- Sweden

- /

- Communications

- /

- OM:NETI B

Discovering European Penny Stocks In May 2025

Reviewed by Simply Wall St

As the European markets continue to navigate a landscape marked by easing trade tensions and mixed economic signals, investors are increasingly looking for opportunities that might have been overlooked. Penny stocks, while an older term, still signify smaller or newer companies that can offer significant value. By focusing on those with strong financials and potential for growth, these stocks can provide both affordability and the possibility of substantial returns.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.28 | SEK2.18B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK3.28 | SEK304.11M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.68 | SEK275.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.48 | SEK211.72M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.67 | PLN124.39M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.462 | NOK105.06M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.67 | €56.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €1.015 | €33.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.63 | €17.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.03M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 445 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Enapter (DB:H2O)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Enapter AG designs, manufactures, and sells hydrogen generators with a market cap of €87.22 million.

Operations: No specific revenue segments are reported for this company.

Market Cap: €87.22M

Enapter AG, with a market cap of €87.22 million, remains a speculative investment as it is currently pre-revenue and unprofitable. Despite this, the company shows potential through its innovative AI software that optimizes electrolyzer performance and recent expansion into Italy's hydrogen market. Enapter's short-term assets exceed its liabilities, providing some financial stability. The company is debt-free and has not experienced significant shareholder dilution recently. However, high volatility and limited cash runway highlight risks associated with penny stocks like Enapter AG. A recent €5.99 million equity offering may help extend its operational runway temporarily.

- Dive into the specifics of Enapter here with our thorough balance sheet health report.

- Gain insights into Enapter's future direction by reviewing our growth report.

Net Insight (OM:NETI B)

Simply Wall St Financial Health Rating: ★★★★★★

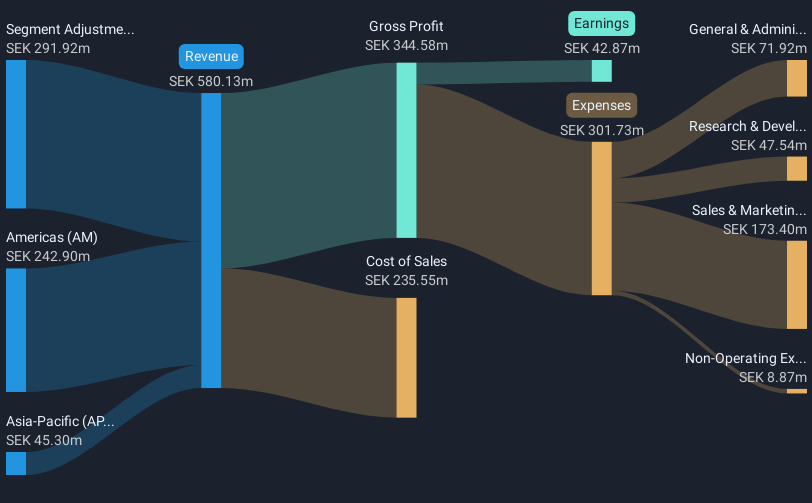

Overview: Net Insight AB (publ) offers media network solutions across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific with a market cap of SEK1 billion.

Operations: The company's revenue for Media Networks is SEK580.13 million.

Market Cap: SEK1B

Net Insight AB, with a market cap of SEK1 billion, faces challenges as its recent Q1 2025 earnings report shows decreased sales of SEK114.57 million and a net loss of SEK14.01 million compared to the previous year. Despite this, the company remains debt-free and has strong short-term asset coverage over liabilities. Recent client collaborations, such as with Globecast for media transport solutions, highlight its strategic focus on unmanaged network services—a potential growth area. However, volatility in share price and declining profit margins underscore typical risks associated with penny stocks like Net Insight AB.

- Click here and access our complete financial health analysis report to understand the dynamics of Net Insight.

- Assess Net Insight's future earnings estimates with our detailed growth reports.

Polytec Holding (WBAG:PYT)

Simply Wall St Financial Health Rating: ★★★★★☆

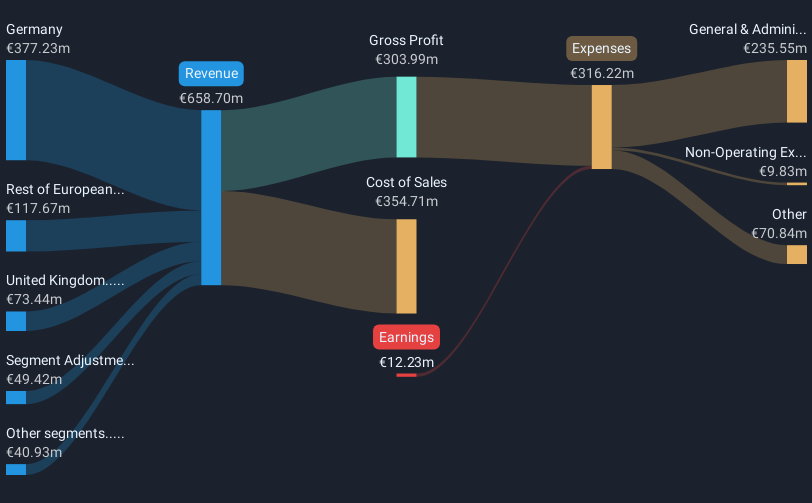

Overview: Polytec Holding AG, with a market cap of €66.65 million, develops and manufactures plastic solutions for passenger cars, light commercial vehicles, commercial vehicles, and smart plastic and industrial applications through its subsidiaries.

Operations: Polytec Holding's revenue from plastics processing is €678.97 million.

Market Cap: €66.65M

Polytec Holding AG, with a market cap of €66.65 million, reported sales of €678.55 million for 2024, reflecting modest revenue growth. Despite reducing its net loss to €6.45 million from the previous year, the company remains unprofitable with a negative return on equity of -3.26%. Its debt is well covered by operating cash flow at 55.3%, and short-term assets exceed both short and long-term liabilities, indicating solid financial management amidst volatility typical for penny stocks. The experienced management and board support stability; however, interest coverage remains weak at 0.2x EBIT, highlighting ongoing financial challenges.

- Take a closer look at Polytec Holding's potential here in our financial health report.

- Evaluate Polytec Holding's prospects by accessing our earnings growth report.

Next Steps

- Navigate through the entire inventory of 445 European Penny Stocks here.

- Looking For Alternative Opportunities? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Net Insight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NETI B

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives