3 European Stocks Estimated To Be Undervalued By Up To 48.6%

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the pan-European STOXX Europe 600 Index rising by 3.44% amid easing tariff concerns, investors are keenly observing opportunities for undervalued stocks in the region. In this environment of renewed optimism and economic growth acceleration in the eurozone, identifying stocks that are potentially undervalued can be an effective strategy for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Qt Group Oyj (HLSE:QTCOM) | €57.05 | €110.66 | 48.4% |

| SNGN Romgaz (BVB:SNG) | RON5.76 | RON11.22 | 48.6% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.915 | €3.74 | 48.8% |

| Net Insight (OM:NETI B) | SEK2.81 | SEK5.57 | 49.6% |

| Rheinmetall (XTRA:RHM) | €1701.00 | €3278.24 | 48.1% |

| BAWAG Group (WBAG:BG) | €99.30 | €193.13 | 48.6% |

| Stille (OM:STIL) | SEK188.00 | SEK367.04 | 48.8% |

| dormakaba Holding (SWX:DOKA) | CHF708.00 | CHF1398.90 | 49.4% |

| Etteplan Oyj (HLSE:ETTE) | €10.60 | €20.91 | 49.3% |

| Obiz (ENXTPA:ALBIZ) | €4.35 | €8.69 | 50% |

Here we highlight a subset of our preferred stocks from the screener.

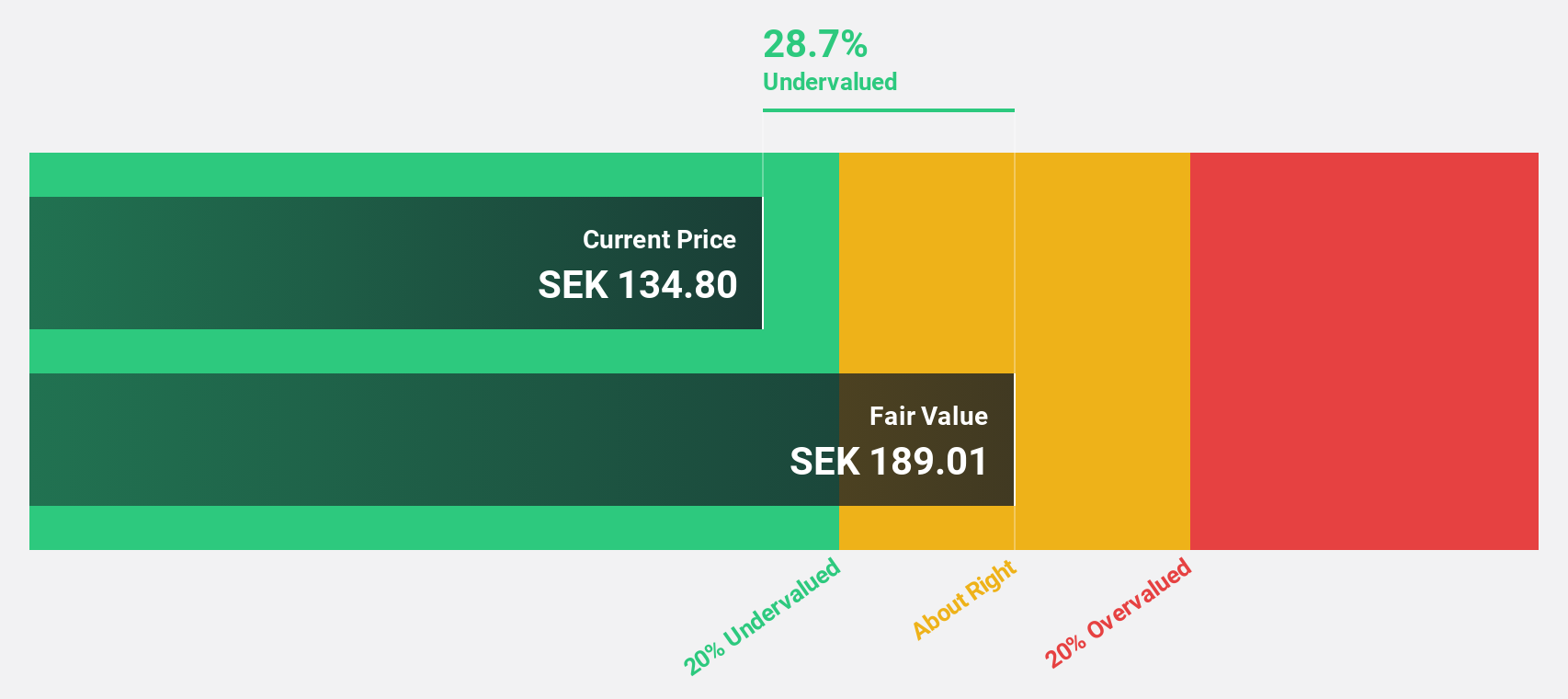

Troax Group (OM:TROAX)

Overview: Troax Group AB (publ) manufactures and sells mesh panels across the Nordic region, the United Kingdom, North America, Europe, and internationally, with a market cap of SEK8.58 billion.

Operations: The company generates revenue of €275.94 million from its mesh panels segment, serving regions including the Nordics, the United Kingdom, North America, Europe, and other international markets.

Estimated Discount To Fair Value: 13.5%

Troax Group, trading at SEK143.4, is considered undervalued based on cash flow analysis, with a fair value estimate of SEK165.73. Analysts expect earnings to grow 18.7% annually, outpacing the Swedish market average of 16.5%. Despite recent declines in Q1 sales and net income compared to last year, revenue is forecast to grow faster than the market at 7% annually. The dividend remains unstable but was recently affirmed at EUR 0.34 per share for distribution in May 2025.

- The analysis detailed in our Troax Group growth report hints at robust future financial performance.

- Click here to discover the nuances of Troax Group with our detailed financial health report.

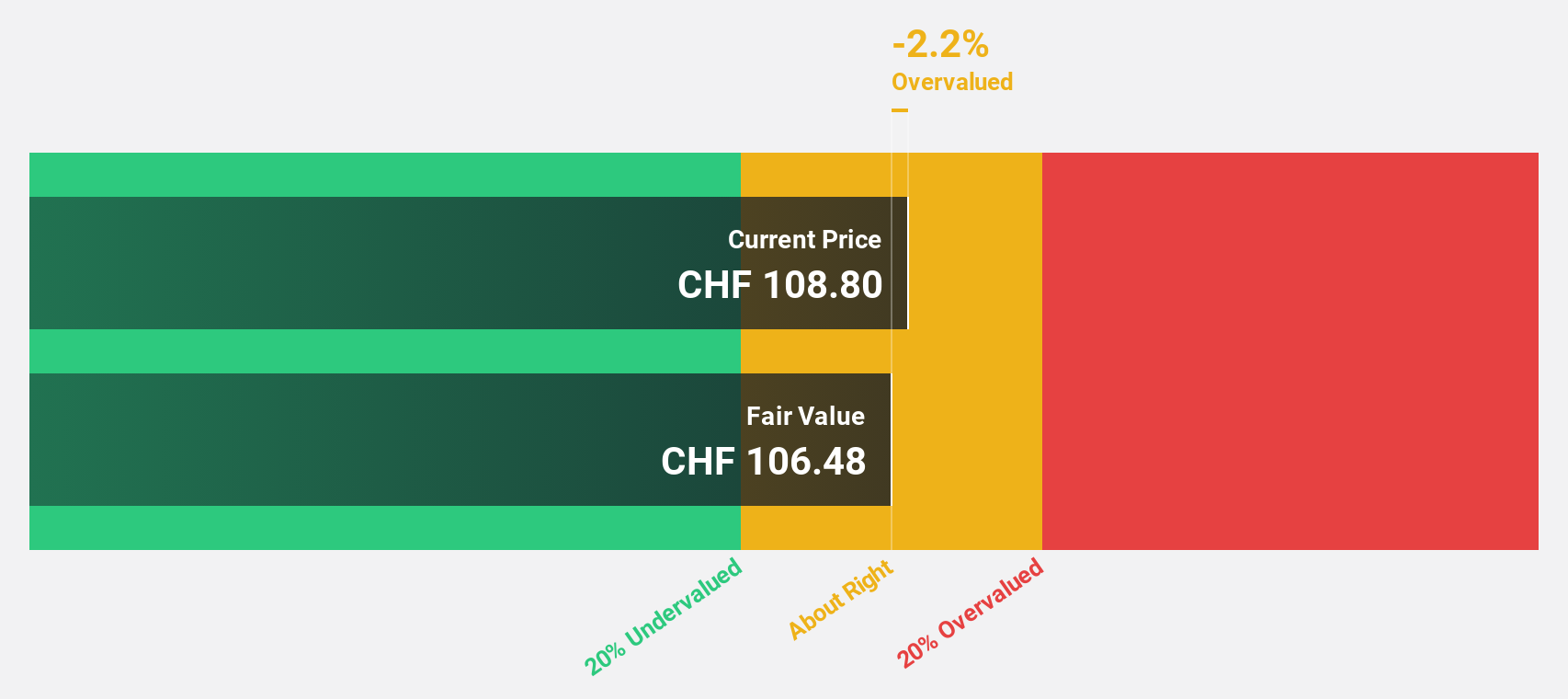

u-blox Holding (SWX:UBXN)

Overview: u-blox Holding AG develops, manufactures, and markets products and services for GPS/GNSS satellite positioning systems across various sectors including automotive, healthcare, and industrial automation with a market cap of CHF656.34 million.

Operations: The company's revenue primarily comes from Wireless Communications Equipment, contributing CHF262.88 million.

Estimated Discount To Fair Value: 17.1%

u-blox Holding, trading at CHF 87.8, is undervalued based on cash flow analysis with a fair value estimate of CHF 105.88. Despite a volatile share price and significant past losses, the company anticipates revenue growth between CHF 60 million and CHF 70 million for Q2 2025, excluding its Cellular business. Collaborations like the one with Intel for GNSS timing cards bolster its position in the growing vRAN market as it aims to become profitable within three years.

- According our earnings growth report, there's an indication that u-blox Holding might be ready to expand.

- Navigate through the intricacies of u-blox Holding with our comprehensive financial health report here.

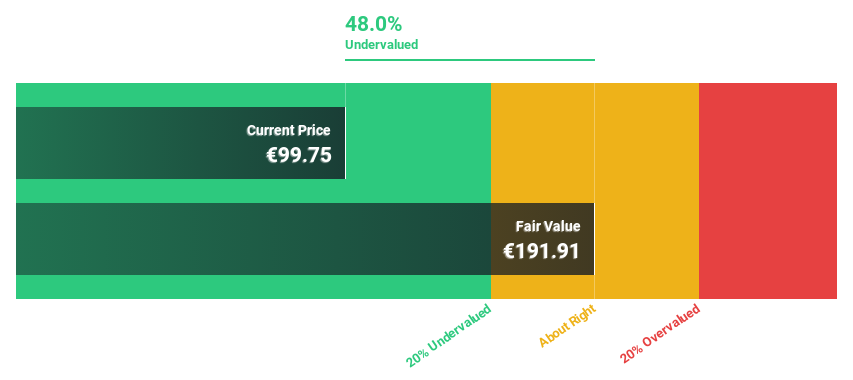

BAWAG Group (WBAG:BG)

Overview: BAWAG Group AG operates as a holding company for BAWAG P.S.K., with a market cap of approximately €7.80 billion.

Operations: The company's revenue is primarily derived from the Retail & SME segment (€1.23 billion) and the Corporates, Real Estate & Public Sector segment (€323.50 million), with additional contributions from Treasury (€59 million) and Corporate Center (€56 million).

Estimated Discount To Fair Value: 48.6%

BAWAG Group is trading at €99.3, significantly undervalued compared to its estimated fair value of €193.13. The bank's earnings are expected to grow faster than the Austrian market at 8.3% annually, supported by a robust revenue forecast of 10.6% growth per year. Despite an unstable dividend track record, BAWAG targets over €800 million in net profit for 2025 with strong quarterly net interest and commission incomes projected, reflecting solid cash flow potential amidst current valuations.

- In light of our recent growth report, it seems possible that BAWAG Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in BAWAG Group's balance sheet health report.

Key Takeaways

- Unlock our comprehensive list of 169 Undervalued European Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BAWAG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:BG

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives