In the face of recent market volatility driven by tariff uncertainties and mixed economic data, investors are increasingly seeking stability through dividend stocks. With their potential to provide consistent income even amid fluctuating markets, these stocks can be a valuable component of a diversified portfolio, especially when global economic conditions appear uncertain.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.51% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

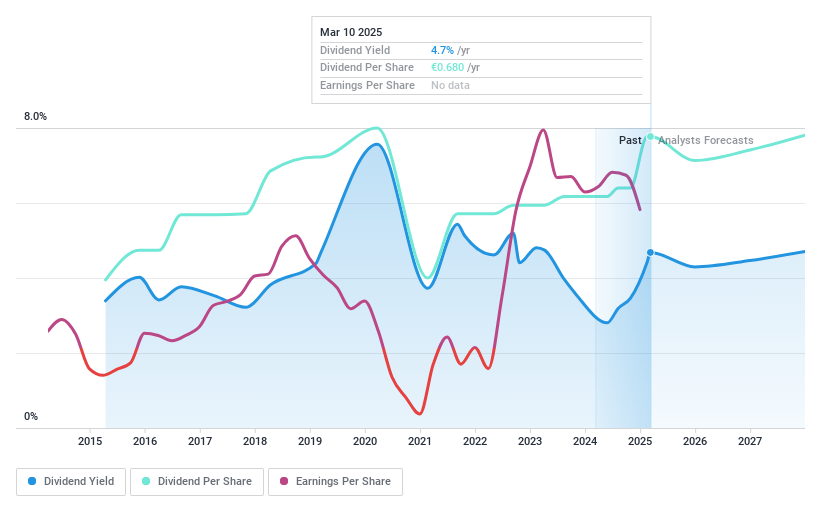

Galp Energia SGPS (ENXTLS:GALP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Galp Energia SGPS operates as an integrated energy company in Portugal and internationally, with a market cap of €11.22 billion.

Operations: Galp Energia SGPS generates revenue from several segments, including Upstream (€3.79 billion), Commercial (€10.29 billion), Industrial & Midstream (€9.25 billion), and Renewables and New Businesses (€89 million).

Dividend Yield: 3.5%

Galp Energia's dividend yield of 3.46% is lower than the top quartile in Portugal, indicating it may not be among the highest-yielding options. However, with a payout ratio of 31.8% and cash payout ratio of 39.4%, dividends are well-covered by earnings and cash flows despite an unstable track record over the past decade. The stock trades at a favorable P/E ratio of 8.4x compared to the market average, though earnings are expected to decline by 10% annually over three years.

- Unlock comprehensive insights into our analysis of Galp Energia SGPS stock in this dividend report.

- Our valuation report unveils the possibility Galp Energia SGPS' shares may be trading at a discount.

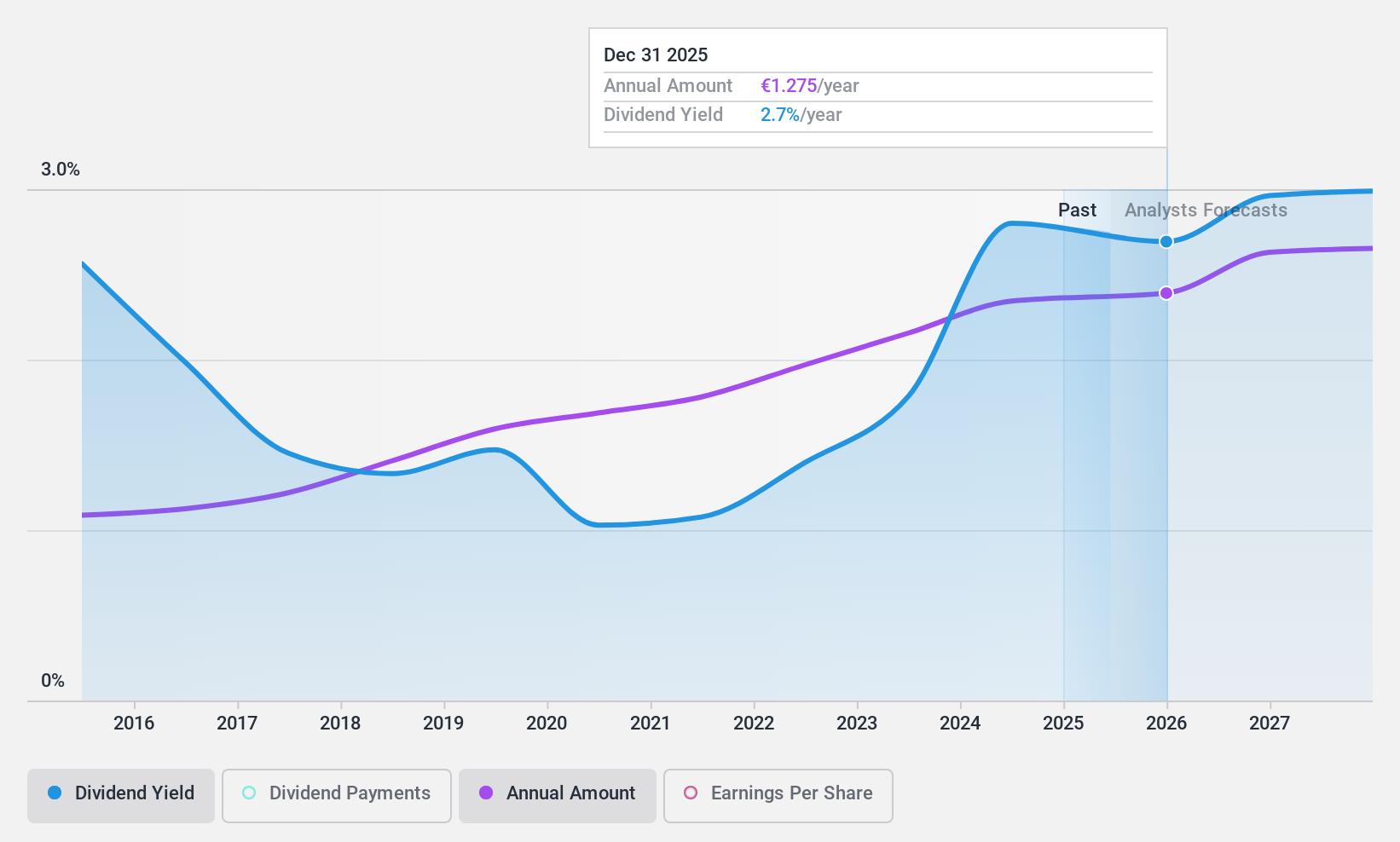

Equasens Société anonyme (ENXTPA:EQS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Equasens Société anonyme offers healthcare IT solutions in Europe with a market cap of €555.40 million.

Operations: Equasens Société anonyme generates its revenue through providing healthcare IT solutions across Europe.

Dividend Yield: 3.3%

Equasens Société anonyme maintains a sustainable dividend with a payout ratio of 44.5% and cash payout ratio of 64.9%, ensuring coverage by both earnings and cash flows. Despite its dividend yield of 3.31% being below the top tier in France, it offers stability and reliability, having grown consistently over the past decade without volatility. Recent revenue figures show slight declines year-over-year, but the stock trades at a significant discount to its estimated fair value, suggesting potential investment appeal despite lower yield attractiveness compared to peers.

- Click to explore a detailed breakdown of our findings in Equasens Société anonyme's dividend report.

- According our valuation report, there's an indication that Equasens Société anonyme's share price might be on the cheaper side.

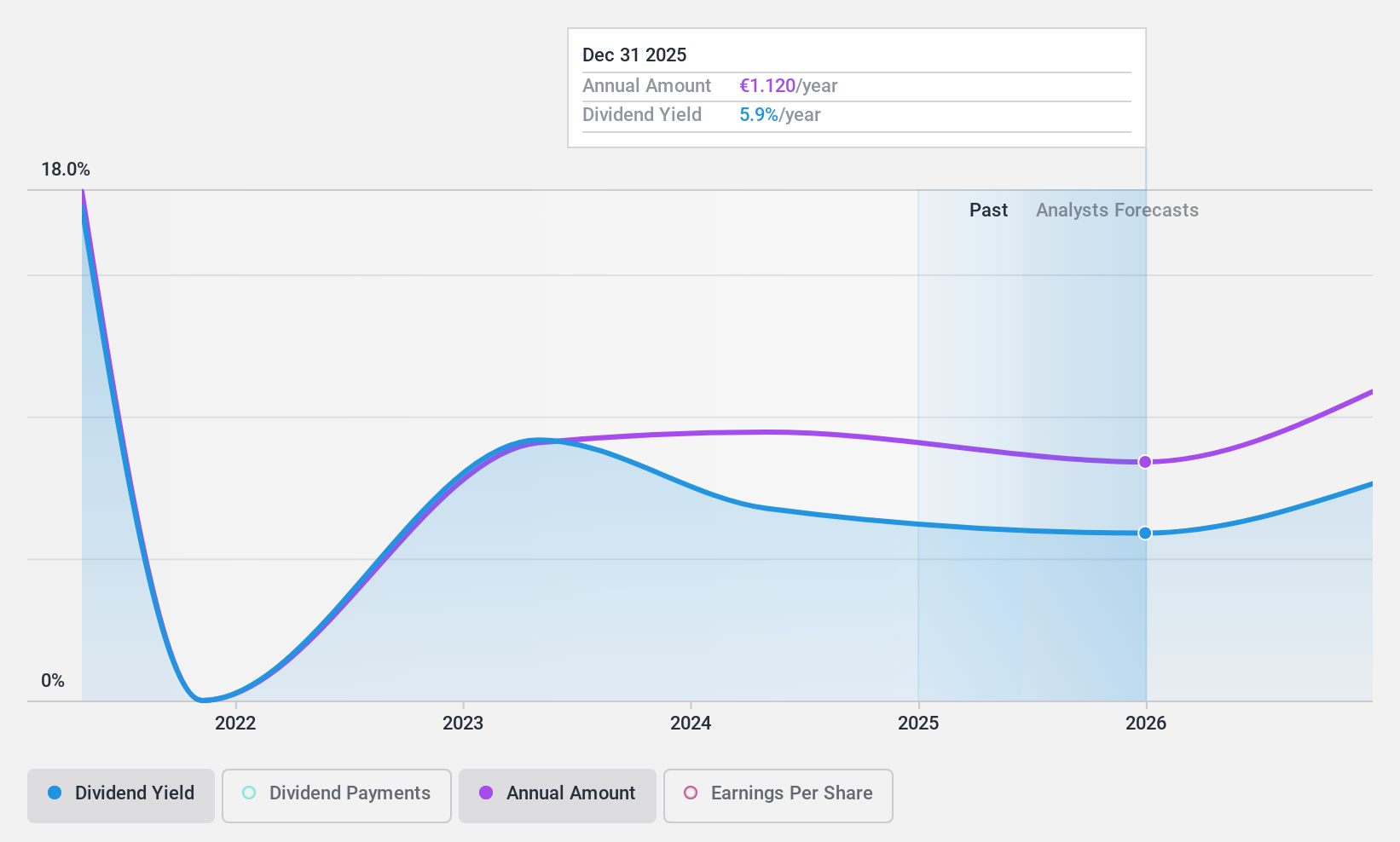

Addiko Bank (WBAG:ADKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Addiko Bank AG offers a range of banking products and services across Croatia, Slovenia, Serbia, Bosnia and Herzegovina, Montenegro, Austria, and Germany with a market cap of €347.17 million.

Operations: Addiko Bank AG's revenue segments include Consumer (€162.50 million), Mortgage (€25.60 million), SME Business (€93.80 million), Public Finance (€6.20 million), and Large Corporates (€9.70 million).

Dividend Yield: 6.7%

Addiko Bank's dividend yield of 6.74% ranks in the top 25% within Austria, yet its payments have been volatile over the past four years. The payout ratio stands at a sustainable 51.7%, with forecasts maintaining this coverage level in three years. Despite a high non-performing loan ratio of 4%, earnings grew by 34.5% last year and are expected to rise annually by 14.48%. Recent M&A activity may influence future performance dynamics.

- Take a closer look at Addiko Bank's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Addiko Bank is trading beyond its estimated value.

Where To Now?

- Investigate our full lineup of 1973 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:ADKO

Addiko Bank

Provides various banking products and services in Croatia, Slovenia, Serbia, Bosnia and Herzegovina, Montenegro, Austria, and Germany.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives