Raiffeisen Bank International (WBAG:RBI): €997m One-Off Loss Sparks New Margin Concerns

Reviewed by Simply Wall St

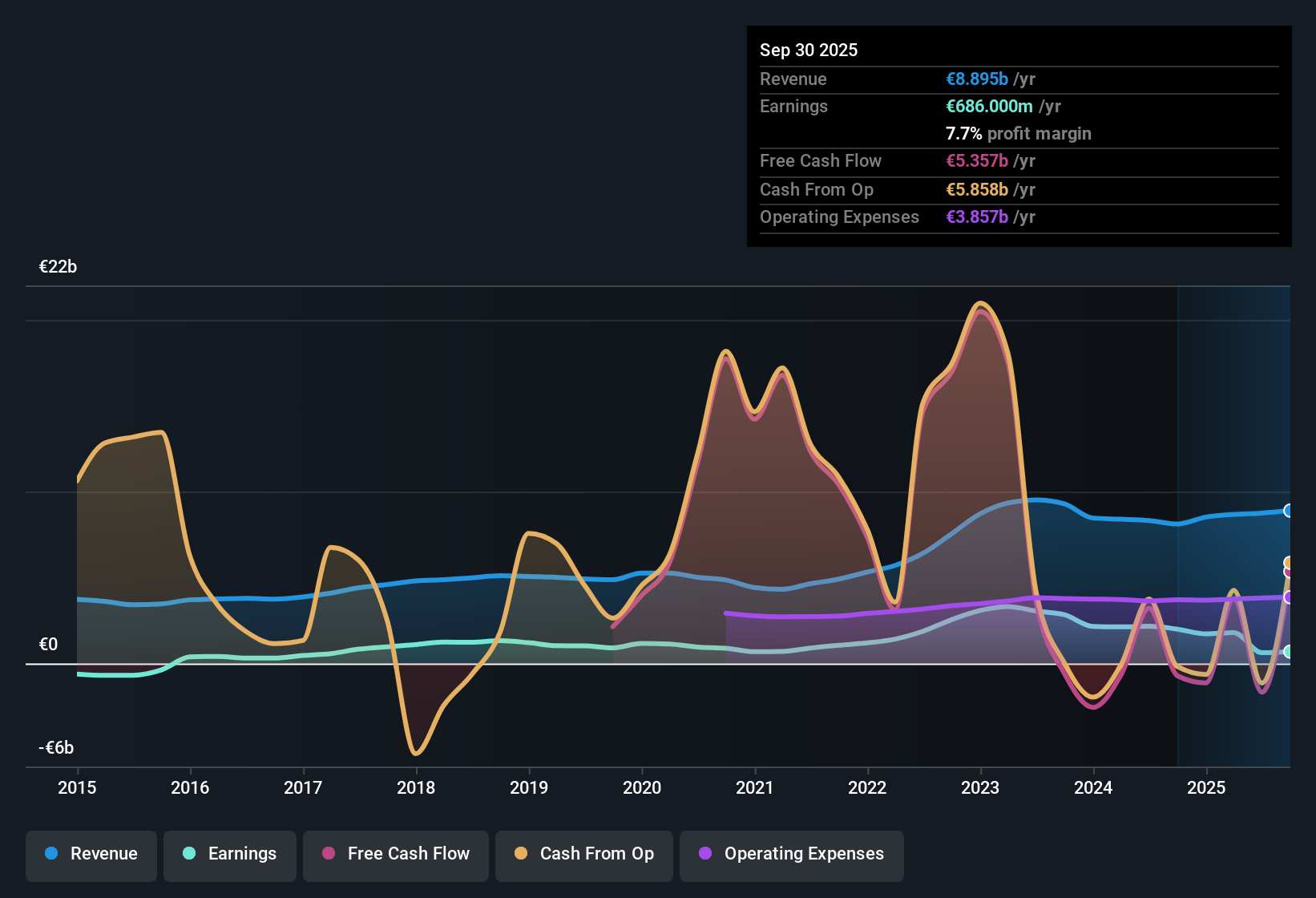

Raiffeisen Bank International (WBAG:RBI) delivered annual earnings that are forecast to grow at 18.28% per year, well ahead of the Austrian market's 8.8% projection. Over the past five years, the bank grew earnings at 8.1% annually. However, this past year saw negative earnings growth and a drop in net profit margins to 8.2% from 24.9%, largely due to a one-off loss of €997.0 million. At a share price of €32.34, the stock is trading below some fair value estimates even as the price-to-earnings ratio stands elevated versus the broader sector. Margin pressure is now competing against strong forward earnings forecasts.

See our full analysis for Raiffeisen Bank International.Now, let’s see how these results stack up against the major narratives that have shaped expectations for Raiffeisen and where they might upend the conversation.

See what the community is saying about Raiffeisen Bank International

Profit Margin Recovery Projected Ahead

- Consensus estimates expect profit margins to rebound from 7.1% today to 22.4% in the next three years, despite last year's steep drop linked to a €997.0 million one-off loss.

- Analysts' consensus view notes that while the sharp margin contraction challenged short-term performance, projected improvements hinge on operational efficiency and digitalization. The goal is to restore margins to near historical levels.

- Cost-to-income ratio currently exceeds 53%, and consensus expects that successfully reducing it will be a key enabler for margin recovery.

- Persistent litigation costs and macroeconomic volatility in core markets pose notable risks to realizing these margin improvements. Recent regulatory and geopolitical pressures have also been highlighted as challenges.

Revenue Outlook Turns Cautious Despite Growth Drivers

- Analyst models forecast that revenues will decline by 4.4% per year for the next three years, even as strong loan and fee growth continues in Central and Eastern Europe.

- Analysts' consensus view emphasizes that underlying momentum in loan and deposit growth, especially digital-driven fee income, is at odds with top-line pressure. This suggests new business lines may struggle to fully offset headwinds.

- The bank’s strategy to expand scalable digital products has produced a rebound in fee income, yet this has not been enough to reverse the anticipated overall revenue decline.

- Exposure to region-specific risks and ongoing litigation costs continues to weigh on investor confidence in revenue durability and group profitability.

Valuation Caught Between Discount and Premium

- At €32.34 per share, Raiffeisen trades below its DCF fair value estimate of €80.62. With a price-to-earnings ratio of 14.6x, it commands a clear premium over the European banks sector average of 9.9x and peer average of 12.9x.

- Analysts' consensus view highlights that even with a discounted share price relative to intrinsic value models, elevated multiples and uncertain revenue growth keep the stock’s risk/reward profile finely balanced.

- The consensus analyst price target of €29.95 is still below the current price, signaling expectations of only modest near-term upside.

- Forecasted earnings growth and narrowing shares outstanding provide some upside case. However, the valuation gap persists until fundamentals catch up or market sentiment shifts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Raiffeisen Bank International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a different take on the figures? In just a few minutes, you can shape your own story with the latest data. Do it your way

A great starting point for your Raiffeisen Bank International research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

See What Else Is Out There

Raiffeisen’s falling profit margins, subdued revenue outlook, and valuation uncertainty highlight just how tough it can be to find consistent, predictable performance in this sector.

If you’re seeking companies that deliver stable earnings and resilient top-line growth in all market conditions, discover stable growth stocks screener (2103 results) that sidestep these challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:RBI

Raiffeisen Bank International

Offers banking services to corporate, private, and institutional customers.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives