BAWAG Group (WBAG:BG): Margin Decline Raises Questions on Growth Narrative After Years of Strong Profits

Reviewed by Simply Wall St

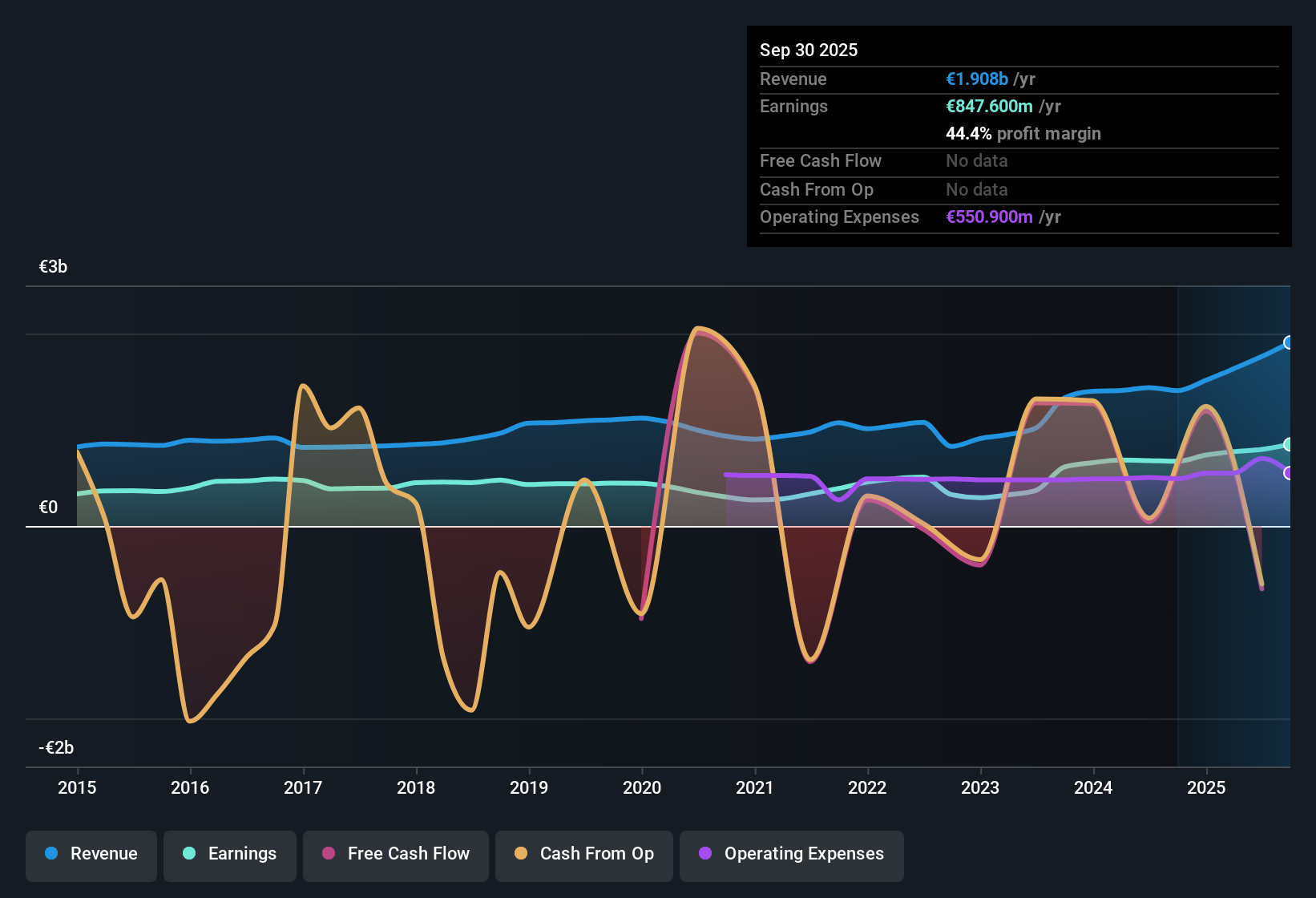

BAWAG Group (WBAG:BG) reported revenue growth of 2.3% per year, trailing the Austrian market's expected 3.1% annual growth. Earnings are forecast to increase 6.7% annually, which remains below the broader market's 11.2% pace. Current profit margins slipped to 45.2% from 47.3% last year. The most recent year's earnings growth of 17% also falls short of BAWAG Group's five-year annual average of 21.9%. These factors give investors plenty to weigh as they assess the bank's performance, with the share price now sitting below some analyst fair value estimates.

See our full analysis for BAWAG Group.Next, we compare these latest numbers to the most popular narratives for BAWAG Group and see where the data supports or contradicts market expectations.

See what the community is saying about BAWAG Group

Integration Moves to Unlock Efficiency Gains

- With ongoing integration of Knab and Barclays Consumer Bank Europe expected to finish by year end, management highlights the potential for operational synergies and further cost efficiencies to feed through to net margins.

- Analysts' consensus view emphasizes that lowering BAWAG's cost/income ratio through disciplined digital transformation, as well as completing these integrations, is pivotal for margin resilience. However, analysts warn that margin guidance for the next three years projects contraction from 45.2% to 43.4% despite these efforts.

- Consensus narrative points to digital adoption and efficiency gains, but the data indicates shrinking margins could remain a headwind if cost savings are slower to materialize than anticipated.

- The balance between capturing synergies and managing integration costs directly impacts BAWAG's ability to meet or exceed current analyst price targets.

- For a deeper dive on how operational shifts compare to peers and the broader consensus, see the latest perspectives in the full consensus narrative. 📊 Read the full BAWAG Group Consensus Narrative.

Resilient Capital and Strategic Growth Drivers

- Strong capital ratios and substantial liquidity, alongside ongoing share buybacks, give BAWAG Group flexibility to pursue further mergers and acquisitions. Analysts expect these strengths to help drive sustainable fee income and robust loan growth in coming years.

- Consensus narrative notes demographic tailwinds, such as aging populations in Western Europe, position BAWAG to benefit from increased demand for retirement planning and personalized financial products, diversifying revenue streams even as regional concentration remains a risk.

- Capital deployment and risk management are hailed as core strengths by analysts, suggesting potential for earnings growth that outpaces the slowdowns flagged in top-line market expectations.

- However, reliance on interest income and exposure to the DACH/NL region means local downturns could still impact BAWAG’s earnings despite broader growth drivers.

Valuation Discount Versus Analyst Targets

- At a share price of €108.3, BAWAG trades at an 11.0x PE ratio, which is in line with the current average for Austrian banks, but slightly below the analyst target price of €130.11 and well under the DCF fair value estimate of €232.43. This has renewed the debate over value versus sector benchmarks.

- Within the consensus narrative, analysts claim this discount partly reflects tempered near-term growth forecasts and margin compression, but also note strong earnings quality and peer-relative value metrics may justify upside if BAWAG executes on operational and digital transformation goals.

- The current market price represents a 12.1% discount to the consensus analyst target, provoking discussion about whether subdued expectations and operational risks are already priced in.

- Peer comparisons make BAWAG look reasonably valued locally, but a premium to the broader European banks industry could cap rerating potential unless growth or efficiency surprises on the upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BAWAG Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the results? Share your view and shape a fresh perspective in just a few quick steps: Do it your way.

A great starting point for your BAWAG Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Margin compression, slowing growth versus peers, and headwinds from integration costs raise questions about BAWAG Group’s ability to outperform in coming years.

If you want more consistency and fewer surprises, focus on companies proven to deliver steady results in all conditions with our stable growth stocks screener (2094 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BAWAG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:BG

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives