Only 2 Days Left Until Palfinger AG (VIE:PAL) Trades Ex-Dividend

Attention dividend hunters! Palfinger AG (VIE:PAL) will be distributing its dividend of €0.51 per share on the 26 March 2019, and will start trading ex-dividend in 2 days time on the 22 March 2019. Investors looking for higher income-generating stocks to add to their portfolio should keep reading, as I examine Palfinger's latest financial data to analyse its dividend characteristics.

View our latest analysis for Palfinger

5 questions to ask before buying a dividend stock

Whenever I am looking at a potential dividend stock investment, I always check these five metrics:

- Is it the top 25% annual dividend yield payer?

- Has it consistently paid a stable dividend without missing a payment or drastically cutting payout?

- Has dividend per share risen in the past couple of years?

- Is is able to pay the current rate of dividends from its earnings?

- Will the company be able to keep paying dividend based on the future earnings growth?

How does Palfinger fare?

The current trailing twelve-month payout ratio for the stock is 33%, which means that the dividend is covered by earnings. Going forward, analysts expect PAL's payout to remain around the same level at 33% of its earnings. Assuming a constant share price, this equates to a dividend yield of around 3.0%. Furthermore, EPS should increase to €2.14.

When assessing the forecast sustainability of a dividend it is also worth considering the cash flow of the business. Cash flow is important because companies with strong cash flow can usually sustain higher payout ratios.

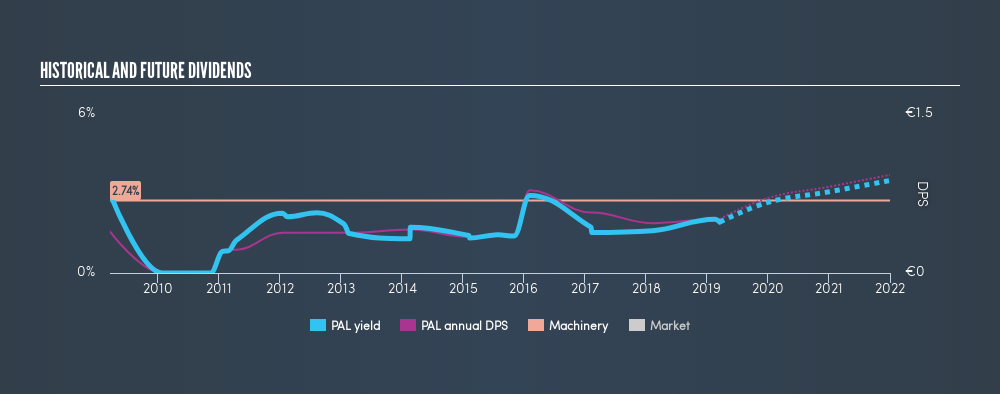

If there's one type of stock you want to be reliable, it's dividend stocks and their stable income-generating ability. Although PAL's per share payments have increased in the past 10 years, it has not been a completely smooth ride. Investors have seen reductions in the dividend per share in the past, although, it has picked up again.

Relative to peers, Palfinger produces a yield of 1.9%, which is on the low-side for Machinery stocks.

Next Steps:

Keeping in mind the dividend characteristics above, Palfinger is definitely worth considering for investors looking to build a dedicated income portfolio. Given that this is purely a dividend analysis, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment. Below, I've compiled three fundamental factors you should look at:

- Future Outlook: What are well-informed industry analysts predicting for PAL’s future growth? Take a look at our free research report of analyst consensus for PAL’s outlook.

- Valuation: What is PAL worth today? Even if the stock is a cash cow, it's not worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether PAL is currently mispriced by the market.

- Other Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WBAG:PAL

Palfinger

Produces and sells crane and lifting solutions in Austria and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives