- WBAG:POS

3 Dividend Stocks To Consider With Yields Up To 5.8%

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and positive sentiment driven by strong labor market data, investors are increasingly looking for stable income opportunities amid economic uncertainties. In this environment, dividend stocks can offer a reliable income stream, making them an attractive option for those seeking to balance growth potential with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.51% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

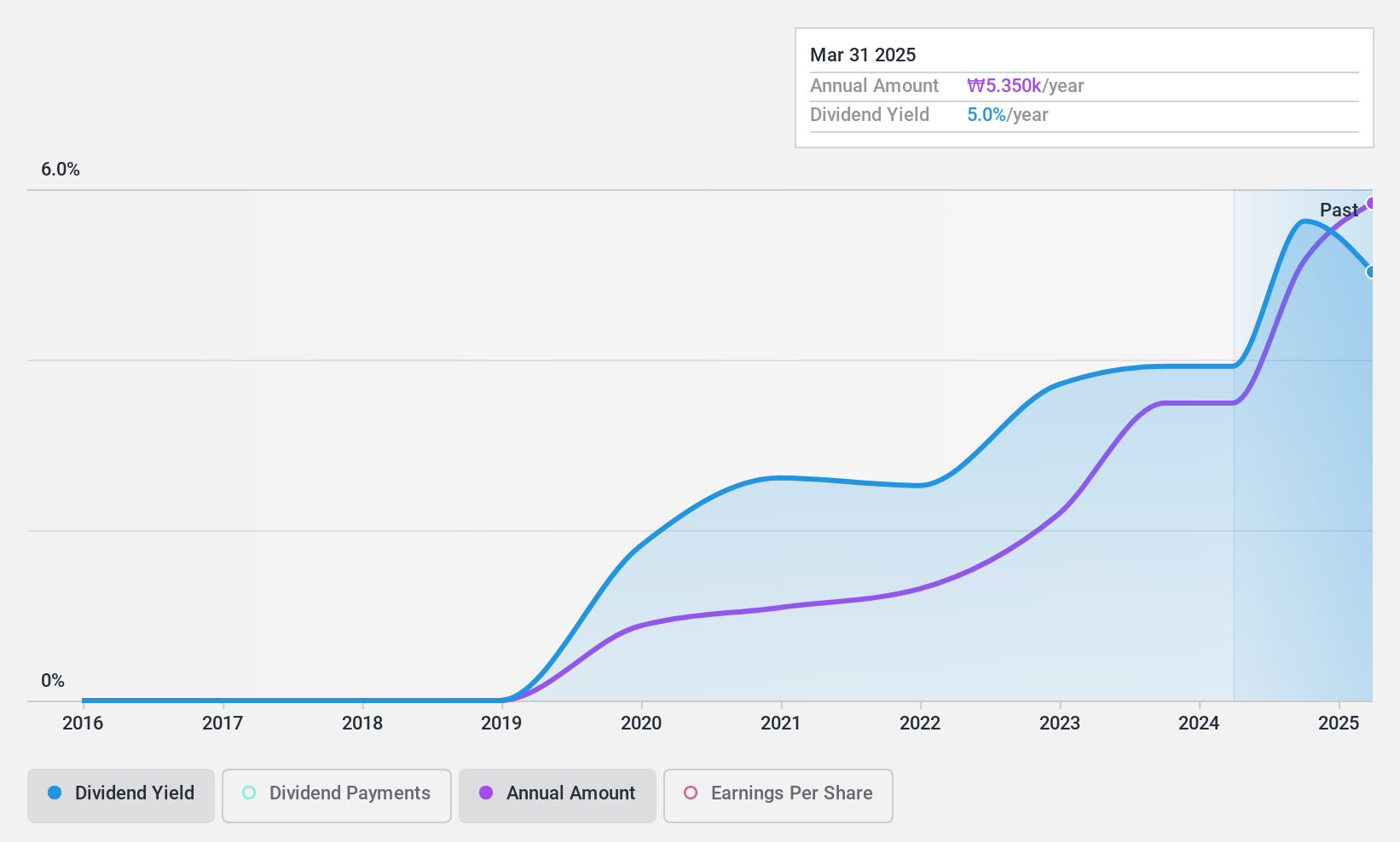

Youngone Holdings (KOSE:A009970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Youngone Holdings Co., Ltd. is a South Korean company that manufactures and sells apparel, footwear, gear, sportswear, and jackets both domestically and internationally, with a market cap of approximately ₩971.33 billion.

Operations: Youngone Holdings Co., Ltd. generates revenue through the production and sale of apparel, footwear, gear, sportswear, and jackets across domestic and international markets.

Dividend Yield: 5.7%

Youngone Holdings' dividend payments are well-supported by both earnings and cash flows, with a low payout ratio of 13.6%. Its dividend yield is in the top 25% of the KR market, though it has only been paying dividends for five years. The company recently established a joint venture with Goldwin Inc., which may impact future financials and dividend potential. Despite its short history, Youngone's dividends have been stable and growing consistently.

- Get an in-depth perspective on Youngone Holdings' performance by reading our dividend report here.

- The analysis detailed in our Youngone Holdings valuation report hints at an deflated share price compared to its estimated value.

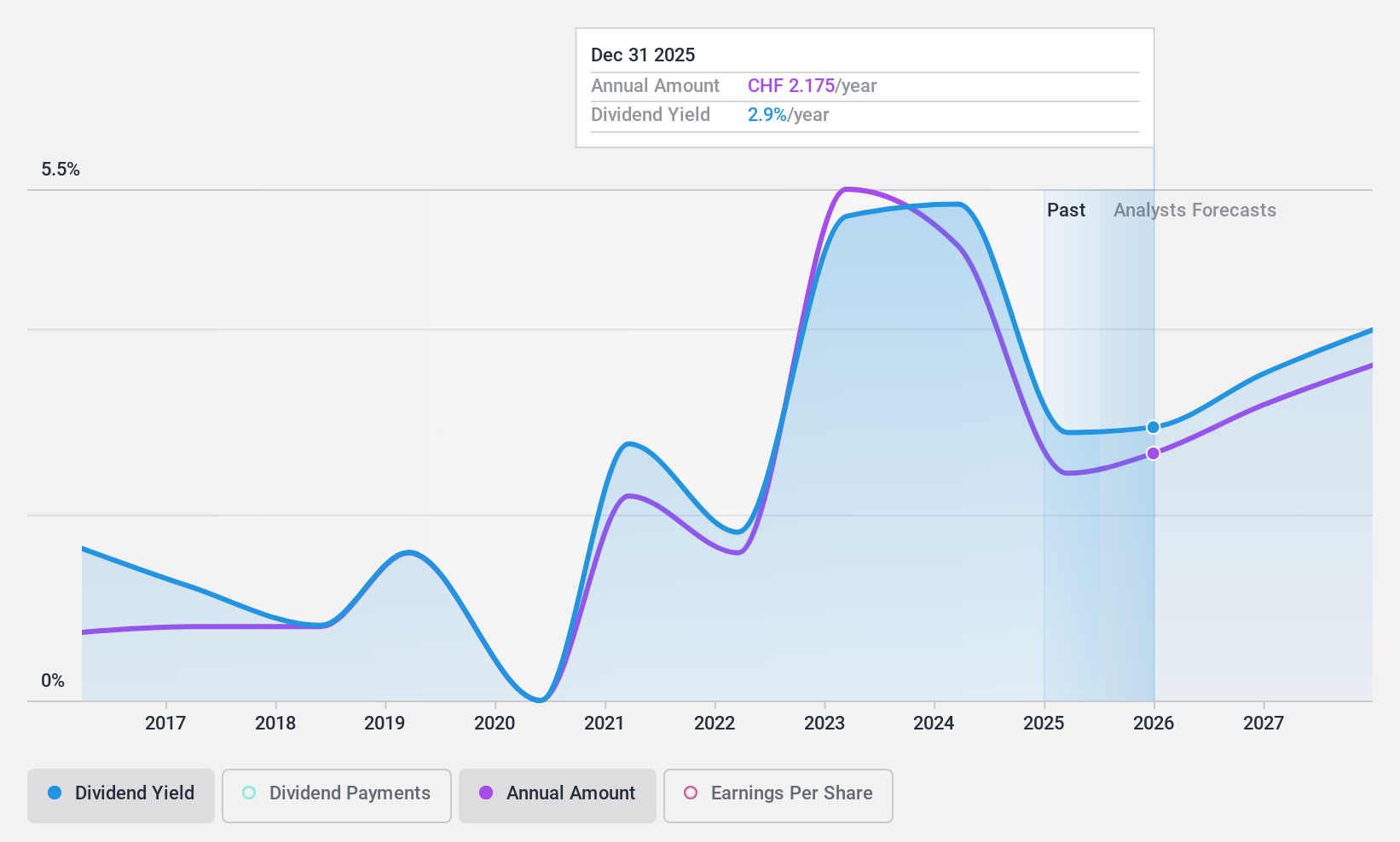

CPH Group (SWX:CPHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CPH Group AG operates in the manufacture and sale of chemicals and packaging films across Switzerland, Europe, the Americas, Asia, and internationally, with a market cap of CHF410.07 million.

Operations: CPH Group AG's revenue is primarily derived from its Chemistry segment at CHF128.62 million, Packaging segment at CHF219.70 million, and the Spun-off divisions (Paper) contributing CHF245.37 million.

Dividend Yield: 5.8%

CPH Group offers a dividend yield of 5.85%, placing it in the top 25% of Swiss market payers. However, its dividends have been volatile over the past decade, with payments not fully covered by earnings due to a high payout ratio of 249.1%. Although profit margins have significantly decreased from last year, dividends are well-covered by cash flows given a low cash payout ratio of 47%. Overall dividend reliability remains questionable.

- Unlock comprehensive insights into our analysis of CPH Group stock in this dividend report.

- Our comprehensive valuation report raises the possibility that CPH Group is priced higher than what may be justified by its financials.

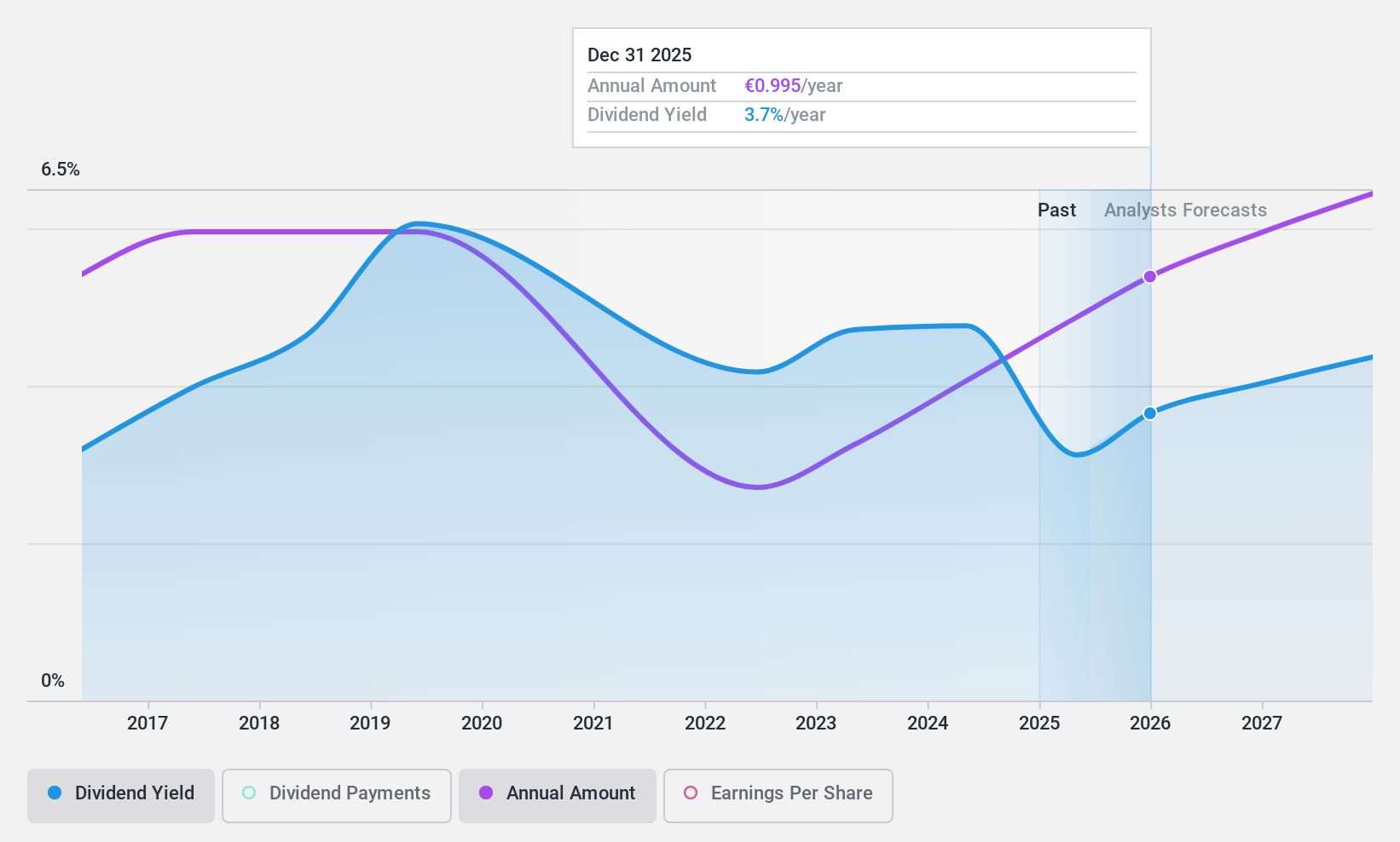

PORR (WBAG:POS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PORR AG is a construction company operating in Austria, Germany, Poland, the Czech Republic, Qatar, Italy, Romania, Bulgaria, Switzerland, Serbia, Great Britain, Slovakia, Norway, Croatia, Belgium and internationally with a market cap of €602.47 million.

Operations: PORR AG generates its revenue primarily from Austria and Switzerland (€3.07 billion), followed by Poland (€1.02 billion), Germany (€962.46 million), and its Infrastructure International segment (€425.83 million).

Dividend Yield: 4.8%

PORR AG's dividend yield is relatively low at 4.76% compared to the top Austrian payers. The company's dividends have been volatile over the past decade, although payments have increased in that period. Despite this volatility, dividends are well-covered by earnings and cash flows with payout ratios of 32% and 45.9%, respectively. Recent earnings showed stable sales growth but slight declines in net income, reflecting some financial stability despite large one-off items impacting results.

- Click here and access our complete dividend analysis report to understand the dynamics of PORR.

- According our valuation report, there's an indication that PORR's share price might be on the cheaper side.

Next Steps

- Get an in-depth perspective on all 1954 Top Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:POS

PORR

Operates as a construction company in Austria, Germany, Poland, the Czech Republic, Qatar, Italy, Romania, Bulgaria, Switzerland, Serbia, Great Britain, Slovakia, Norway, Croatia, Belgium, and internationally.

Adequate balance sheet average dividend payer.